Bitcoin’s Rise to Fame: Can it Still Make You a Millionaire?

The cryptocurrency rally has abruptly halted after a solid 15-month period that saw Bitcoin (BTC) hitting an all-time high earlier this year. However, Bitcoin price has been rangebound and is presently trading below 69,000. This comes despite renewed optimism that the Federal Reserve could soon start its interest rate cuts.

Bitcoin’s price performance

Bitcoin’s price performance

The Bitcoin rally gathered steam in early January after the SEC approved 11 spot Bitcoin ETFs. The cryptocurrency dipped in April with the start of the halving event. The halving event, which occurs once every four years, lowers the block reward by 50%, with the goal of limiting the total supply of Bitcoin to 21 million coins.

“I think it’s just a matter of time, and it’s inevitable there’s gonna be an XRP ETF, there’s gonna be a solana ETF, there’s gonna be a cardano ETF, and that’s great,” Ripple’s Brad Garlinghouse said on stage during Coindesk’s Consensus crypto conference in Austin, Texas.

However, Bitcoin, ethereum, XRP, and crypto regulatory clarity is in the bottom decile, according to Garlinghouse. “Getting the regulatory posture right in the United States is just critical.”

Ripple’s Brad Garlinghouse

Ripple’s Brad Garlinghouse

Ripple, along with major crypto exchange Coinbase and crypto asset manager Grayscale, have led a long-running campaign by the crypto industry to convince the U.S. Securities and Exchange Commission (SEC) to update its regulatory rule book for crypto.

Crypto ETFs on the rise

Crypto ETFs on the rise

Crypto scored a major win over the SEC last month when the regulator appeared to bend to political pressure and began the process of waving through a handful of spot ethereum ETFs.

Ethereum ETFs approved

Ethereum ETFs approved

Shark Tank billionaire Mark Cuban, an outspoken supporter of president Joe Biden, has warned former U.S. president Donald Trump could win the 2024 election due to Biden’s opposition to crypto.

Mark Cuban on crypto

Mark Cuban on crypto

Trump has promised to make the U.S. “the leader in the field” of crypto, and warned Biden “wants it to die a slow and painful death. That will never happen with me.”

Donald Trump on crypto

Donald Trump on crypto

Forget the S&P 500: Bitcoin Could Still Be the Best Long-Term Investment if You Want to Retire a Millionaire

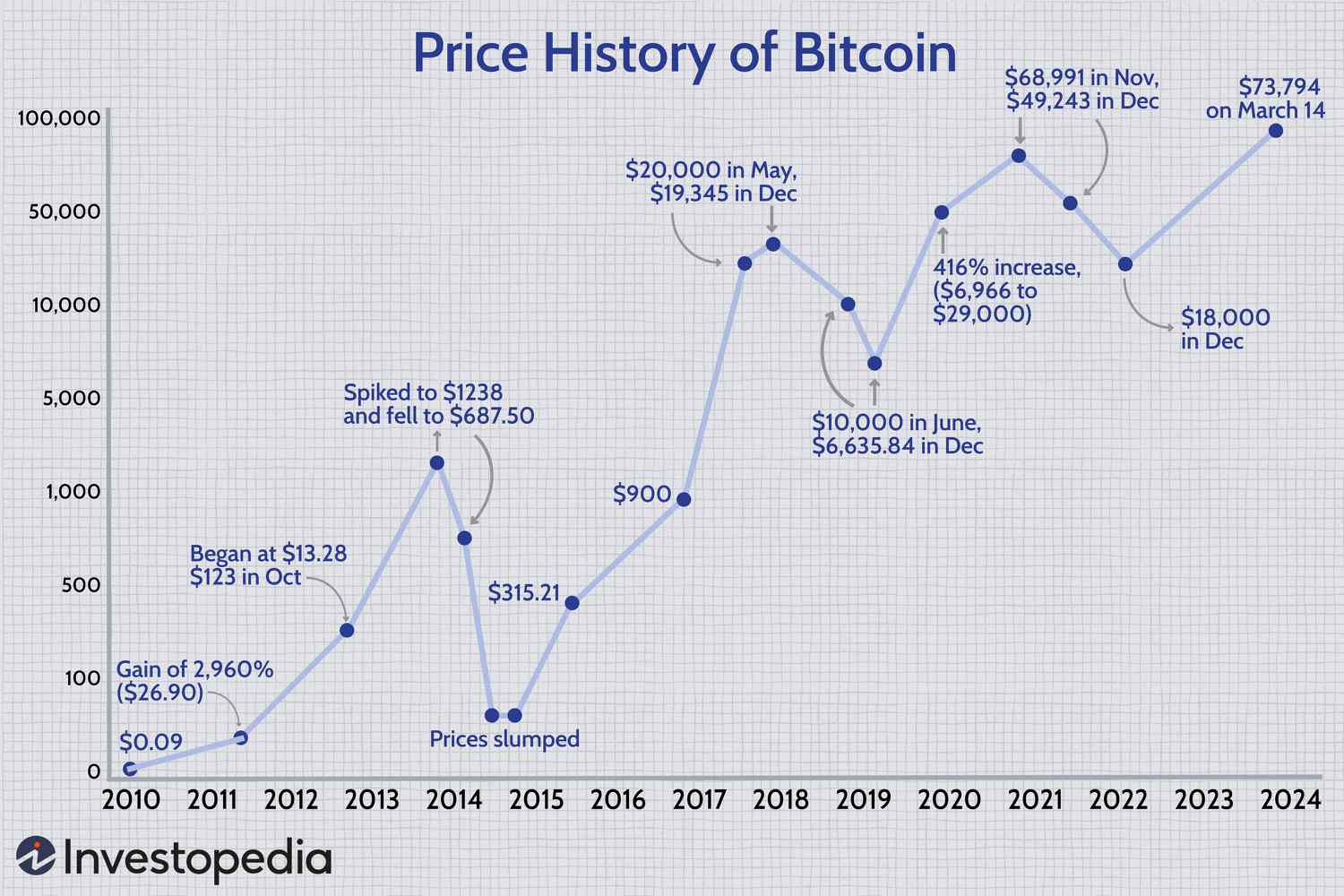

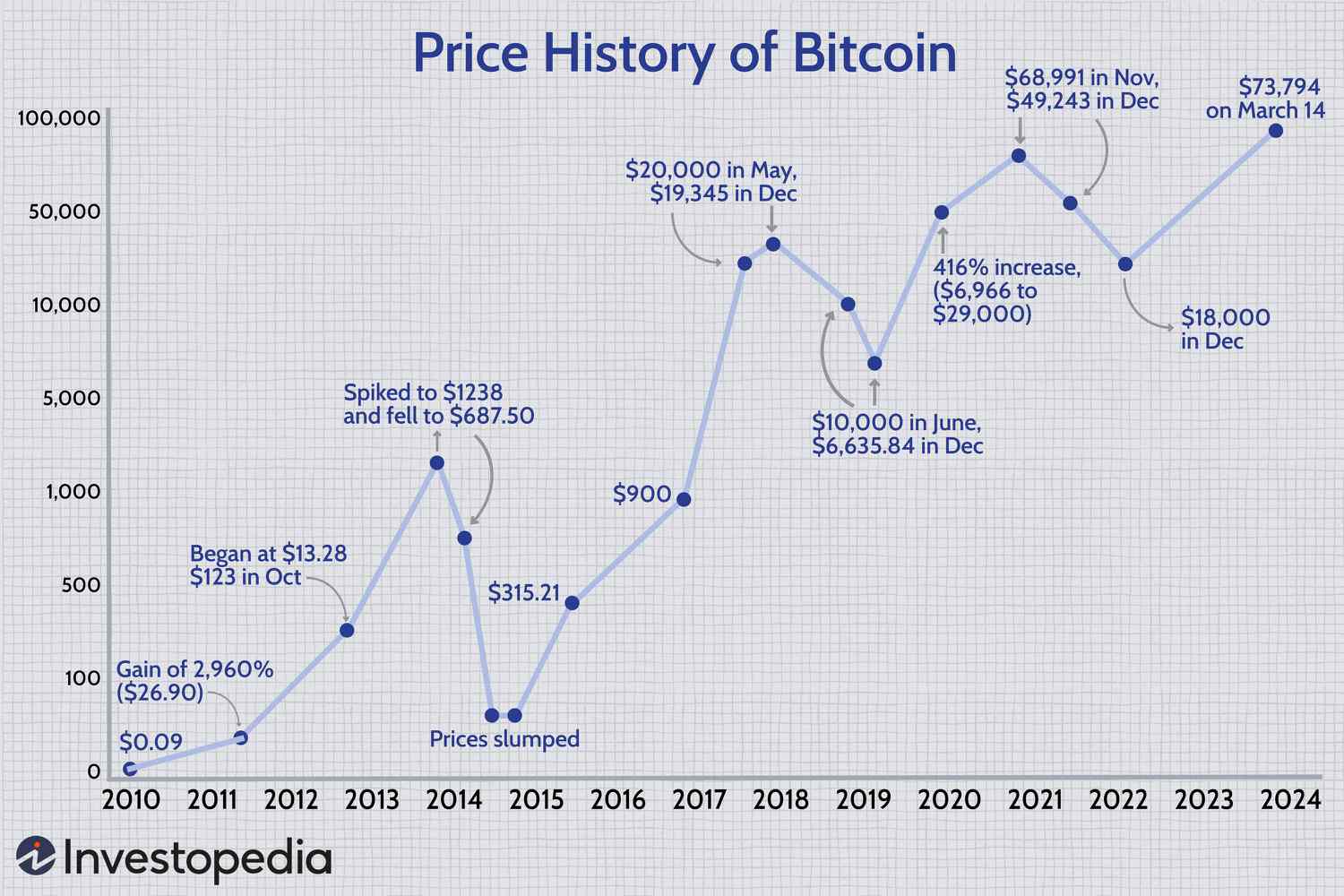

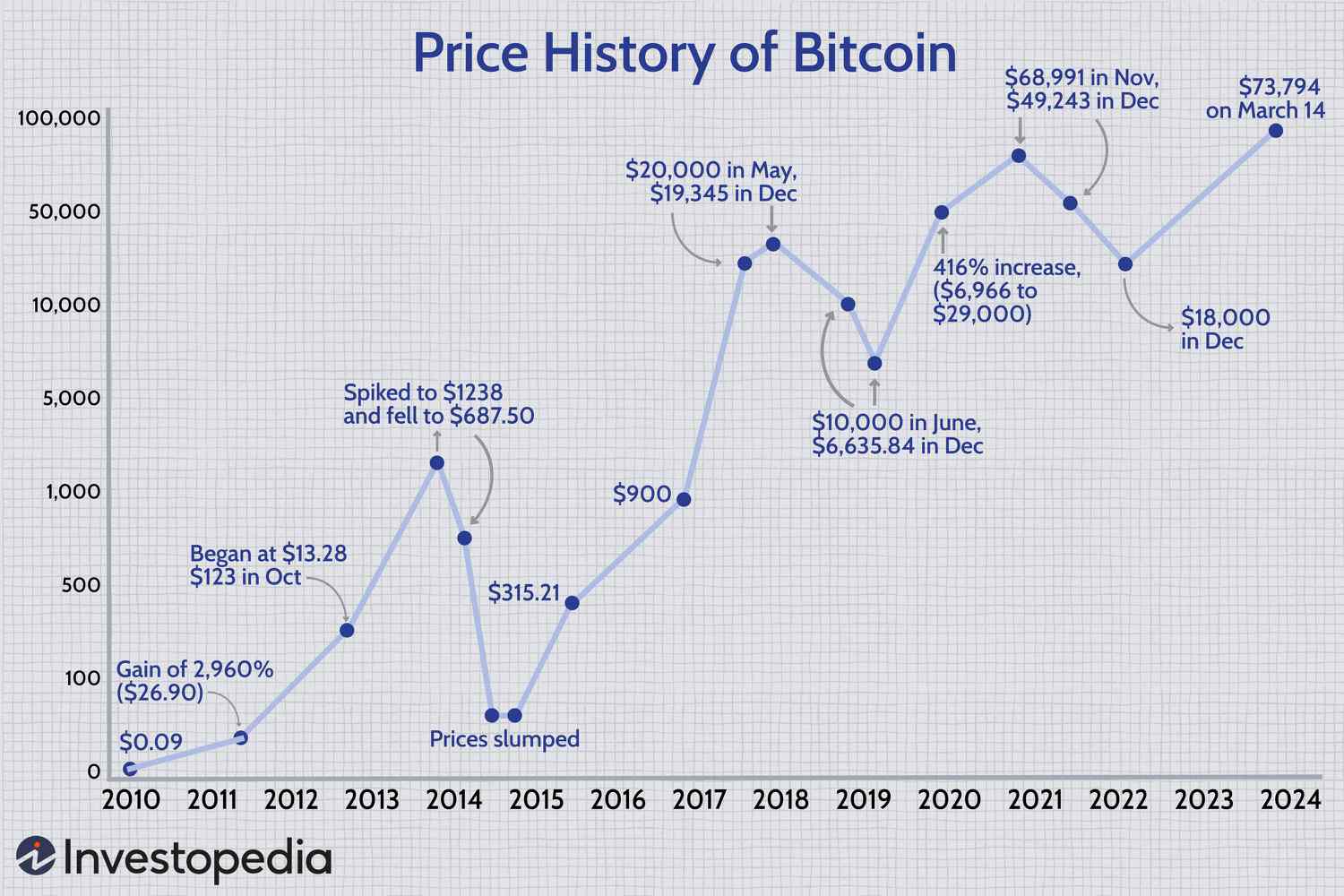

Over multiyear time horizons, Bitcoin continues to outperform every other major asset class, and it’s not even close. The idea that Bitcoin might be a better long-term investment than the S&P 500 may be controversial, but consider the evidence.

Bitcoin vs S&P 500

The answer might surprise you. Yes, Bitcoin is extraordinarily volatile. And, yes, the crypto market has historically been a very risky place to invest. But there’s a good reason why institutional investors are piling into Bitcoin these days: It’s impossible to ignore Bitcoin’s superior long-term returns.

Institutional investors in crypto

Institutional investors in crypto

How much Bitcoin should be in your portfolio? Using Modern Portfolio Theory, which takes into account factors such as correlations between asset classes, it’s possible to calculate just how much Bitcoin should be in your portfolio. As you might have guessed by now, that percentage has been steadily rising over time.

Optimal Bitcoin allocation

Optimal Bitcoin allocation

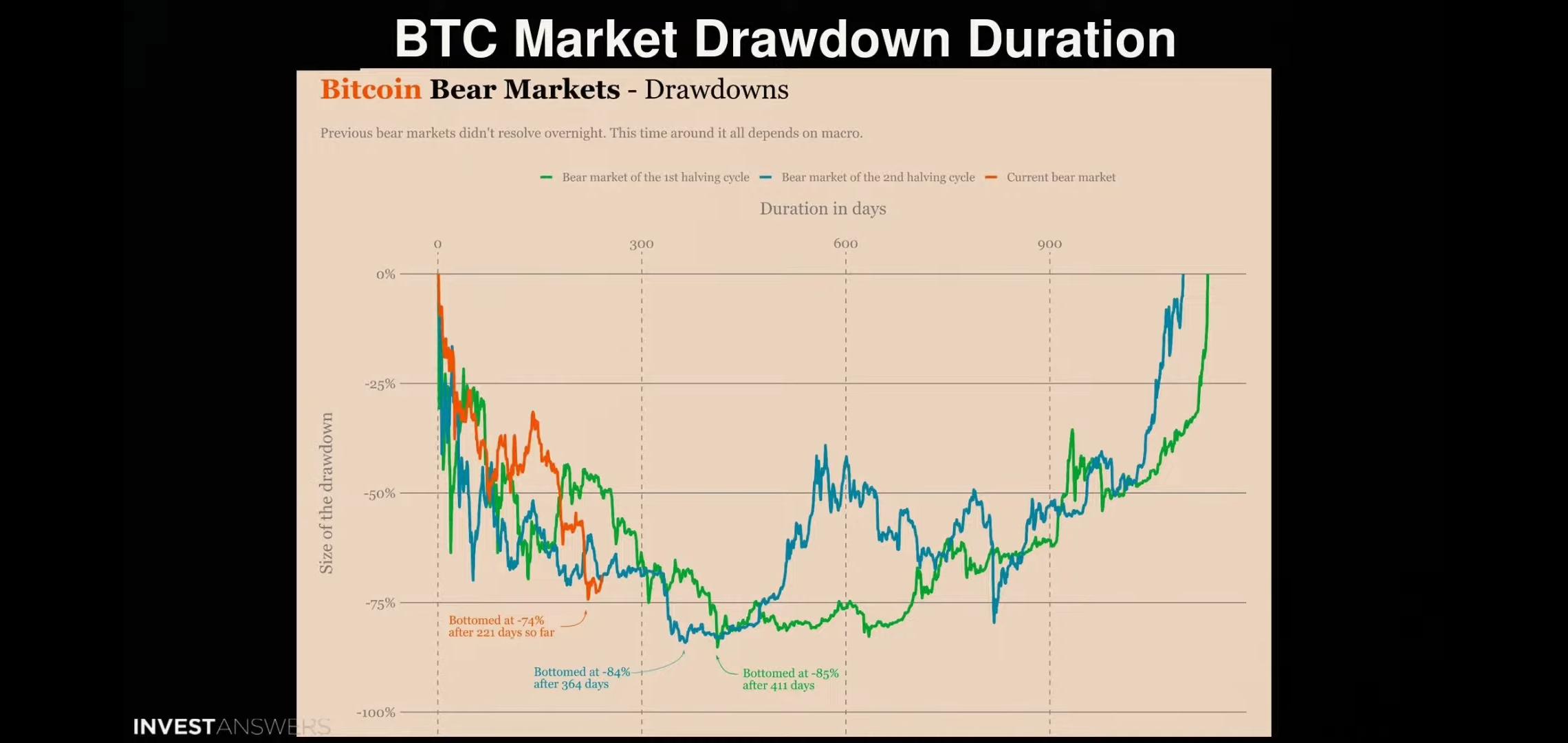

While I’m extremely bullish on Bitcoin, I would never advise someone to put nearly 20% of their portfolio into such a risky and volatile asset. After all, as even Wood acknowledges, there have been at least four major drawdowns in the history of Bitcoin when its price has collapsed by 77% or more.

Bitcoin drawdowns

Bitcoin drawdowns

That’s scary, but it also points to Bitcoin’s resilience. After every major bloodbath, Bitcoin has returned even stronger, going on to set new all-time highs. But you have to be patient. You need to have a long enough holding period to ensure that you can capture all of Bitcoin’s upside while recovering from any particularly nasty drawdowns.

Bitcoin resilience

Bitcoin resilience

Does slow and steady still win the race? Obviously, comparing the performance of Bitcoin to that of the S&P 500 is bound to be controversial. But you can’t ignore the evidence. As impressive as the performance of the S&P 500 might be over a particular time period, Bitcoin is almost certain to outperform it.

Bitcoin vs S&P 500

Thus, if you are really serious about becoming a millionaire, you might consider adding a sliver of Bitcoin to your portfolio. Think of it as the magic rocket fuel that could send your portfolio skyrocketing to new highs. Just make sure you’re buckled up and ready for some periods of extreme turbulence.

Bitcoin rocket fuel

Bitcoin rocket fuel