The Ups and Downs of Bitcoin: A Market Evaluation

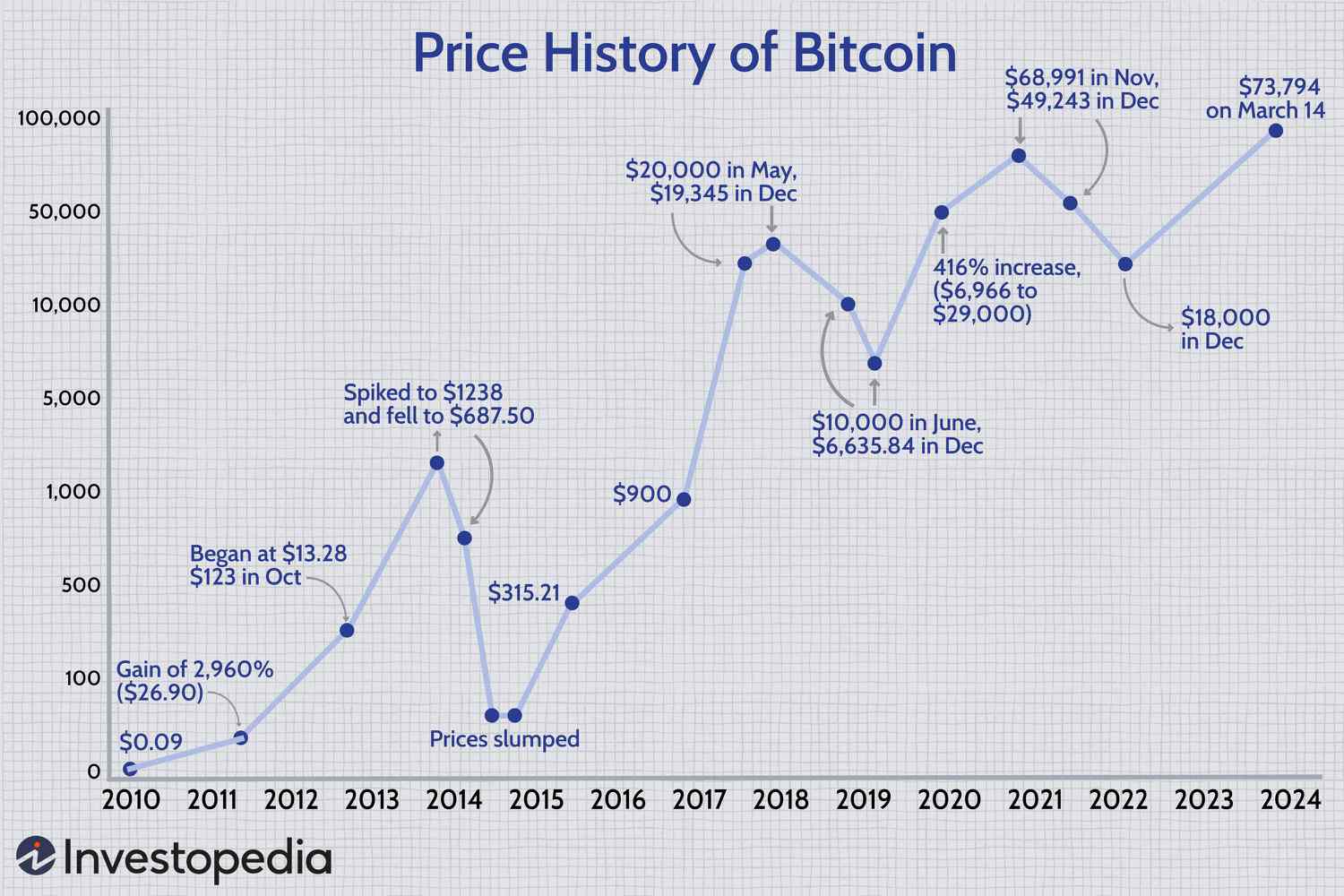

The cryptocurrency market has experienced significant fluctuations, particularly after a stellar start to 2023. Bitcoin (BTC), the flagship cryptocurrency, reached a staggering all-time high of $73,750 in mid-March. However, the euphoria soon dwindled, with the price falling to approximately $68,000 as of May 23, marking a sharp 15% decline from its peak.

Bitcoin’s price has shown significant volatility.

Bitcoin’s price has shown significant volatility.

The Impact of the Halving Event

One of the pivotal events influencing Bitcoin’s recent downturn is the successful completion of its halving event. This significant occurrence, which happens every four years, reduces the block reward miners receive by half. The intended effect is to limit Bitcoin’s total supply to 21 million coins. Historical trends suggest that such halving events typically stimulate demand due to the anticipated scarcity, often leading to price increases. However, the immediate aftermath has proven to be less favorable.

The reasons behind this decline can be correlated with external economic factors. Wall Street faced notable headwinds in April, following a robust first quarter. Inflation fears began to loom large, dampening previous optimism about potential rate cuts from the Federal Reserve. Persistently high interest rates adversely affect growth-oriented assets, including cryptocurrencies.

Navigating a Challenging Economic Landscape

Despite these challenges, Bitcoin has made commendable gains this year, currently enjoying a 54% year-to-date increase after an impressive 207% rise throughout 2023. Additionally, it has surged over 50% since the inception of Bitcoin ETFs in January. This contrast in performance underscores the cryptocurrency’s resilience amidst uncertainties.

As the Federal Reserve deliberated its stance during the April 30-May 1 FOMC meeting, hints indicated that officials remain open to hiking interest rates should inflation persist above the 2% target. Yet, there are positive indications with inflation declining in April. The Consumer Price Index (CPI) saw an increase of just 0.3% month-over-month, falling short of economists’ expectations. This decline provides a glimmer of hope for potential rate cuts, which could significantly benefit cryptocurrencies moving forward.

Trends in key economic indicators could impact the crypto landscape.

Trends in key economic indicators could impact the crypto landscape.

Potential Growth Opportunities in Crypto Stocks

Delving deeper into the cryptocurrency space, there are several stocks worth watching as we progress into 2024. We have identified four companies that are well-aligned with the crypto industry and show strong potential moving forward:

- NVIDIA Corporation (NVDA) — A titan in the semiconductor arena and a key player in graphics processing units (GPUs), NVIDIA is poised to thrive in a flourishing cryptocurrency market.

- Robinhood Markets, Inc. (HOOD) — As a robust platform for trading both traditional assets and cryptocurrencies, Robinhood has integrated crypto investing into its offerings, broadening its appeal to a diverse clientele.

- Coinbase Global, Inc. (COIN) — Coinbase is recognized as a cornerstone of the cryptocurrency economy, providing essential infrastructure and technology to support the burgeoning market.

- Interactive Brokers Group, Inc. (IBKR) — A prominent automated electronic brokerage firm offering clients access to various assets, including cryptocurrencies.

These firms are categorized with strong ratings, either a Zacks Rank of 1 (Strong Buy), 2 (Buy), or 3 (Hold), making them attractive considerations for investors focused on the cryptocurrency realm.

Conclusion: A Market in Transition

In summary, the cryptocurrency market, particularly Bitcoin, finds itself at a crucial juncture with mixed signals from economic data and key events like the halving affecting market dynamics. While the immediate future reflects uncertainty, the underlying trends point to a potentially favorable environment for Bitcoin and related assets.

As we watch how external economic factors and internal market developments unfold, investors should remain vigilant and informed, ensuring they navigate potential opportunities and pitfalls within this ever-evolving landscape.

Exploring investment opportunities in the cryptocurrency sector.

Exploring investment opportunities in the cryptocurrency sector.