Bitcoin’s Summer Slump: What’s Next for the Flagship Cryptocurrency?

As the summer months approach, bitcoin investors are bracing themselves for a potential slump in June. Despite a 13% gain in May, the flagship cryptocurrency may struggle to maintain its momentum in the coming weeks. According to Coin Metrics, bitcoin’s eighth monthly gain in the past nine months was largely driven by the SEC’s approval of ether ETFs in the U.S.

“Once these new products are fully rubber-stamped by the SEC, possibly as soon as late June, you can expect that to act as a catalyst for ether and the wider altcoin space, with bitcoin coming along for the ride,” said Antoni Trenchev, co-founder of crypto exchange Nexo.

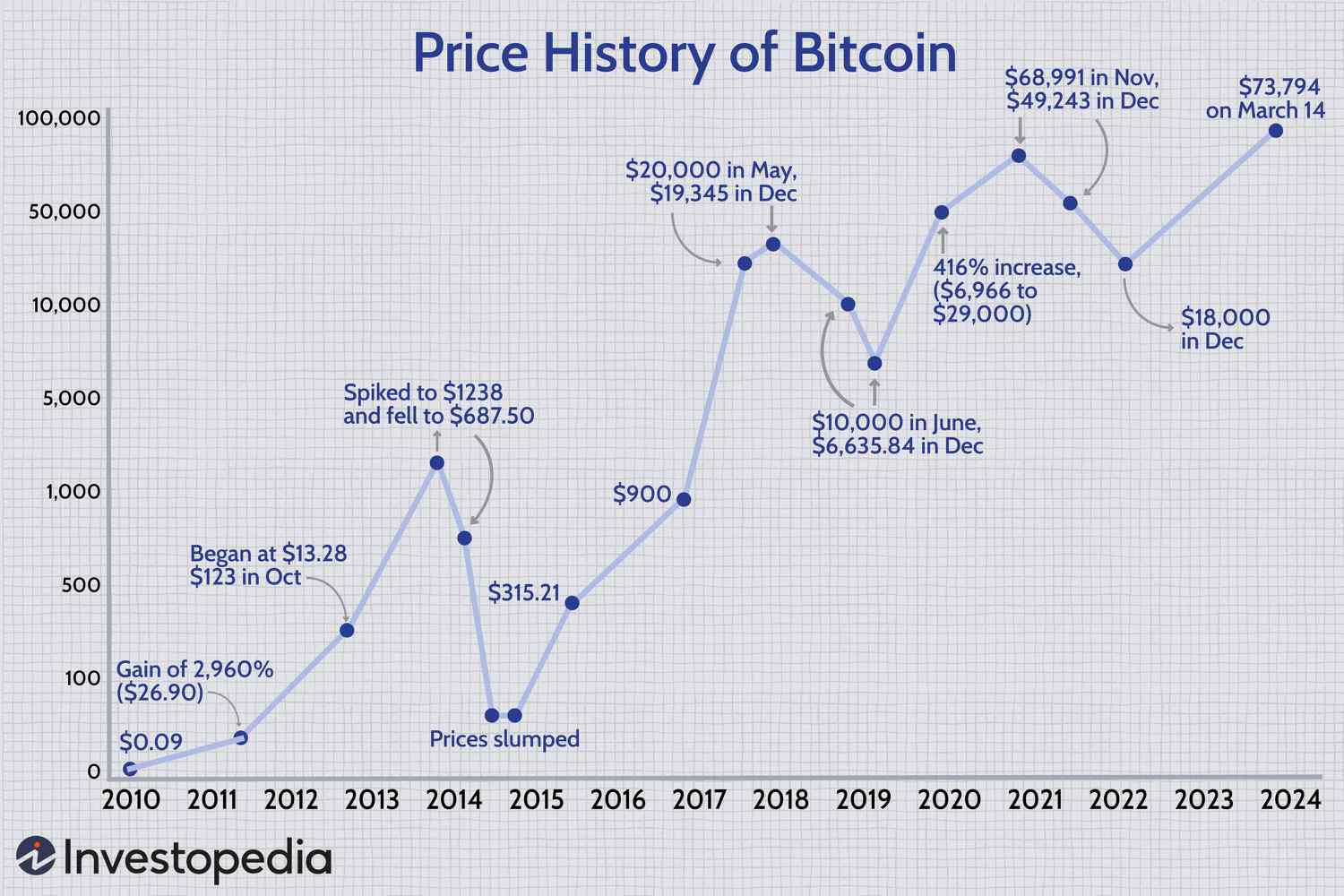

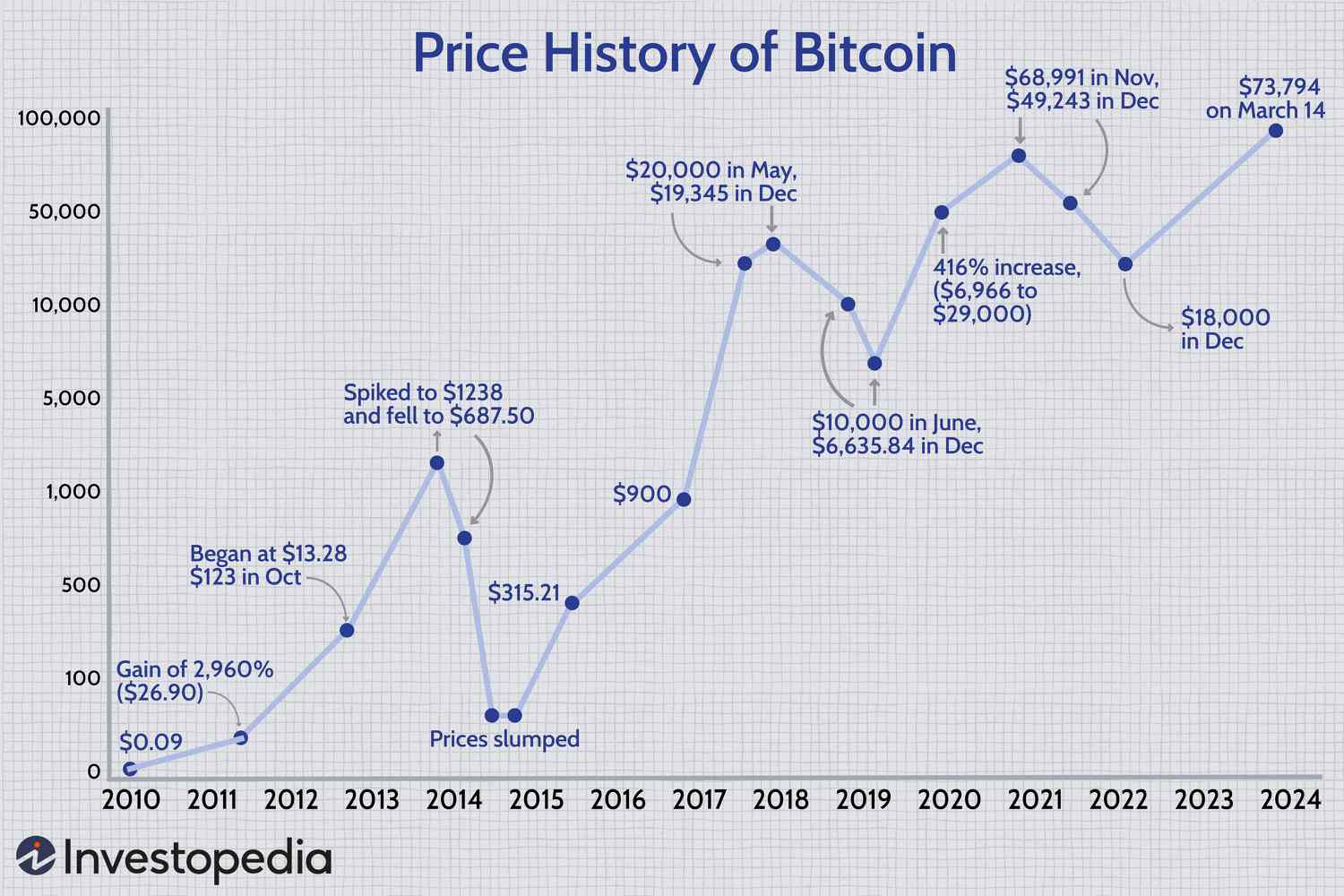

Bitcoin’s price chart shows a steady increase in May

Bitcoin’s price chart shows a steady increase in May

Bitcoin has traded in a tight range since retreating from its March record, and the lack of a clear catalyst may lead to a period of consolidation. However, as Trenchev notes, “bitcoin has barely budged in the past three months, and more of the same isn’t necessarily a bad thing as long, and dull, periods of consolidation usually precede violent moves – just look at the last halving year in 2020 when Bitcoin sat on its hands for five months before exploding upwards.”

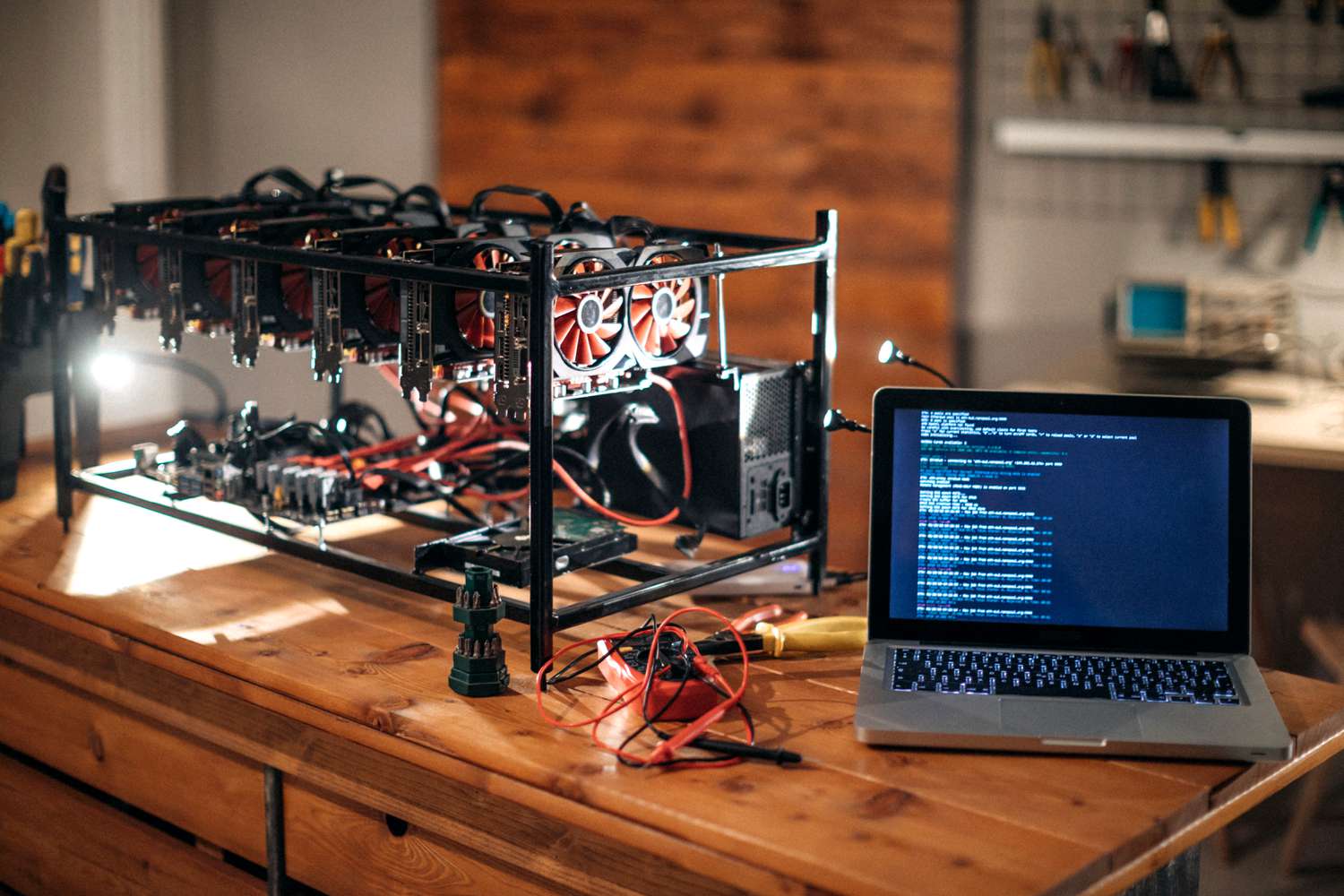

Bitcoin miners are struggling to maintain profitability

Bitcoin miners are struggling to maintain profitability

One potential headwind for bitcoin is the struggle faced by miners. According to Yuya Hasegawa, crypto market analyst at Japanese bitcoin exchange Bitbank, the average time it takes miners to find and process a new block is rising, while the network’s hash rate is declining. This suggests that their profitability is weakening as their ability to mine new coins wanes.

“If the price keeps sliding, they might have to sell their bitcoin holdings to maintain cash flow, which could cause a vicious cycle,” Hasegawa said.

As the Federal Reserve’s next policy meeting approaches, traders will be watching closely for any signs of a shift in monetary policy. The personal consumption expenditures price index rose 0.2% in April, as expected, which may influence the Fed’s decision-making process.

The Federal Reserve’s next policy meeting will be closely watched

The Federal Reserve’s next policy meeting will be closely watched

Beyond Fed policy, Washington will continue to be the center of the world for crypto in June, with investors listening closely to U.S. presidential campaign messaging. As Trenchev notes, “the last month has witnessed the improbable and unlikely sight of both sides of the U.S. political divide warming to crypto ahead of the U.S. election.”

“Witnessing that narrative continue to play out in June will be a riveting sport and has huge implications for long-term regulation of the space,” Trenchev said.

As the summer months approach, bitcoin investors will be watching closely for any signs of a turnaround. Will June be a month of consolidation, or will a new catalyst emerge to drive the price of bitcoin higher? Only time will tell.

Will bitcoin’s summer slump be a temporary setback or a prolonged downturn?

Will bitcoin’s summer slump be a temporary setback or a prolonged downturn?