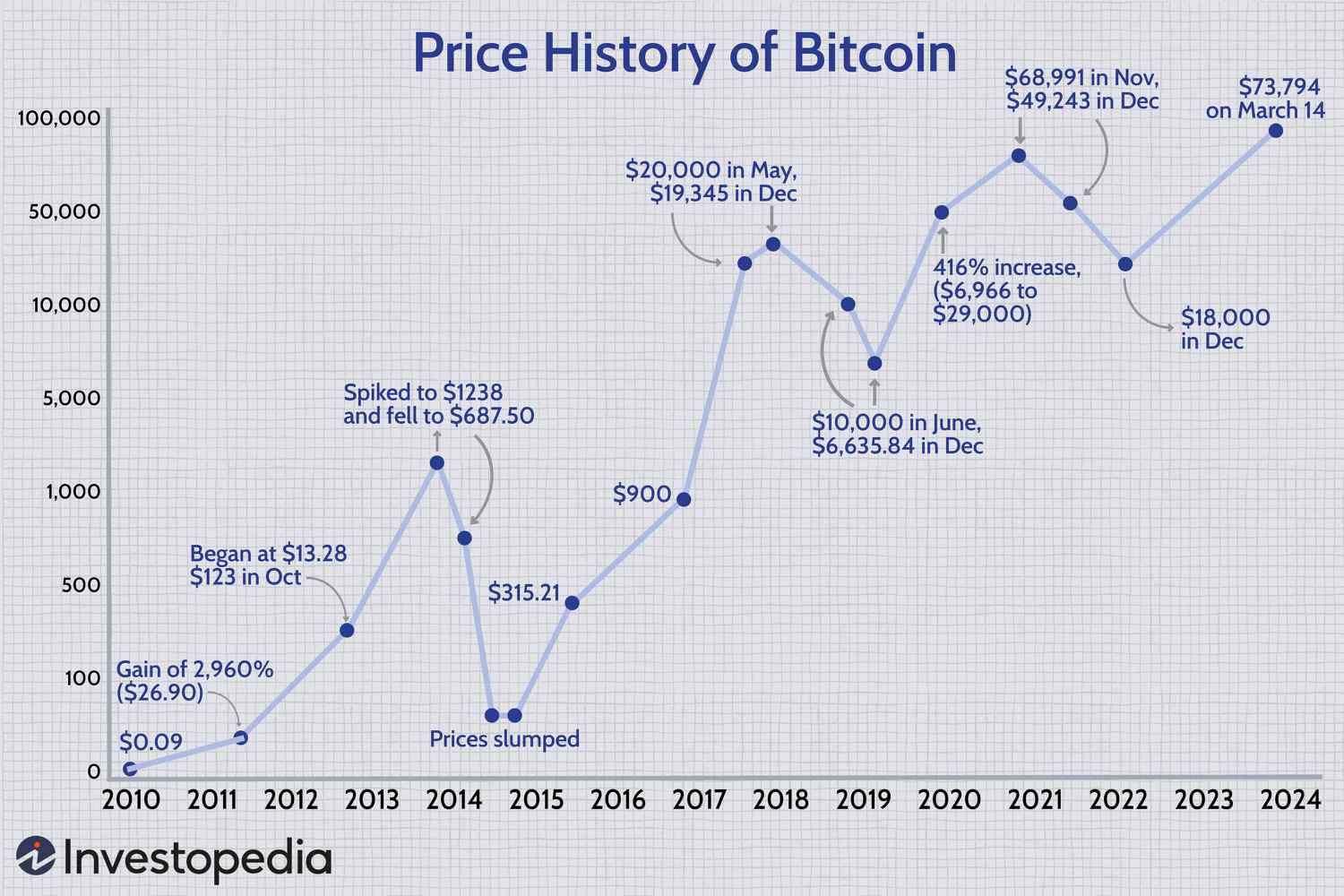

Bitcoin’s Strength Tested by Macro Factors

Despite bitcoin’s current strength, macroeconomic factors pose a significant risk to its continued growth. According to crypto analyst Chang, bond yields are unstable, and the demand is weak compared to U.S. Treasuries issuance. This could negatively impact bitcoin’s price.

Bitcoin’s price remains strong, but macro factors threaten its growth.

Bitcoin’s price remains strong, but macro factors threaten its growth.

Bitcoin’s price has been chopping at elevated levels, suggesting a typical temporary bull-market pause. However, Chang warns that recent macroeconomic developments could impede a move higher. The yield on the benchmark 10-year Treasury has climbed 24 basis points to 4.55% in two weeks, according to data from TradingView.

“Bitcoin is still strong, but macro factors are threatening,” Chang said. “Bond yields are very unstable as the demand is weak compared to U.S. Treasuries issuance. If there is a negative impact on bitcoin, it will likely be due to yields and the dollar index.”

Rising Yields and Their Impact on Bitcoin

Treasury yields have been rising, predominantly due to persistent U.S. debt concerns, the deluge of bond supply, and the uptick in Japanese government bond yields. This could inject volatility into stock markets and dent the appeal of investing in relatively risky assets like bitcoin and technology stocks.

Bond yields are rising, posing a risk to bitcoin’s growth.

Bond yields are rising, posing a risk to bitcoin’s growth.

The two-year Treasury yield is already approaching 5%. The ability to lock in returns of 5% in government bonds, which are seen as safe investments, might persuade macro traders to rotate money out of stocks, cryptocurrencies, and other, riskier corners of the financial market.

PCE Price Index: A Key Indicator

Traders will closely watch the personal-consumption expenditures (PCE) price index for guidance on the direction of Federal Reserve interest rates. The data, the Fed’s preferred inflation measure, is scheduled for release on Friday at 8:30 EST (12:30 UTC).

“The most important main event of the day is PCE. The data the Fed loves. The 2% inflation target they talk about is PCE, not CPI. If the data beats expectations, people will not buy risk assets,” Chang said.

A bigger-than-expected jump in the core figure would weaken the case for renewed interest-rate cuts, leading to a further hardening of bond yields.

The PCE price index is a key indicator of inflation and interest rates.

The PCE price index is a key indicator of inflation and interest rates.

In conclusion, while bitcoin’s strength is still evident, macro factors pose a significant risk to its continued growth. The rising yields and the PCE price index will be crucial in determining the direction of bitcoin’s price in the coming days.