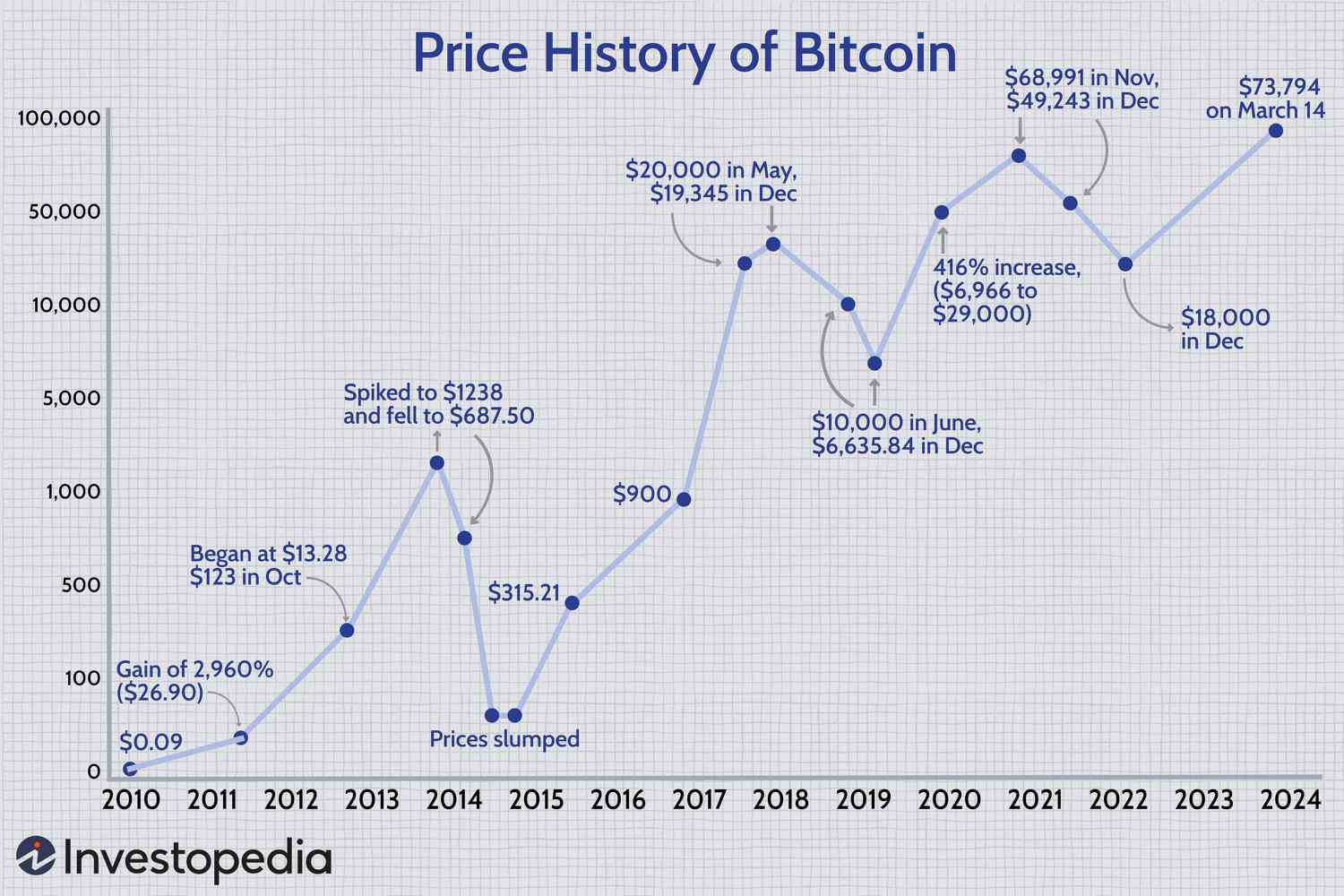

Bitcoin’s recent 10% sell-off since June 7 has sent a warning sign to the broader stock market, according to Stifel strategist Barry Bannister. As someone who has been following the crypto market for a while, I have to agree that this decline is more than just a minor correction.

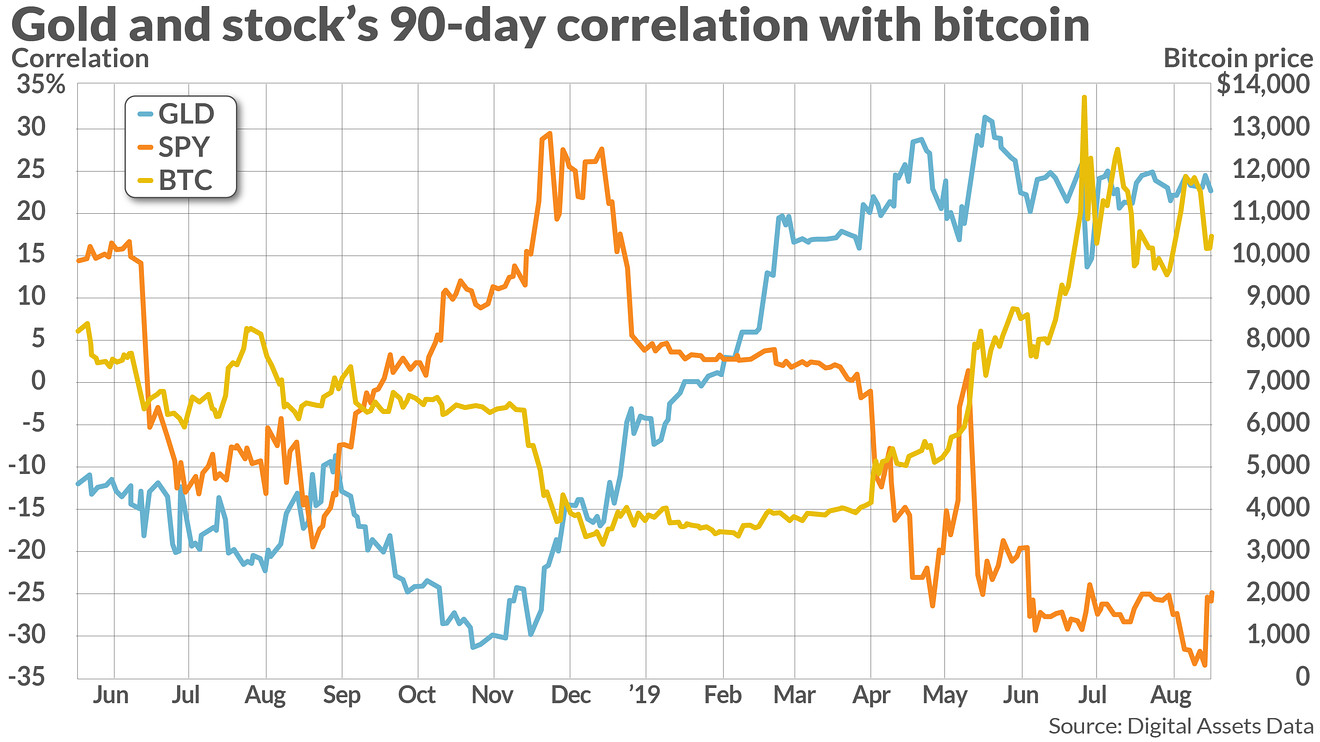

In a recent note, Bannister highlighted the strong correlation between bitcoin and the Nasdaq 100 since 2020. This isn’t surprising, given that both assets share similar characteristics as speculative risk-on assets. However, while bitcoin has been trading lower in June to around the $65,000 level, the broader stock market continues to hit new record highs driven by gains in mega-cap tech stocks like Nvidia and Apple.

But what does this mean for the stock market? According to Bannister, bitcoin’s inability to hit new record highs suggests that the stock market is likely to play catch-up as it’s set to decline in line with the cryptocurrency.

“Recently the weakening of bitcoin signals an imminent S&P 500 summer correction and consolidation phase,” Bannister said.

Bannister isn’t the only analyst on Wall Street taking stock market cues from bitcoin. Fairlead Strategies founder Katie Stockton told CNBC on Monday that she, too, is tracking the broadening divergence between US tech stocks and bitcoin.

“When we see bitcoin pulling back in that framework and the Nasdaq 100 just forging higher, that concerns us to some degree, just short term,” Stockton said.

Bitcoin’s decline has been felt across the market

Bitcoin’s decline has been felt across the market

Adding to Bannister’s conviction of an imminent stock market sell-off is the Federal Reserve, which could keep interest rates higher for longer to combat still-elevated inflation.

In a summer correction scenario, Bannister sees high-flying Big Tech stocks like Nvidia getting hit the hardest as analysts’ forward earnings estimates show signs of peaking.

However, Bannister did concede that he might be early on his call for a market correction as bubbles often march to the beat of their own drum.

It is possible that stocks continue to rise before experiencing an even more painful decline of about 20%.

“Past bubbles since the 19th century indicate the S&P 500 could well rise to ~6,000 at year-end 2024 and then round trip to near where 2024 began five quarters later, by ~1Q26 (S&P 500 ~4,800),” Bannister said.

The stock market’s fate is closely tied to bitcoin’s

The stock market’s fate is closely tied to bitcoin’s

As someone who has been following the market for a while, I have to agree that the signs are pointing to a correction. But what does this mean for investors? Should they be preparing for a worst-case scenario or is this just a minor blip on the radar?

The answer is not straightforward, but one thing is clear: investors should be cautious and prepared for any eventuality.

In conclusion, the recent decline in bitcoin has sent a warning sign to the broader stock market, and investors should be cautious and prepared for any eventuality. Whether the market corrects this summer or continues to rise before a more painful decline, one thing is certain: the fate of the stock market is closely tied to bitcoin’s.

Investors should be cautious and prepared

Investors should be cautious and prepared