Bitcoin’s Resurgence: A New Era of Accumulation?

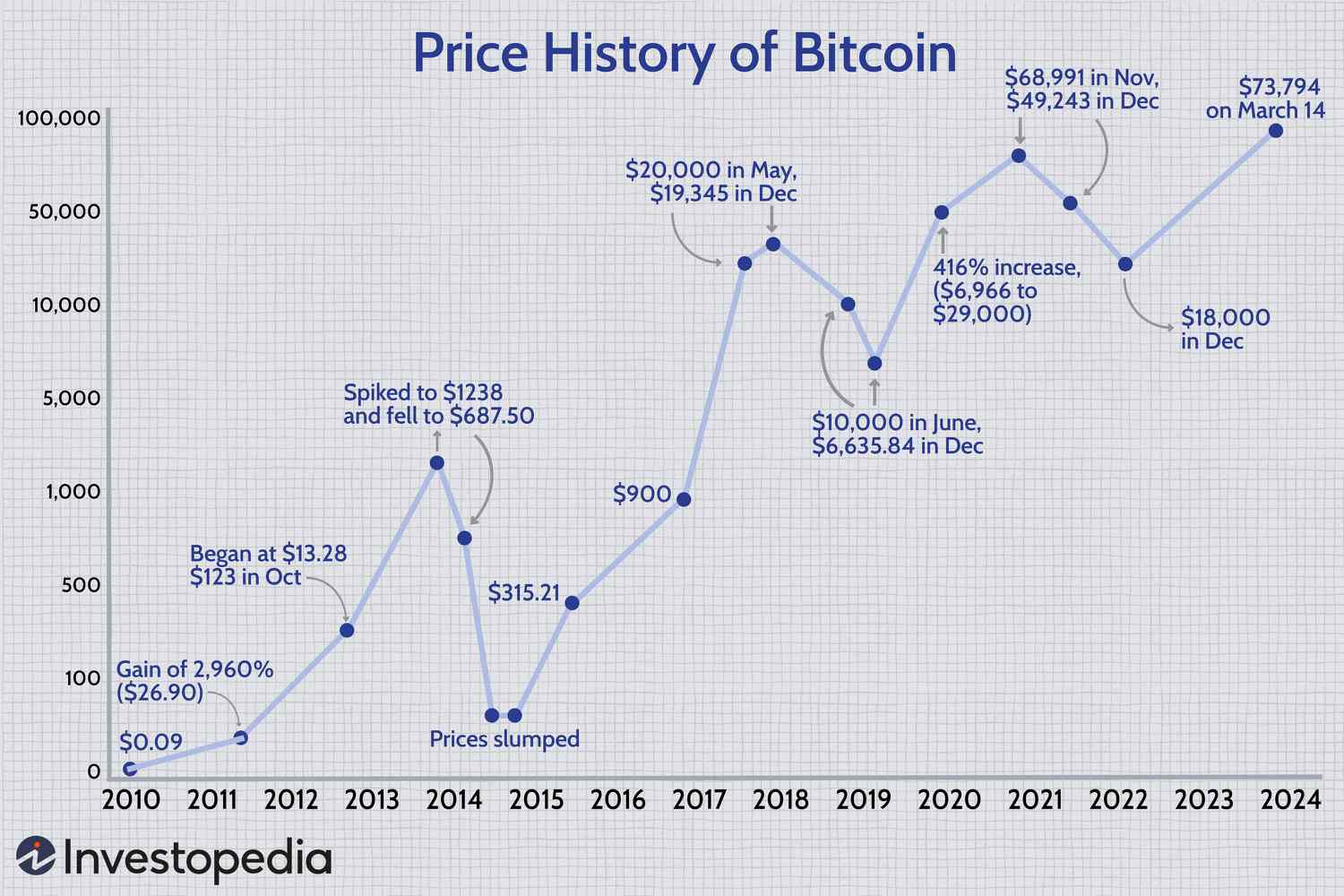

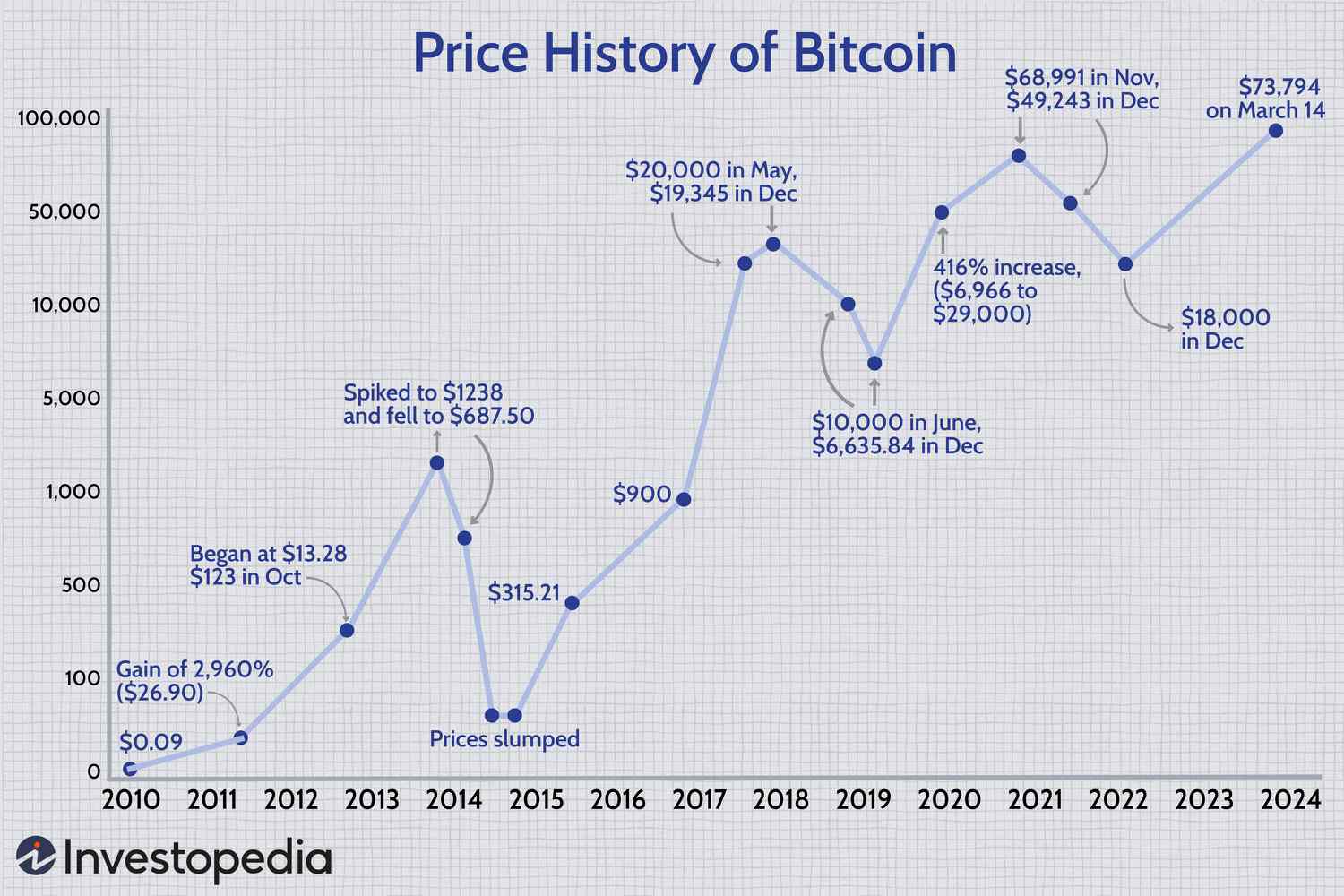

The cryptocurrency market has been in a state of flux since March, with Bitcoin’s price hovering around the $70,000 mark. However, according to a recent report by Bitfinex, the correction phase that has been plaguing the market may finally be coming to an end.

Bitcoin’s price action over the past few months

Bitcoin’s price action over the past few months

The report suggests that the selling pressure that sparked the correction has stalled, and investors are once again accumulating Bitcoin. This is a significant development, as it indicates a shift in market sentiment.

“This correction phase now appears to be nearing an end,” Bitfinex analysts said in a Monday market update.

The data suggests that long-term holders, who were previously selling, have started to re-accumulate Bitcoin for the first time since December 2023. This is a bullish sign, as it indicates that investors are confident in the cryptocurrency’s future prospects.

New BTC and ETH accumulation addresses rising over the past month

New BTC and ETH accumulation addresses rising over the past month

Furthermore, the number of new Bitcoin and Ethereum accumulation addresses has been growing over the past month, a sign of increasing bullish sentiment despite the price stability.

The next week could be an interesting one to watch, with key inflation data releases and a Federal Reserve meeting that could fuel volatility in either direction.

As the market continues to consolidate, it’s clear that Bitcoin is knocking on the door of $70,000 once again. Will it break through this level and continue its upward trajectory? Only time will tell.

Bitcoin breaking through $70,000

Bitcoin breaking through $70,000

One thing is certain, however - the cryptocurrency market is always full of surprises, and investors would do well to stay vigilant and adapt to changing market conditions.