Bitcoin’s Resurgence: A New Era of ETFs and Institutional Investment

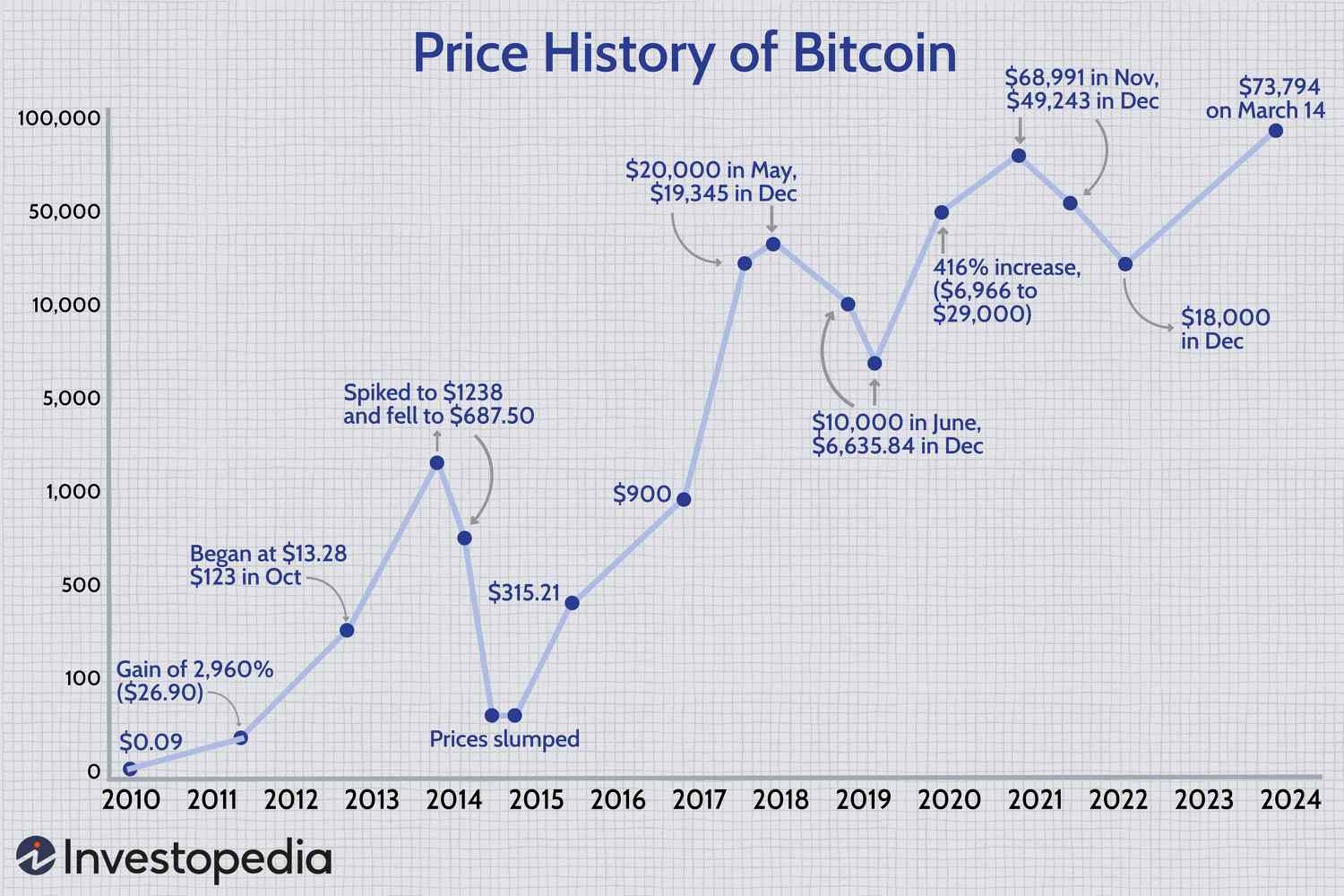

The bitcoin price has made a remarkable recovery, surging 15% since its recent low of $56,000 per bitcoin. This sudden upswing has been fueled by the launch of several spot bitcoin and ethereum exchange-traded funds (ETFs) in Hong Kong, which has sparked rumors of a potential influx of institutional investment.

Hong Kong’s new bitcoin ETFs could be about to be hit by a major earthquake.

Hong Kong’s new bitcoin ETFs could be about to be hit by a major earthquake.

The debut of these ETFs has sent shockwaves through the market, with some insiders predicting a major earthquake in the world of bitcoin and ethereum. Richard Byworth, managing partner at SyzCapital, revealed that the ETFs could be added to the stock connect, allowing mainland Chinese investors to tap into the market. This development has enormous implications, as it would open the floodgates to a massive influx of capital from China.

The bitcoin price has rallied 15% since crashing to lows of $56,000 per bitcoin last week.

The bitcoin price has rallied 15% since crashing to lows of $56,000 per bitcoin last week.

The launch of these ETFs has been met with excitement from industry insiders, with some predicting a huge bitcoin price rally. Samson Mow, former chief strategy officer at Blockstream, tweeted that investors should be more bullish, citing a report that Hong Kong’s ChinaAMC spot bitcoin ETF took in $121 million on its first trading day.

Hong Kong’s new bitcoin ETFs could be about to be hit by a major earthquake.

Hong Kong’s new bitcoin ETFs could be about to be hit by a major earthquake.

The implications of this development are enormous, with some predicting a major earthquake in the world of bitcoin and ethereum. As the market continues to evolve, one thing is clear: the future of cryptocurrency has never looked brighter.

The future of cryptocurrency has never looked brighter.

The future of cryptocurrency has never looked brighter.