Bitcoin’s Volatile Ride: What’s Behind the Recent Price Swings?

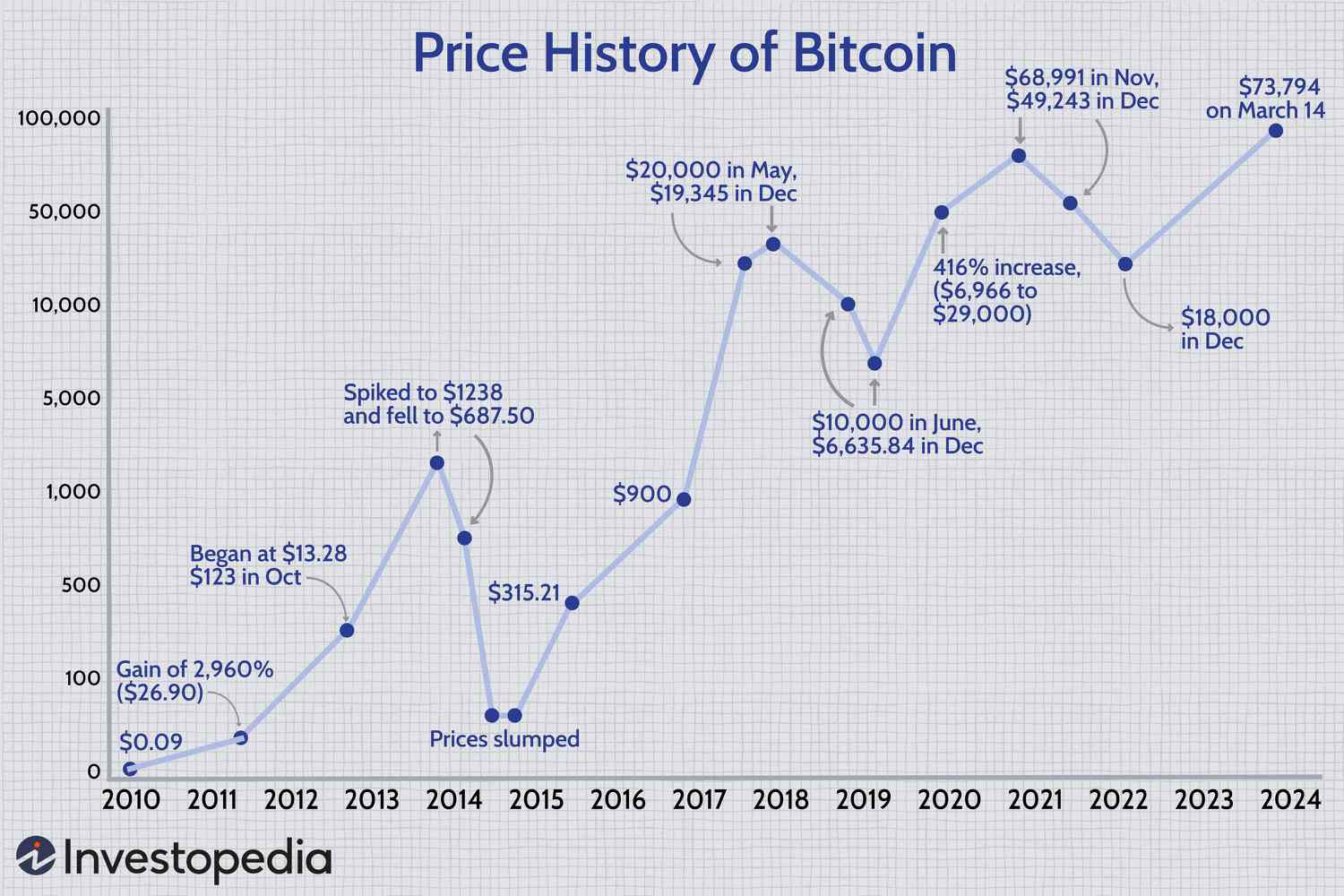

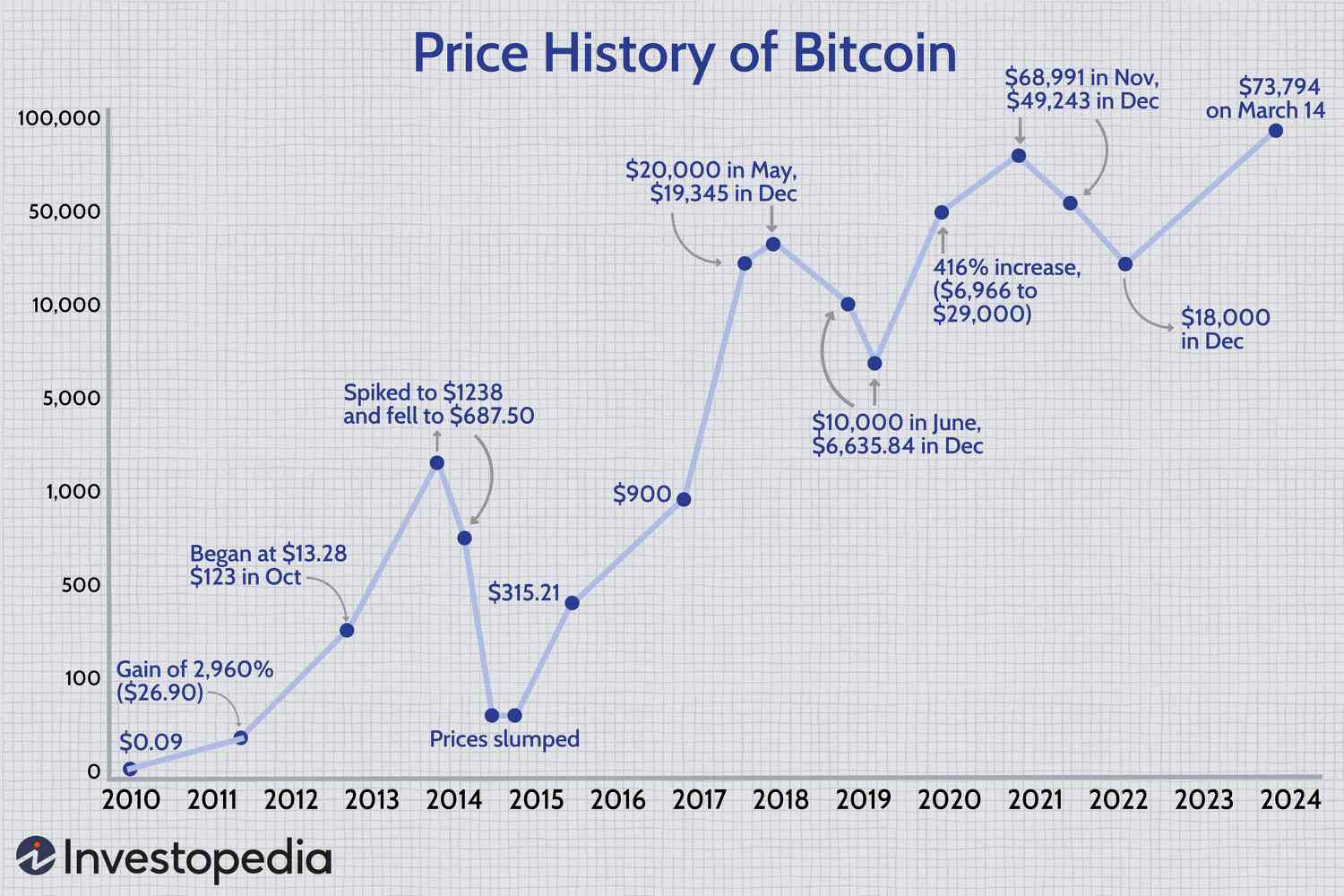

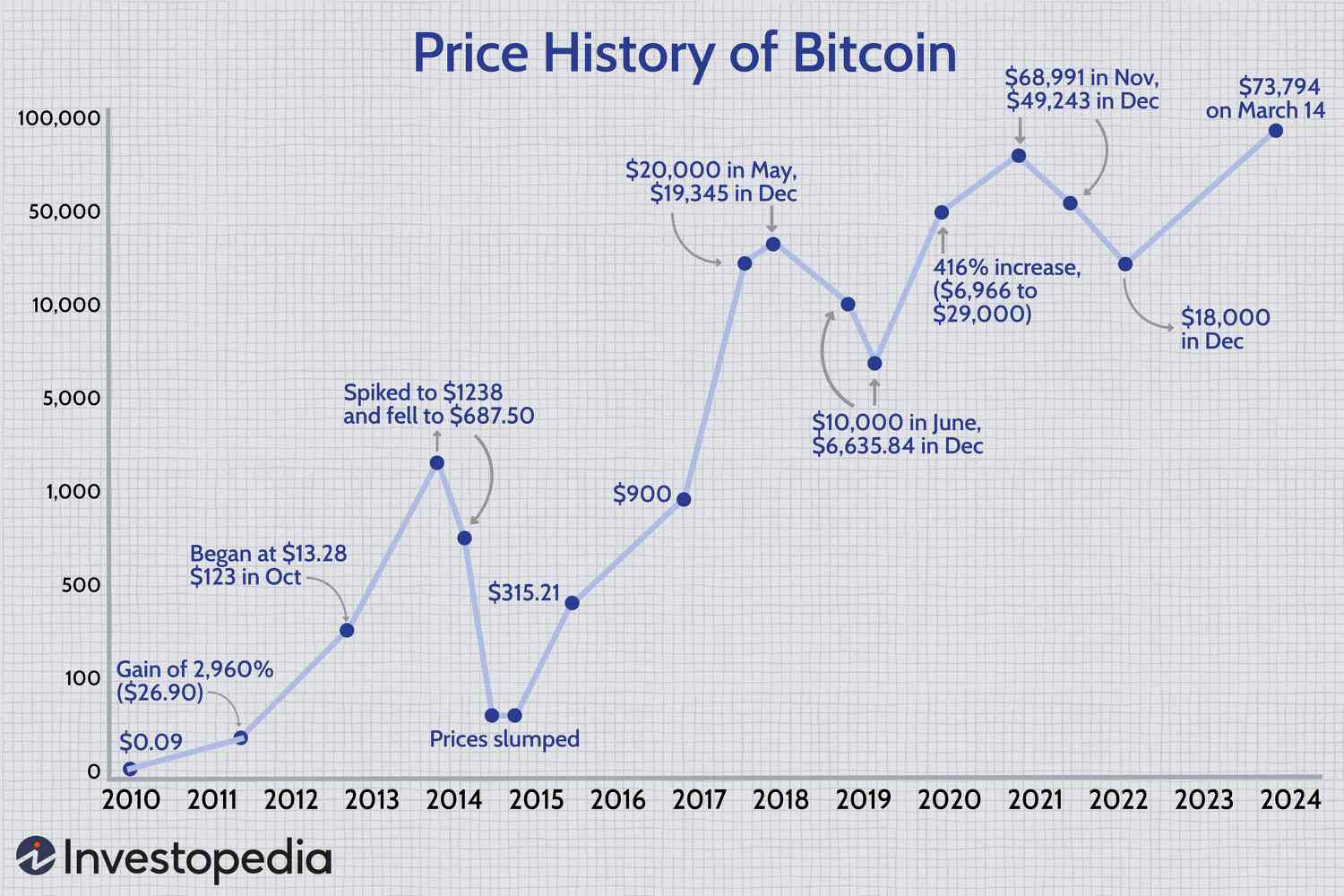

As I write this, Bitcoin is hovering around the $64,000 mark, a significant rebound from its recent dip below $60,000. The cryptocurrency’s price has been on a wild ride lately, and many are wondering what’s driving this volatility.

Bitcoin’s price fluctuations have been making headlines lately.

Bitcoin’s price fluctuations have been making headlines lately.

One major factor at play is the upcoming halving event, which is slated to take place this week. For the uninitiated, halving is a pre-programmed event that occurs every four years, where the rewards for Bitcoin miners are slashed in half. This reduction in supply is expected to have a significant impact on the market.

In the past, halving has preceded a bull run for Bitcoin. Will history repeat itself this time around? Only time will tell.

But there are other factors at play as well. Geopolitical tensions, such as the recent drone and missile attack on Israel, have been affecting crypto markets. Additionally, miners are selling their Bitcoin ahead of the halving, which is putting downward pressure on the price.

Miners are selling their Bitcoin ahead of the halving event.

Miners are selling their Bitcoin ahead of the halving event.

According to analysts at Amina, miner balances are near an all-time low, and net flows through spot Bitcoin exchange-traded funds have been negative since last week. This is further exacerbating the downward pressure on the price.

Despite these headwinds, it’s been a strong year for Bitcoin, with its price up 50% so far. The cryptocurrency hit an all-time high above $73,000 in March, and many are optimistic about its future prospects.

Bitcoin’s price has been on a wild ride lately, but many are optimistic about its future.

Bitcoin’s price has been on a wild ride lately, but many are optimistic about its future.

As I reflect on the current state of the crypto market, I’m reminded of the importance of staying informed and adapting to changing circumstances. Whether you’re a seasoned investor or a newcomer to the world of cryptocurrency, it’s essential to stay up-to-date on the latest developments and trends.

Staying informed is key in the ever-changing world of cryptocurrency.

Staying informed is key in the ever-changing world of cryptocurrency.