Bitcoin’s Sudden Plunge: What’s Behind the Cryptocurrency’s 7% Drop?

The cryptocurrency market has been on a wild ride lately, and Bitcoin is no exception. In just 24 hours, the flagship cryptocurrency plummeted by over 6%, leaving investors and enthusiasts alike wondering what’s behind the sudden drop.

Interest Rates and Dollar Strength: The Perfect Storm

The recent surge in interest rates and the strengthening of the US dollar have created a perfect storm that’s taking a toll on Bitcoin’s value. As the 10-year US Treasury yield hit its highest level of the year, investors are flocking to the dollar, causing Bitcoin to take a hit. According to Joel Kruger, market strategist at LMAX Group, “Bitcoin doesn’t need much excuse to go through a period of correction after such an explosive performance in Q1.”

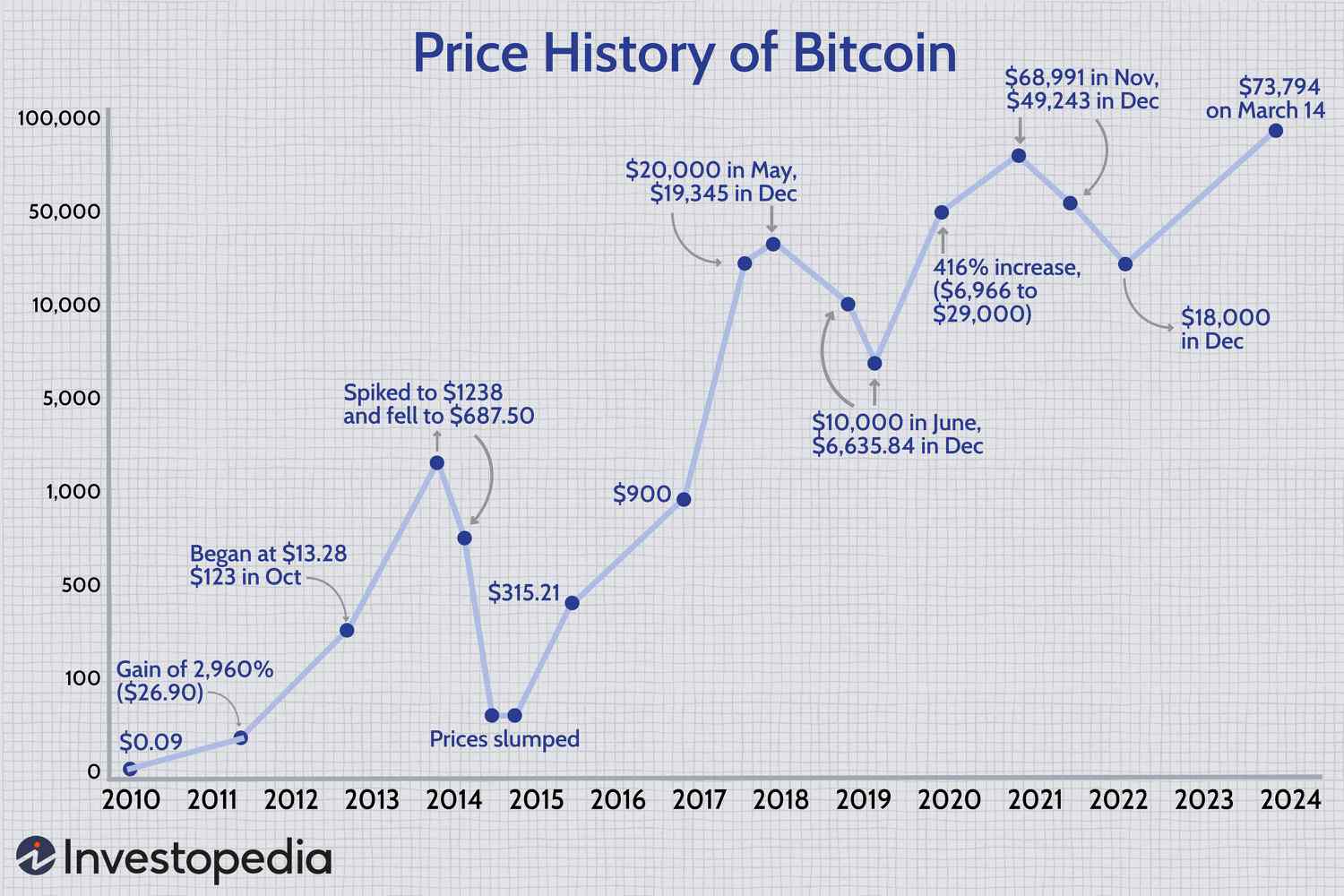

Bitcoin’s recent performance

Bitcoin’s recent performance

The Whale Effect: A Large Holder’s Impact on the Market

But that’s not all. A large Bitcoin holder, or “whale,” recently transferred over 4,000 Bitcoin to the Bitfinex exchange, sparking a selling frenzy that’s contributing to the cryptocurrency’s downward spiral. Data from CryptoQuant shows a spike in the exchange’s reserves, which typically signals a boost in selling activity.

The Ripple Effect: Stocks Tied to Bitcoin Take a Hit

The impact of Bitcoin’s drop is being felt beyond the cryptocurrency market. Stocks tied to Bitcoin’s performance, such as Coinbase, MicroStrategy, and mining stocks like Marathon Digital and Riot Platforms, are all taking a hit. CleanSpark, one of the best-performing miners this year, has also seen its stock slide.

The ripple effect on stocks

The ripple effect on stocks

What’s Next for Bitcoin?

As the cryptocurrency market continues to fluctuate, one thing is certain: Bitcoin’s recent drop is a reminder that the market can be unpredictable. While some may see this as a correction, others may view it as an opportunity to buy in. One thing is for sure – the world will be watching to see what’s next for Bitcoin.

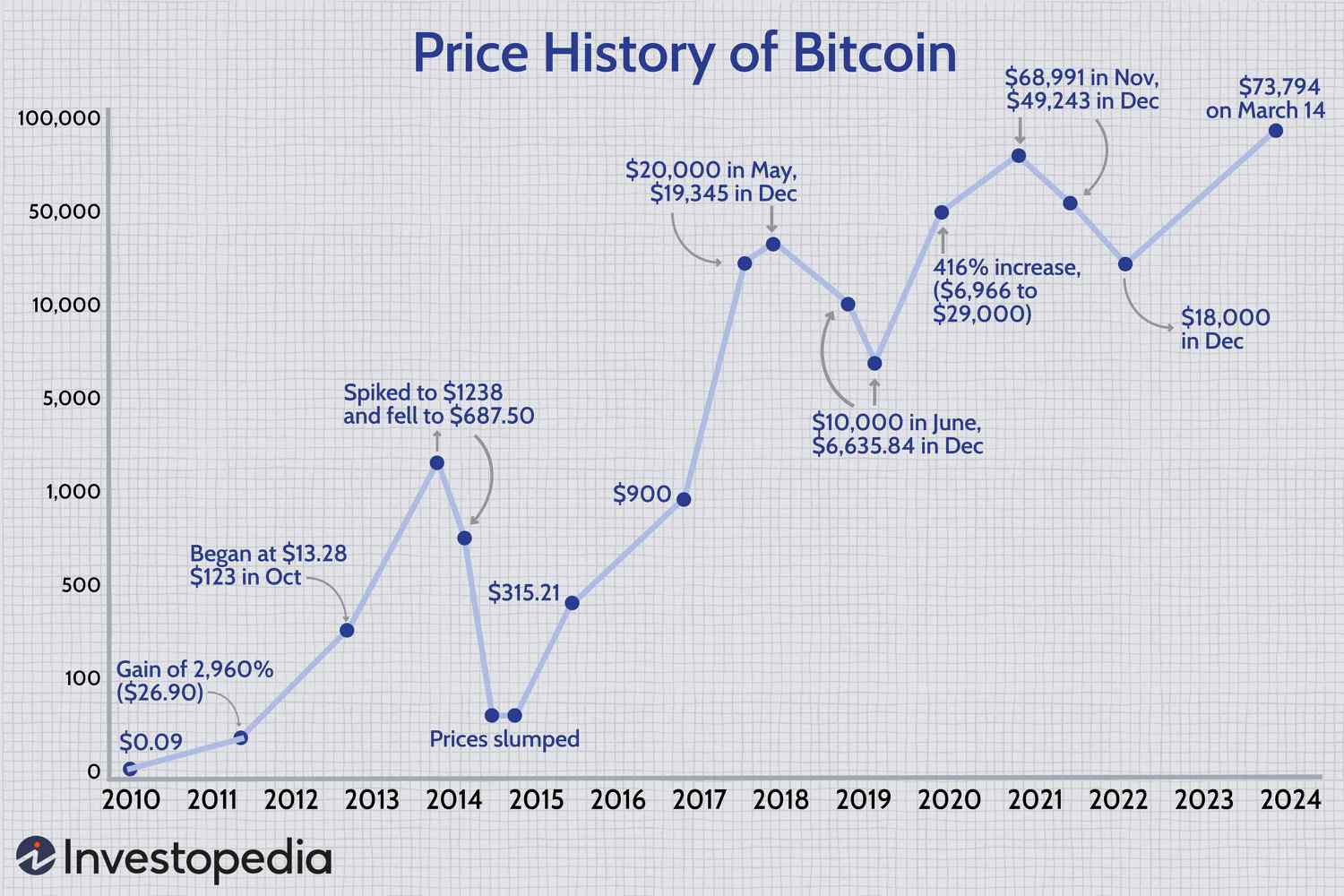

The future of Bitcoin

The future of Bitcoin