Bitcoin’s Rollercoaster Ride: A Comedy of Errors

In a twist of fate that left investors scratching their heads, the crypto market recently shed a whopping $400 billion in value following Bitcoin’s all-time high. As the dust settled, Bitcoin found itself in a precarious position, desperately trying to stage a rebound amidst the chaos.

The rollercoaster journey began when Bitcoin took a nosedive on Wednesday, briefly plummeting below the $61,000 mark in a session of volatile trade. However, in a surprising turn of events, Bitcoin managed to claw its way back, trading just over $63,900 by 07:20 a.m. ET, marking a modest 1% increase from the previous 24 hours.

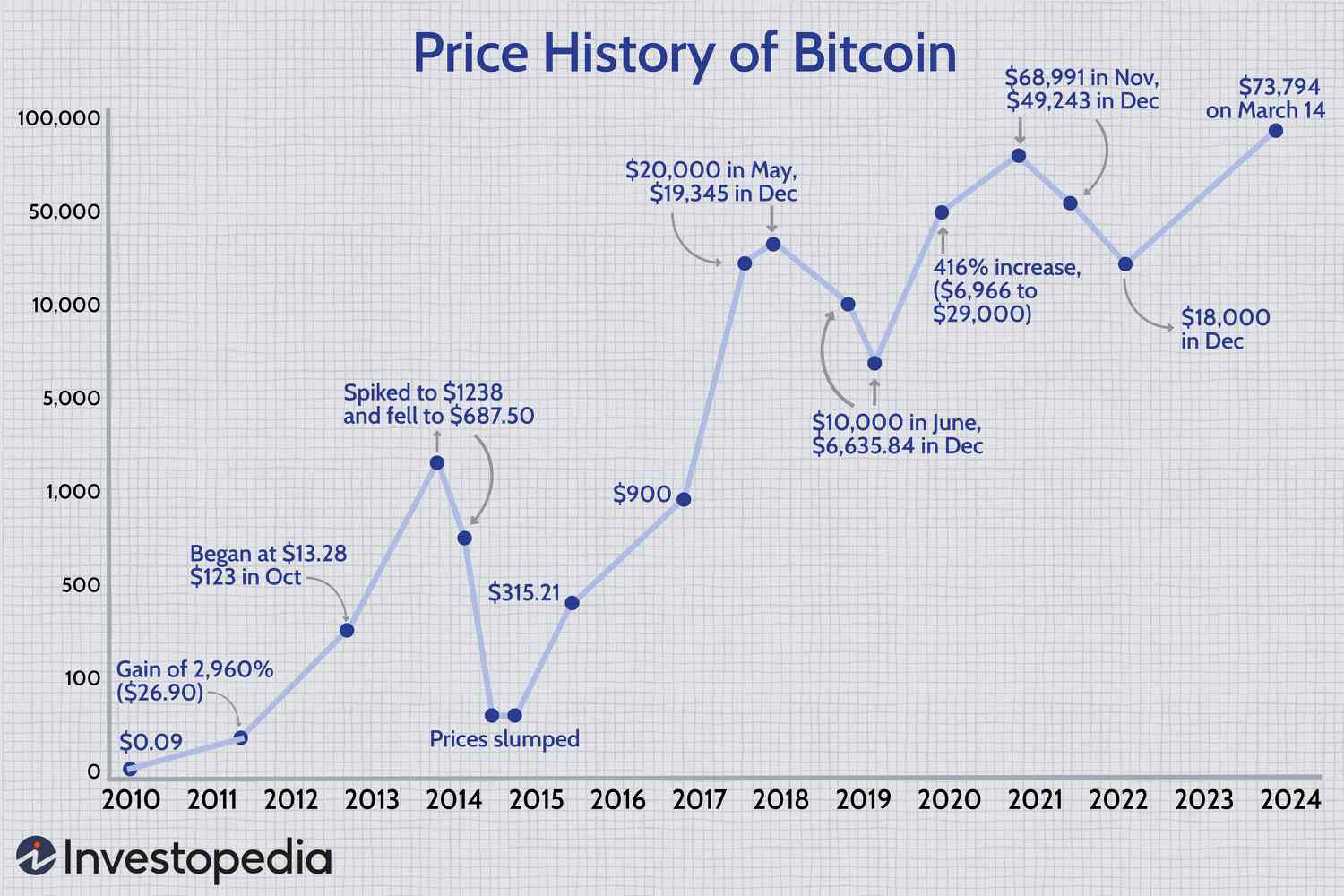

The drama continued as Bitcoin reached an intraday high of $65,716, only to be overshadowed by its own success. With a stellar 124% increase in the past year, Bitcoin had soared to a record high of nearly $73,800 just a week prior.

Fueling the frenzy were the launch of spot Bitcoin exchange-traded funds in the U.S. back in January and the much-anticipated halving event. The halving, a mystical occurrence encoded in Bitcoin’s DNA, effectively slows the supply of the digital coin, historically propping up prices.

Despite the euphoria surrounding Bitcoin, the reality check came swiftly. The total value of all digital coins took a nosedive post-Bitcoin’s peak, shedding a staggering $200 billion by Wednesday morning. The entire cryptocurrency market witnessed a collective loss of around $370 billion, with other digital assets like ether and Solana following suit.

As the dust settles, one can’t help but marvel at the whimsical nature of the crypto world. With fortunes made and lost in the blink of an eye, Bitcoin’s rollercoaster ride serves as a stark reminder of the unpredictable landscape investors navigate.

Stay tuned for more updates on the crypto saga!

Disclaimer: The content of this article is purely fictional and meant for entertainment purposes only.