Bitcoin’s Sudden Plunge: What’s Behind the Cryptocurrency’s 10% Drop?

The leading cryptocurrency has taken a severe hit, plummeting by 10% in just the last week. This sudden drop has resulted in significant losses across the crypto market. What’s behind this sudden downturn?

A 10% drop in Bitcoin’s value in a single week

A 10% drop in Bitcoin’s value in a single week

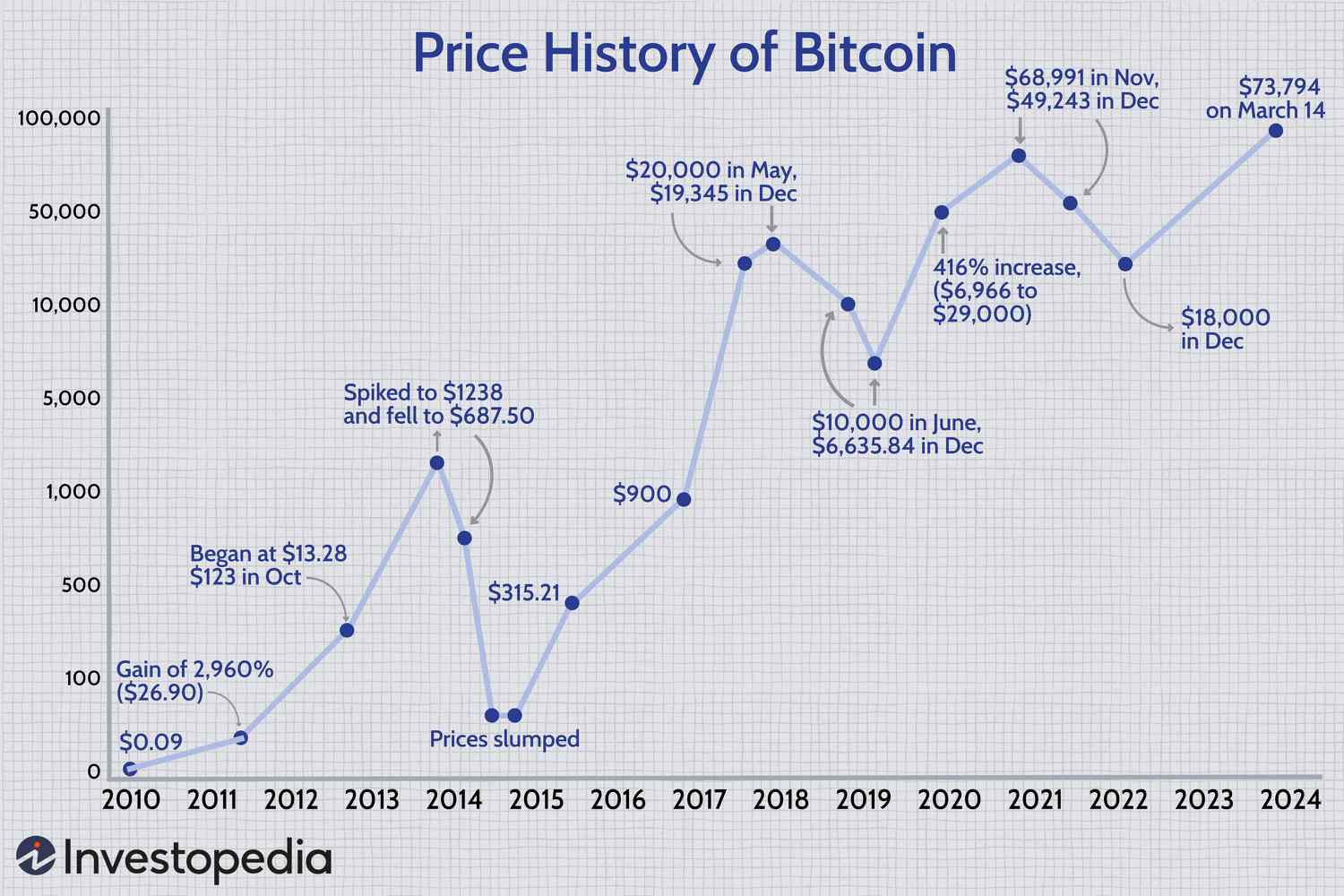

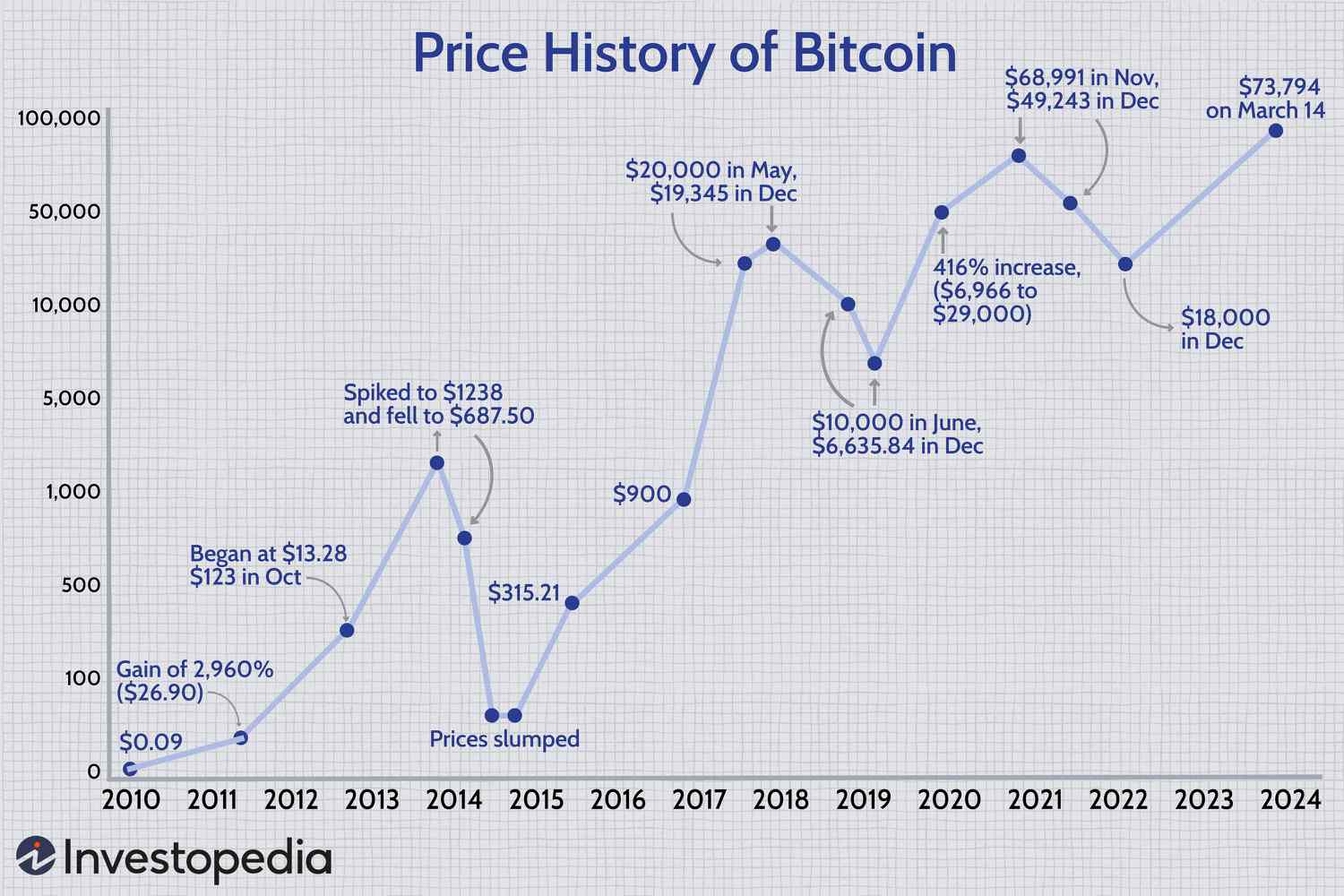

According to CoinMarketCap, Bitcoin traded around $55,000 Friday morning, after falling more than 4% in a day and losing more than 10% in a week. This dramatic fall has left many investors reeling.

The Defunct Mt. Gox Exchange: A Possible Culprit?

Experts believe that the recent repayment of Bitcoin by defunct crypto exchange Mt. Gox may be behind the sudden drop. Mt. Gox, which went bankrupt a decade ago due to a hack, is supposed to refund $9 billion worth of Bitcoin this month. A recent report by Arkham Intelligence revealed that the defunct crypto exchange transferred 47,229 Bitcoin, valued at more than $2.7 billion, to a new wallet on Thursday.

‘Creditors receiving Bitcoin may promptly sell it.’ - Experts

This influx of Bitcoin into the market may be causing the value to drop as creditors sell their newly acquired assets.

Other Cryptocurrencies Feel the Heat

The effects of the drop are not limited to Bitcoin. Ether, the second-largest cryptocurrency by market capitalization, has fallen by more than 5.5% and is currently hovering around $2,900. Cardano and Dogecoin have dropped by 8.5% and 6.5%, respectively, over the past 24 hours. Overall, the global crypto market cap is at $2.02 trillion, with a 4.5% drop on Friday morning.

The global crypto market cap takes a hit

The global crypto market cap takes a hit

Mt. Gox: A Notorious Name in Cryptocurrency

Mt. Gox was once the world’s largest Bitcoin exchange, handling nearly 70% of all Bitcoin transactions at its peak. The exchange declared bankruptcy in 2014, owing creditors 45 billion yen ($414 million). Creditors have been waiting for the repayment of their holdings ever since.

Mt. Gox, a name synonymous with cryptocurrency controversy

Mt. Gox, a name synonymous with cryptocurrency controversy

The road to repayment has been long and arduous, with Mt. Gox making its first transaction in over five years earlier this year. The plan is to distribute the assets back to creditors before October 31, 2024.

The Future of Cryptocurrency

As the cryptocurrency market continues to fluctuate, one thing is certain: the impact of Mt. Gox’s repayment will be felt across the industry. Will Bitcoin and other cryptocurrencies recover from this sudden drop, or is this a sign of things to come?

Only time will tell.