Bitcoin’s Resurgence: How Fed Rate Cuts Fuel Crypto’s Future

As the world of cryptocurrency continues to evolve, recent developments in the financial landscape are injecting new energy into Bitcoin. The announcement by the US Federal Reserve to cut interest rates by 50 basis points marks the first such move since 2020. This decision has spurred a renewed interest in Bitcoin, pushing its value above the $61,000 mark after a period where it struggled to maintain its position above $60,000 and tested support levels around $55,000 multiple times.

Bitcoin’s upward trajectory in light of new economic shifts.

Bitcoin’s upward trajectory in light of new economic shifts.

Bitcoin and the Impact of Federal Decisions

The implications of the Fed’s decision are not merely transactional; they represent a significant shift in how digital assets might respond to traditional economic policies. The initial reactions from investors have been overwhelmingly positive, leading to a rise in Bitcoin’s value. However, beneath this facade lies a multifaceted situation. Analysts had speculated a more conservative 25 basis points cut, but the Fed’s significant move suggests a more aggressive approach to economic management.

Glimpsing the Future of Bitcoin

Predicting the trajectory of Bitcoin remains a daunting task. Currently hovering around $62,092, there’s a noticeable resistance level at $62,600. Should Bitcoin break this threshold, it has the potential to experience bullish momentum, targeting a price of approximately $64,935.

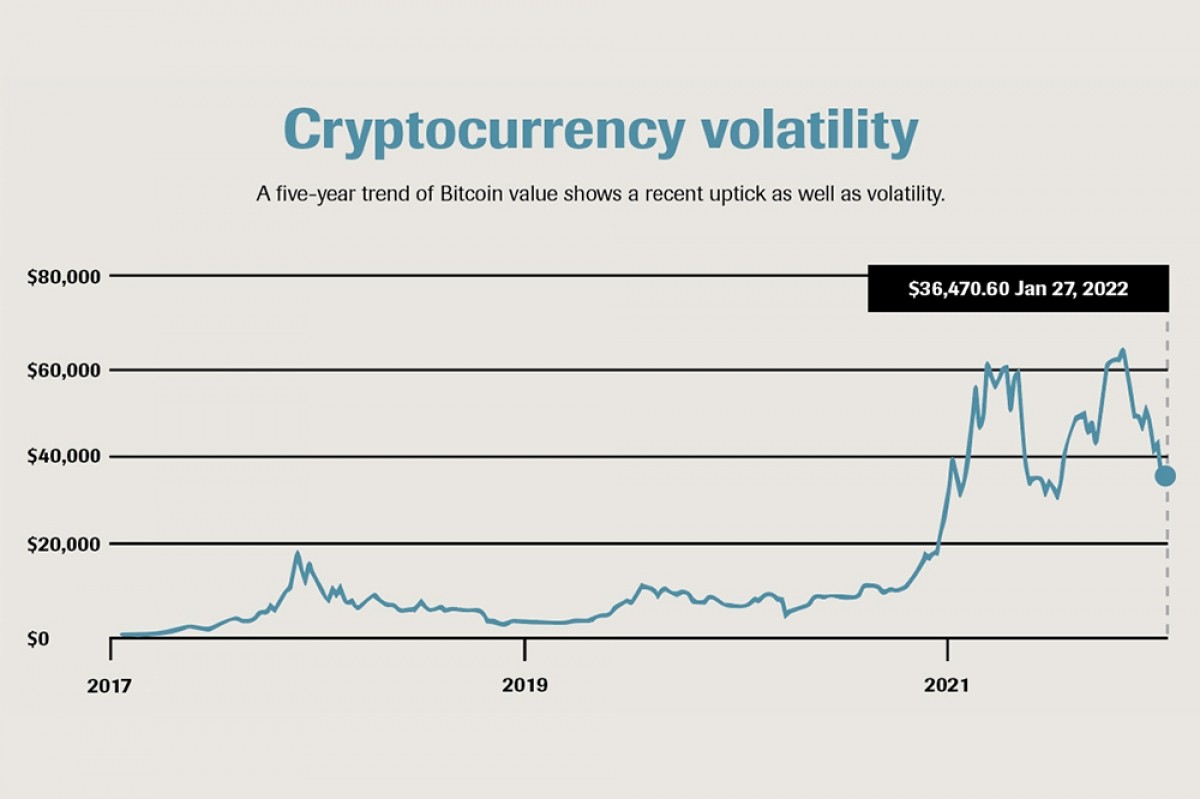

However, prospective investors should exercise caution. The road ahead is paved with uncertainty, as the cryptocurrency market is known for its inherent volatility. The next few months may reflect significant price fluctuations, influenced by global economic conditions and investor sentiment.

“Bitcoin’s unregulated nature presents a double-edged sword, providing freedom yet inflicting risk.”

Navigating Economic Transformations

At a time when economic slowdowns are a pressing global concern, central banks grapple with the delicate balance of fostering growth while managing inflation. Bitcoin, with its inherently decentralized and unregulated framework, offers a unique alternative for wealth preservation and accumulation. It’s becoming increasingly clear that for many, Bitcoin is not just an investment but a hedge against traditional market unpredictability.

How Bitcoin is positioning itself amidst economic challenges.

How Bitcoin is positioning itself amidst economic challenges.

Despite this allure, it’s crucial for investors to remain grounded in reality. The ambiguity of monetary policies and external economic pressures means that Bitcoin’s current resilience may be tested in the coming months. As investors, understanding these dynamics is vital to making informed decisions.

Conclusion: The Coin’s Dual Nature

In wrapping up, the recent Fed rate cut can be seen as both a catalyst for Bitcoin’s rise and a reminder of the unpredictable nature of the crypto market. While this singular event has injected optimism among investors, it also underscores the necessity for vigilance. The future of Bitcoin, fueled by ongoing economic changes, remains an intriguing but uncertain journey. As I reflect on my own experience in the crypto space, it’s clear that while Bitcoin thrives on speculation and speculation thrives on Bitcoin, understanding the wider economic context is essential. In this digital age, knowledge is power, and discerning the signals from the noise is key to navigating the world of cryptocurrency effectively.

Exploring the potential of cryptocurrencies in a changing economic environment.

Exploring the potential of cryptocurrencies in a changing economic environment.

In Closing

As we venture deeper into this era of digital currencies, recognizing the role of economic indicators, like Fed rate cuts, in shaping market dynamics will be crucial. As Bitcoin continues to captivate the financial world, it invites both excitement and caution as we collectively chart the unpredictable waters ahead.