BlackRock Swaps Bitcoin for Ethereum: Analyzing the Market Move

In a surprising twist in the cryptocurrency space, BlackRock has recently sold a significant chunk of Bitcoin (BTC) to bolster its Ethereum (ETH) holdings. This move comes amid a bullish wave for Ethereum, which surged nearly 7% recently, reaching a peak of $2,485 on October 12, 2024. Such a spike in price was invigorated by dovish signals from the US Consumer Price Index (CPI) report, fostering increased demand for risk assets.

The price interplay between Ethereum and Bitcoin is shaping market strategies.

The price interplay between Ethereum and Bitcoin is shaping market strategies.

The Move that Shook the Market

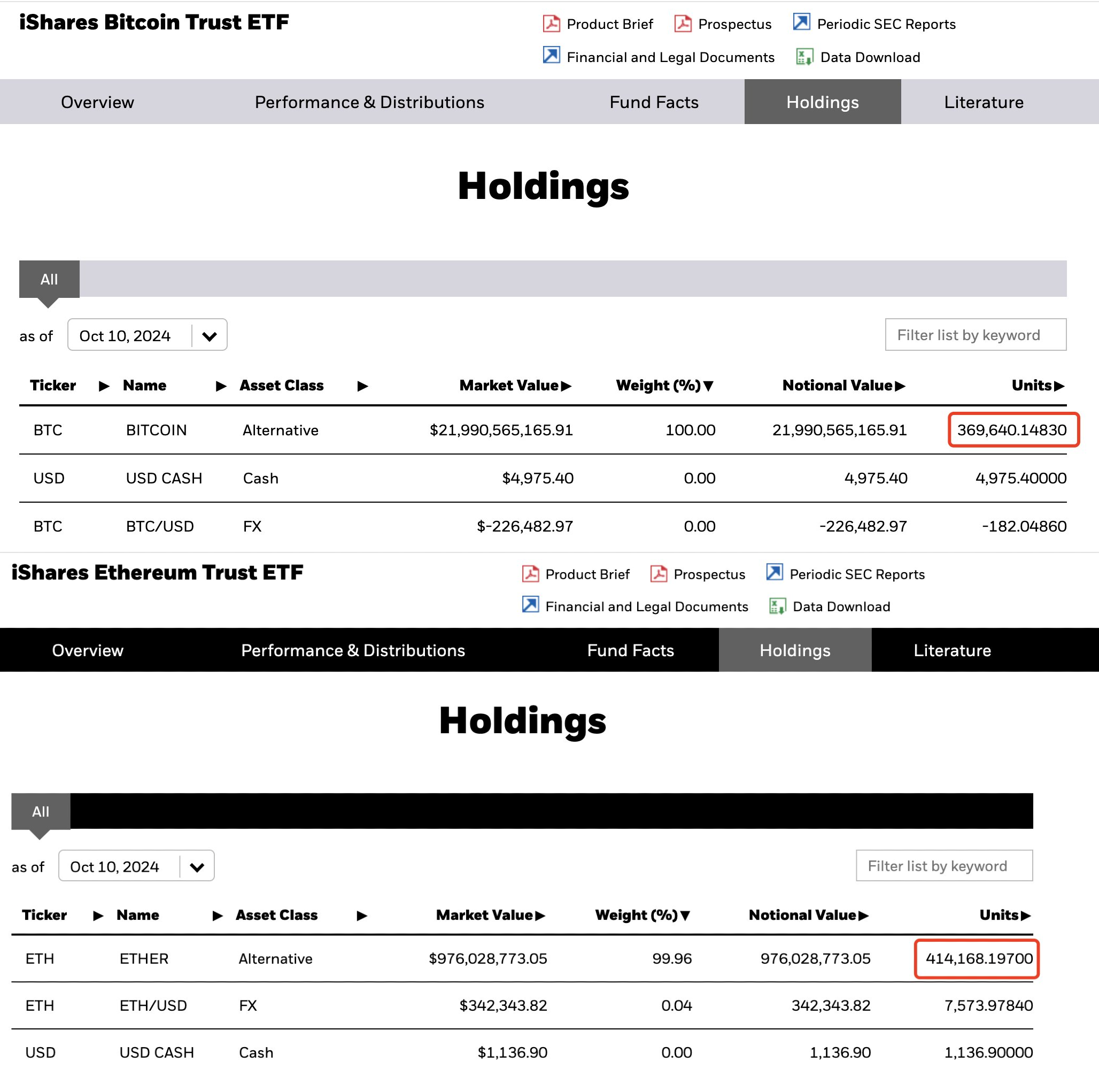

BlackRock’s market activity has captured the attention of traders and investors alike. The asset manager offloaded 182 BTC, valued at approximately $11.34 million, to acquire an impressive 7,574 ETH, worth about $18.52 million. This strategic shift is drawing various interpretations from analysts, particularly around whether it indicates a stronger belief in Ethereum’s future potential.

The reaction to this transaction has been varied. While some view BlackRock’s increasing commitment to Ethereum as a bullish sign for the cryptocurrency, there are whispers of skepticism, suggesting that this move might be more about responding to client demand rather than a sweeping strategic pivot.

A Bullish Ethereum Train

Over the last couple of days, the upward trajectory of Ethereum’s price leaves many hopeful about its prospects. The optimism was evident, especially given how closely the asset dodged a potential dip below the critical $2,400 mark. As expectations of economic easing gained momentum following the CPI report, Ethereum has risen sharply, hinting at a possible price rally toward $2,600 by month-end.

Optimism surrounding Ethereum is visibly reflected in its recent price movements.

Optimism surrounding Ethereum is visibly reflected in its recent price movements.

Yet, macroeconomic sentiments aren’t solely driving this enthusiasm. The flows from institutional giants like BlackRock imply a potentially stronger adoption curve for Ethereum-based exchange-traded funds (ETFs). This is particularly intriguing following the SEC’s initial green light for ETH ETFs back in July, despite the slow market uptake since then.

Navigating The Market’s Waters

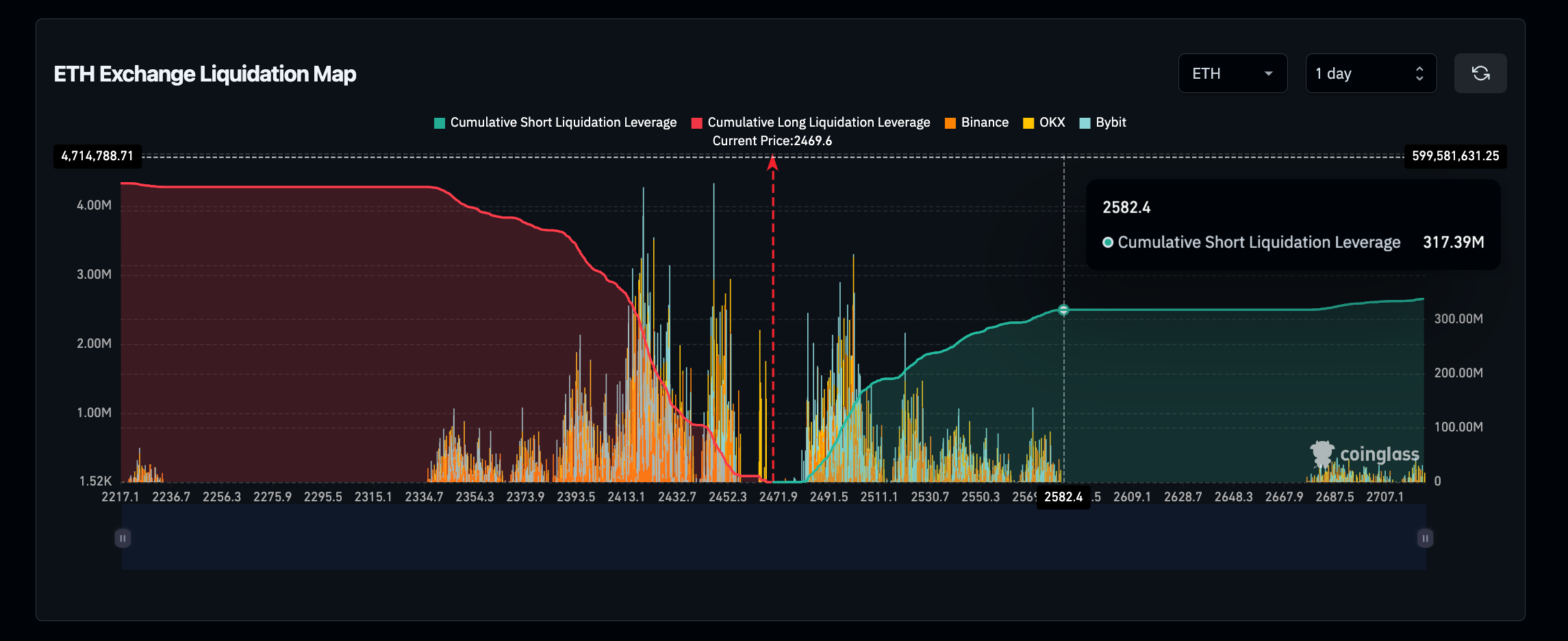

As the market attempts to stabilize, all eyes are on the $2,600 resistance level. However, ETH still faces substantial selling pressure, specifically around the $2,590 mark, where an estimated $337 million in short positions lurk. It’s here where bears are staking out a challenge, potentially testing the market’s resolve. Should the bulls manage to push through this barrier, it could open the floodgates for a wider rally.

Ethereum’s price dynamics reveal a significant battleground near the $2,590 resistance.

Ethereum’s price dynamics reveal a significant battleground near the $2,590 resistance.

Kevin Oakeson, CEO of HMNBRD Network, highlighted the importance of discerning between client-driven activity and BlackRock’s broader strategic moves in the market. He noted,

“It’s vital to differentiate between products held for clients through ETFs and actual long-term strategic positions. What we’re seeing with BlackRock is likely influenced by client demand more than anything else.”

Despite the potential rally toward $2,600, it’s clear that Ethereum’s journey will not be without obstacles. BlackRock’s considerable Bitcoin holdings remain a potent reminder of the asset manager’s broader orientation towards the leading cryptocurrency, underlining the stark contrast in their strategic allocations.

BlackRock’s holdings illustrate the vast difference between its Bitcoin and Ethereum allocations.

BlackRock’s holdings illustrate the vast difference between its Bitcoin and Ethereum allocations.

Looking Ahead

Ethereum’s current price positioning indicates resilience, particularly with support levels between $2,420 and $2,450. If Ethereum can maintain above this range, the outlook remains promising for bulls aiming for a breakthrough beyond $2,600.

The upcoming FOMC meeting on November 7 will be critical, as market participants hope for dovish signals that could enhance ETH’s attractiveness as an investment within the increasingly competitive landscape of digital assets.

In conclusion, BlackRock’s pivot towards Ethereum exemplifies a growing confidence in the asset’s potential. The dual forces of institutional interest and supportive macroeconomic indicators present an exciting yet challenging environment for Ethereum’s future.