Bitcoin’s Sovereign Wealth Fund Boom: What’s Next for the Cryptocurrency Market?

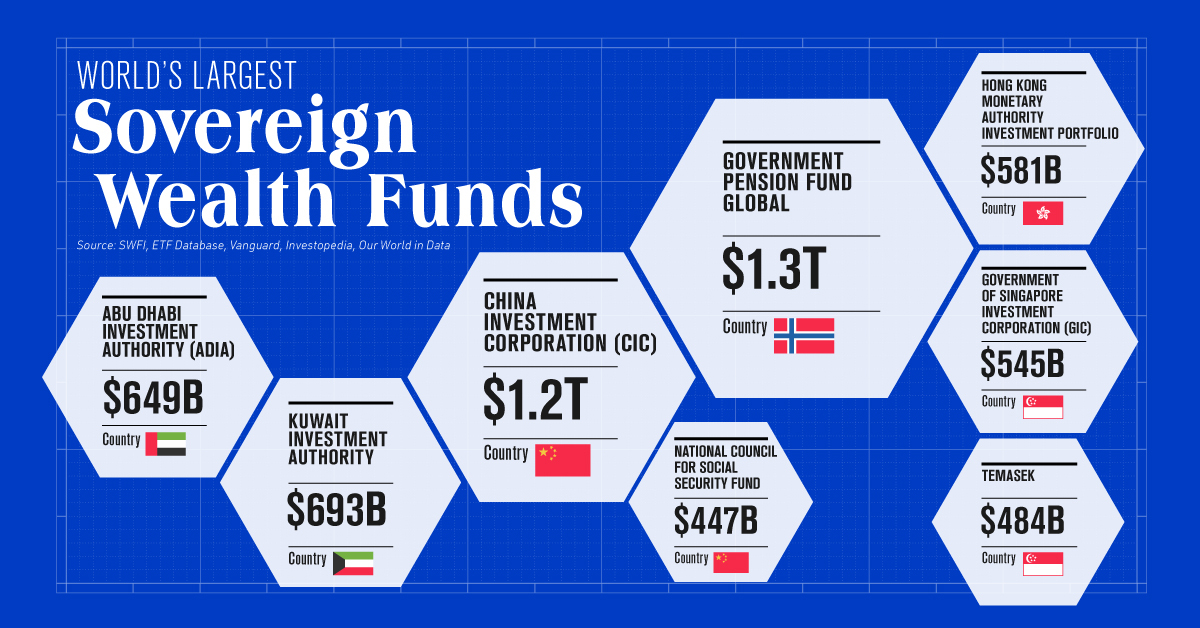

The bitcoin price has stabilized following a sudden “perfect storm” sell-off that wiped $300 billion from the combined bitcoin and crypto market. The bitcoin price remains near $60,000 per bitcoin, up around 50% from the beginning of the year, powered by a fleet of new Wall Street spot bitcoin exchange-traded funds (ETFs).

Bitcoin ETFs have opened up the cryptocurrency to a new cohort of investors.

Bitcoin ETFs have opened up the cryptocurrency to a new cohort of investors.

Now, as the “end goal” for Tesla billionaire Elon Musk’s X is poised to cause bitcoin price chaos, an executive at spot bitcoin ETF issuer BlackRock has revealed sovereign wealth funds are showing interest in bitcoin—and could begin trading in coming months.

“Many of these interested firms—whether we’re talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices—are having ongoing diligence and research conversations, and we’re playing a role from an education perspective,” Robert Mitchnick, BlackRock’s head of bitcoin and crypto, told Coindesk.

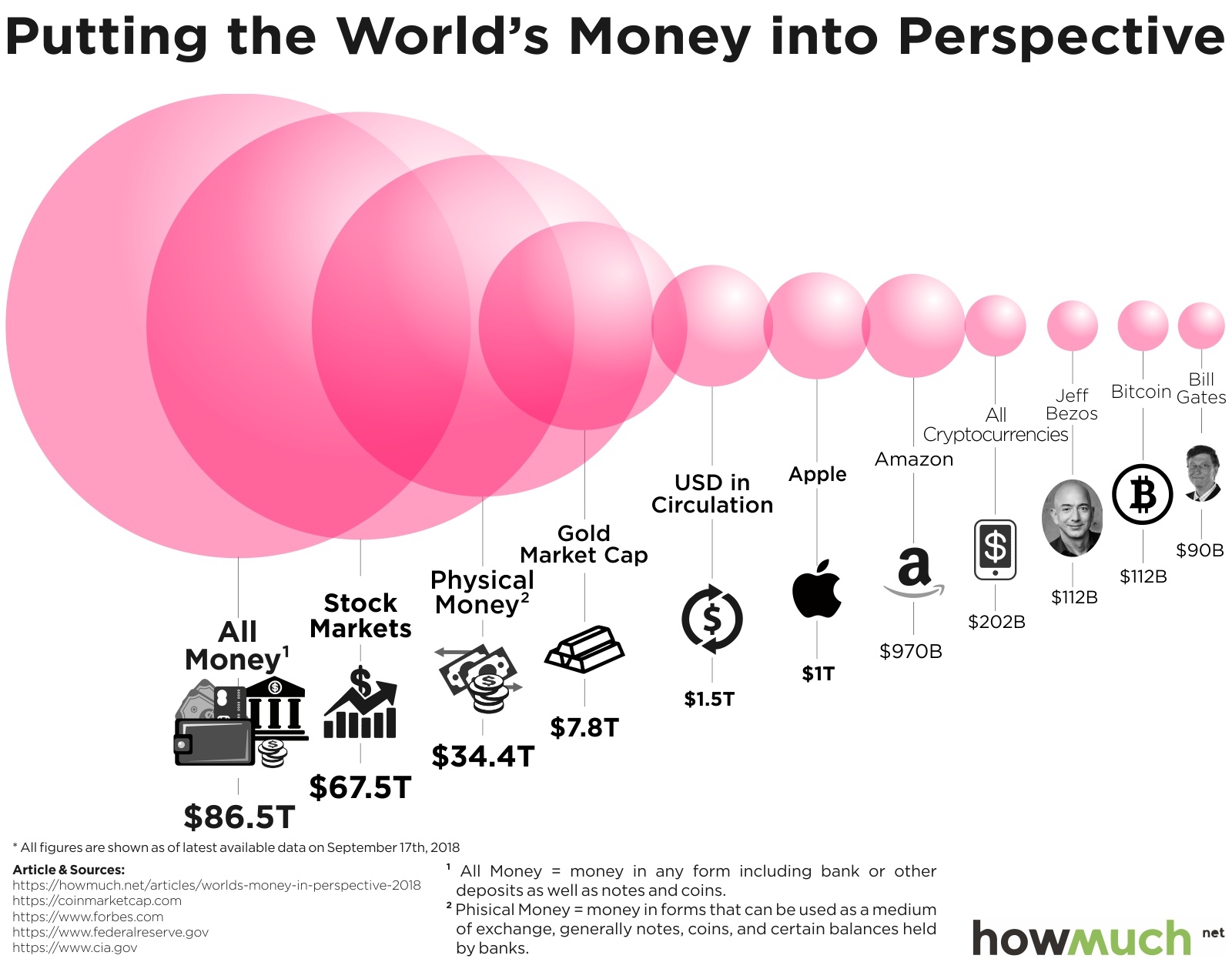

Sovereign wealth funds, such as those run by Kuwait and Saudi Arabia, are talking to BlackRock about bitcoin as the bitcoin price has bounced back this year. This interest from sovereign wealth funds would represent a huge shift in investment attitude toward bitcoin and crypto.

Sovereign wealth funds are showing interest in bitcoin.

Sovereign wealth funds are showing interest in bitcoin.

The arrival of long-awaited spot bitcoin ETFs on Wall Street this year have already opened up bitcoin to a new cohort of investors who previously regarded it as an unproven store of value. The largest of the new funds, BlackRock’s IBIT, has amassed $17 billion in assets under management in the three months since its debut, recently notching a 71-day inflow streak.

Bitcoin ETFs have seen significant inflows in recent months.

As the bitcoin price continues to rise, it’s clear that the cryptocurrency market is on the cusp of a major shift. With sovereign wealth funds and institutional investors showing interest, it’s likely that the bitcoin price will continue to rise in the coming months.

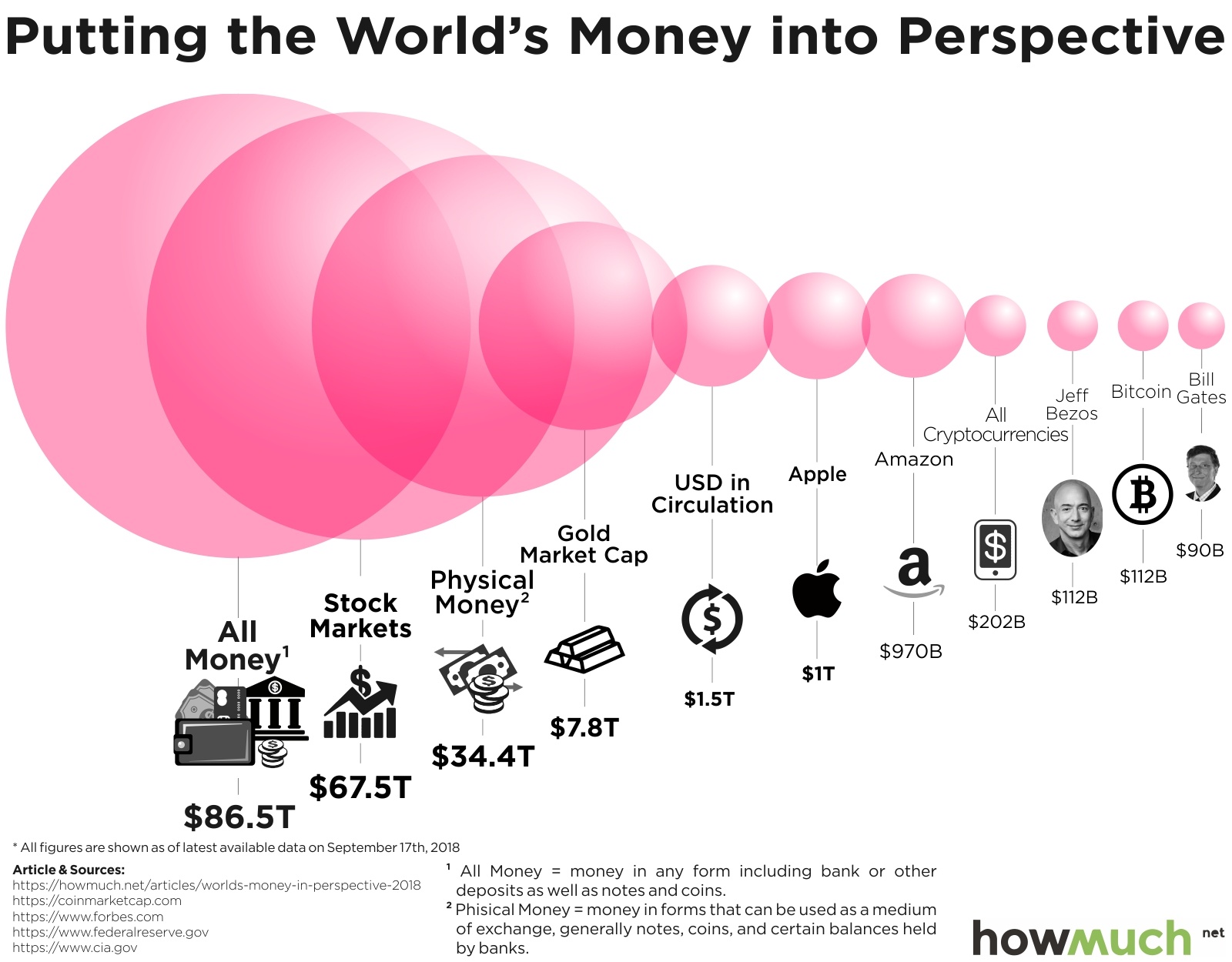

The bitcoin price has rocketed higher over the last year.

The bitcoin price has rocketed higher over the last year.

What’s next for the cryptocurrency market? Only time will tell, but one thing is certain: the future of bitcoin is looking brighter than ever.