Bitcoin’s Wild Ride: Market Analysts Weigh in on Recent Price Swings

The cryptocurrency market has been on a rollercoaster ride in recent days, with Bitcoin (BTC) prices plummeting to new one-month lows of $64,000. The sudden drop has left many market analysts scratching their heads, wondering what’s behind the sudden downturn.

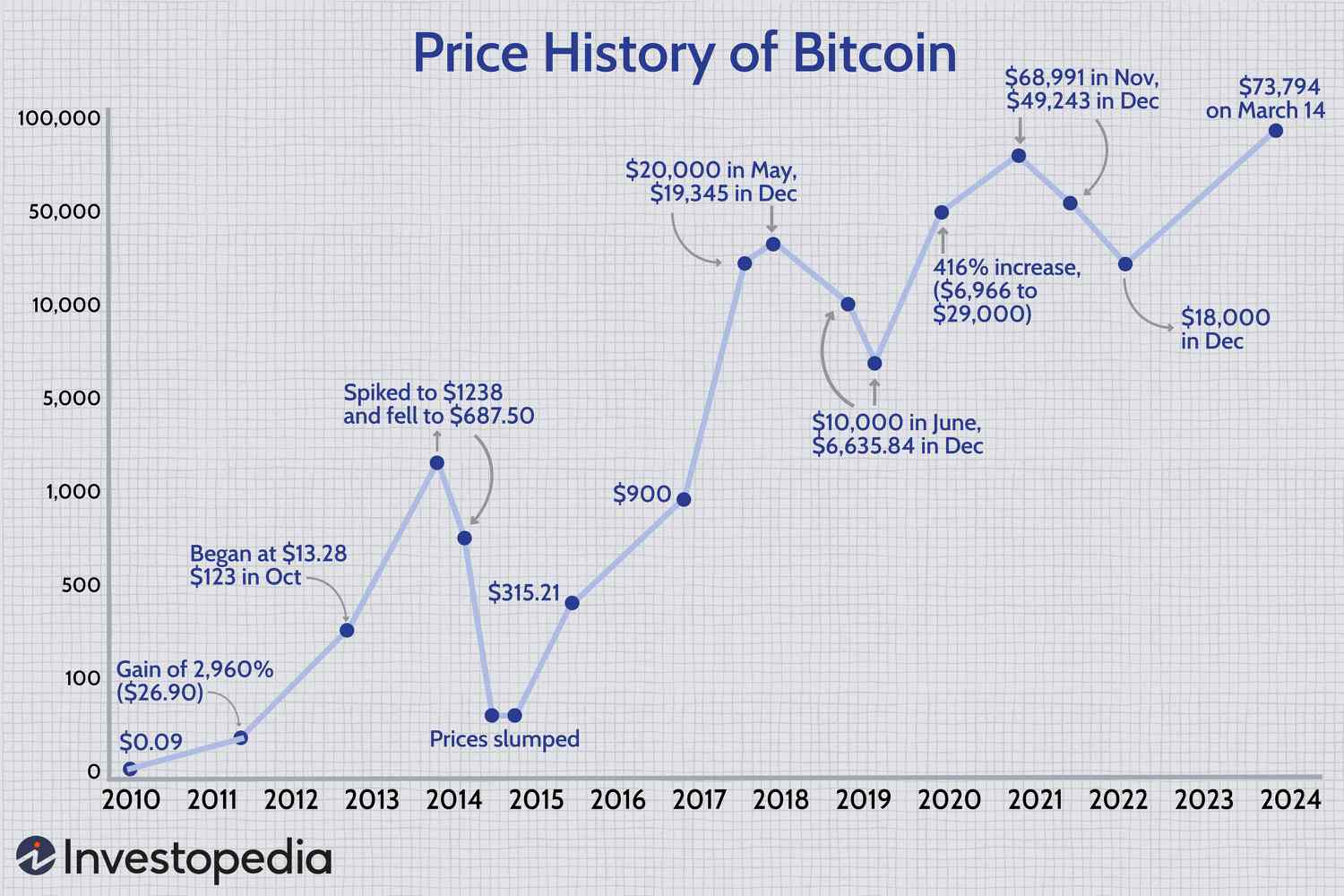

Bitcoin price chart

One theory is that the recent outflows from spot Bitcoin exchange-traded funds (ETFs) may be contributing to the market’s bearish sentiment. According to data from Farside Investors, spot Bitcoin ETFs have seen outflows on five of the last six trading days.

Bitcoin ETF outflows

Henrik Andersson, chief investment officer at Apollo Crypto, believes that the reduced interest in spot Bitcoin ETFs may be a contributing factor to the market’s downturn. “It looks like negative BTC ETF flows led to weakness in alts, which triggered liquidations of leverage long traders in Bitcoin, Ethereum, and Dogecoin,” Andersson told Cointelegraph.

However, not everyone agrees that the ETF outflows are the primary cause of the market’s downturn. Digital asset firm 10xResearch believes that the relationship between the two may be more complex. “It has come as a surprise that Bitcoin is failing to rally despite weak inflation data, but the Ethereum and altcoin crash might have been predictable,” the firm said.

Ethereum price chart

Meanwhile, Bitcoin miners are experiencing a resurgence in fortunes, with mining stocks up double digits despite the recent price slump. According to Mitchell Askew, head analyst at Blockware Solutions, the Valkyrie Bitcoin Miners exchange-traded fund (WGMI) is now up around 54% since the halving event.

Bitcoin mining stocks

In other news, a recent bill passed by the House of Representatives has raised concerns about the cryptocurrency industry’s influence on regulatory policy. The Financial Innovation and Technology for the 21st Century Act would exempt crypto assets and platforms from the definition of “securities,” meaning that the Securities and Exchange Commission’s power to regulate crypto would shrink dramatically.

Cryptocurrency regulation

Critics argue that the bill would create a regulatory loophole, allowing the crypto industry to evade oversight and putting consumers at risk. Mark Hays, senior policy analyst at Americans for Reform, believes that the bill would “close the purported crypto regulatory gap with a wrecking ball instead of a modest patch, damaging financial regulatory safeguards for all Americans, not just crypto consumers.”

Cryptocurrency regulation

As the cryptocurrency market continues to evolve, one thing is clear: the need for effective regulation and oversight is more pressing than ever. Whether the recent market downturn is a sign of things to come or just a minor blip on the radar remains to be seen.

Cryptocurrency market