Bitcoin’s Rise to $1 Million: What You Need to Know

As the world of cryptocurrency continues to evolve, one thing is certain: Bitcoin is on the rise. With some Wall Street analysts predicting a staggering 1,415% increase to $1 million in the next decade, it’s no wonder investors are taking notice. But what’s driving this surge, and is it too good to be true?

Institutional Investors Take the Reins

One major factor contributing to Bitcoin’s growth is the increasing demand from institutional investors. The recent approval of spot Bitcoin ETFs has opened the floodgates, providing a regulatory seal of approval and making it easier for institutions to invest in the cryptocurrency. This influx of new investors has led to a significant increase in demand, which in turn is driving up the price.

Institutional investors are flocking to Bitcoin

The Power of Halving Events

Another key factor is the periodic halving events that occur every four years. These events reduce the supply of new Bitcoin, leading to a decrease in selling pressure and a subsequent increase in price. Historically, these events have preceded significant price appreciation, and analysts are predicting the same will happen this time around.

Bitcoin halving events have consistently led to price increases

A Worthwhile Investment, but Not for the Faint of Heart

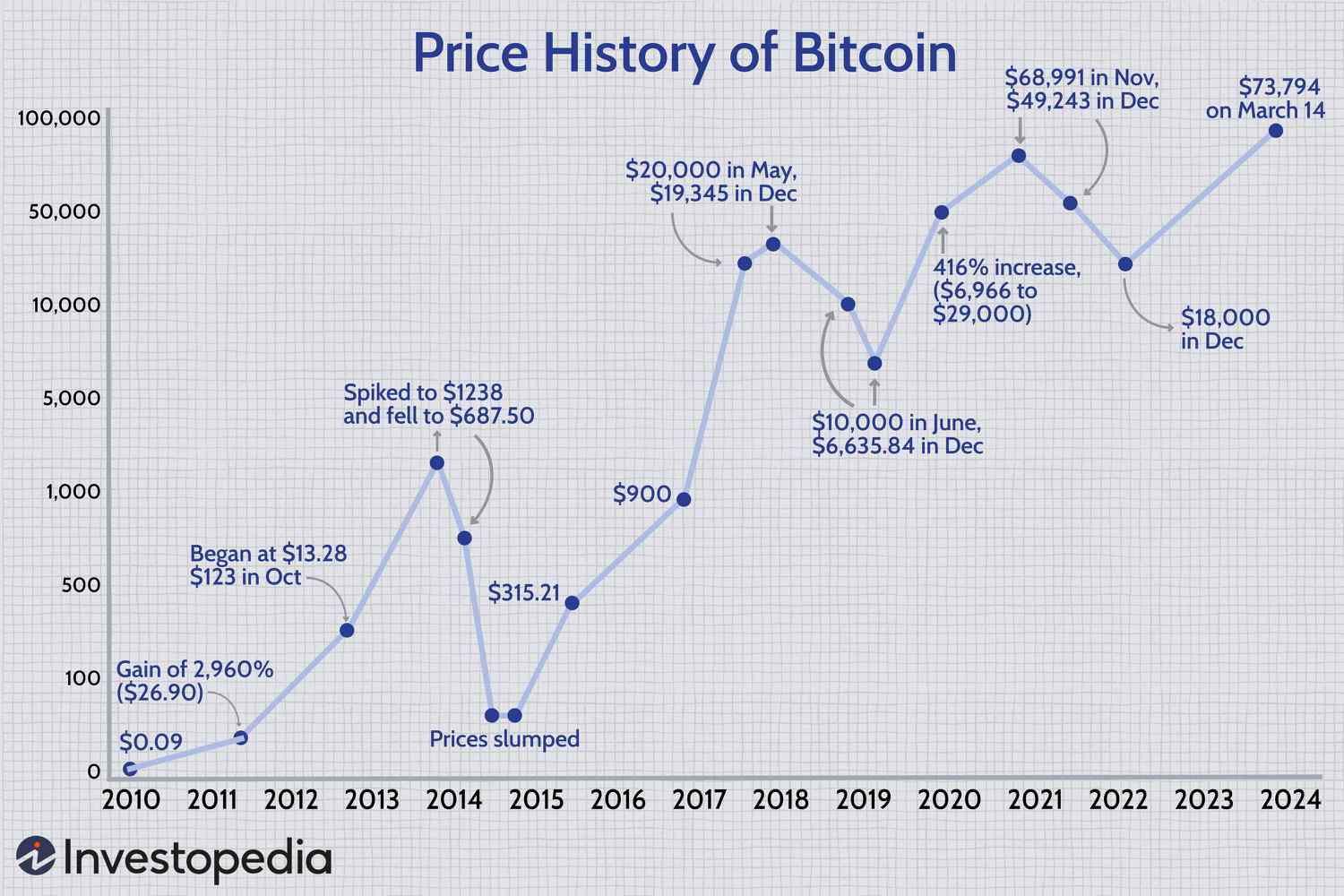

While the potential gains are certainly enticing, it’s essential to remember that Bitcoin is a volatile investment. The cryptocurrency has experienced significant downturns in the past, and there’s no guarantee it won’t happen again. Investors need to be prepared for the possibility of a 75% decline, as seen in 2021-2022.

Bitcoin’s volatility can be daunting, but the potential rewards are worth it

However, for those willing to take the risk, the potential rewards are substantial. With some analysts predicting a price tag of $3.8 million if institutional investors allocate just 5% of their assets to spot Bitcoin ETFs, the possibilities are endless.

Conclusion

Bitcoin’s rise to $1 million may seem like a lofty goal, but with the increasing demand from institutional investors and the power of halving events, it’s certainly within reach. For investors who can tolerate the volatility, Bitcoin may be a worthwhile addition to their portfolio. But for those who can’t stomach the risk, it’s best to steer clear.

The future of Bitcoin is bright, but it’s not for everyone