Bitcoin’s Resurgence: A Boost to Crypto Stocks

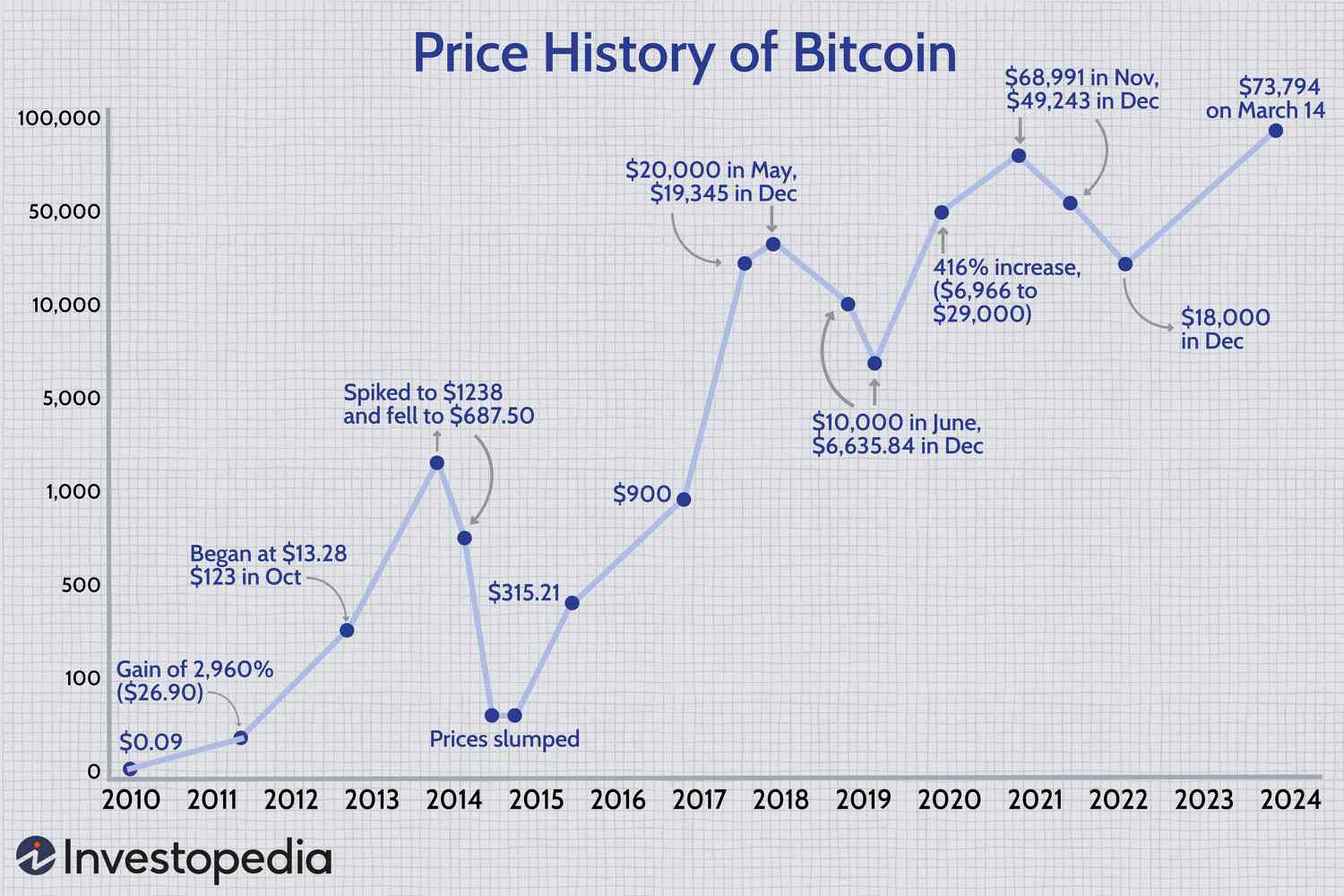

The cryptocurrency market has witnessed a significant surge in recent days, with Bitcoin (BTC) making a strong comeback. According to CoinMarketCap data, the largest cryptocurrency by market capitalization has surpassed $71,000, just 3.4% away from its all-time high of $73,737, which it reached in March.

Bitcoin’s price surge

Bitcoin’s price surge

The rally in Bitcoin’s price has had a positive impact on companies associated with the crypto industry. MicroStrategy (MSTR), a software company, has seen its stock surge over 6%, currently trading at $1,531.67 per share. MicroStrategy has actively added BTC to its balance sheet this year, holding $15 billion worth of Bitcoin currently. Since January, the company’s stock has more than doubled, boasting a remarkable 122% gain.

MicroStrategy’s stock surge

MicroStrategy’s stock surge

US-based crypto exchange Coinbase (COIN), the largest crypto exchange in the United States, has also experienced a surge of over 6% in its stock price. The exchange, which went public in 2021, has been performing well this year. In February, Coinbase shared its Q4 2023 results, showing a return to profitability. Currently priced at $255.99 per share, Coinbase’s stock has jumped by over 63% in 2024.

Coinbase’s stock surge

Coinbase’s stock surge

However, Bitcoin mining companies are not seeing significant gains. Hut 8 Corp (HUT) has seen a marginal jump of less than 2% and is currently priced at $9.14 per share. CleanSpark, a company that utilizes green energy for BTC mining, has observed a rise of over 1%, with its stock trading at $15.79.

Bitcoin mining companies

Bitcoin mining companies

In other news, Genesis, a bankrupt cryptocurrency lending firm, has reportedly sold 36 million shares of the Grayscale Bitcoin Trust (GBTC) to acquire additional Bitcoin and settle its debts with creditors. The sale took place on April 2, with each share valued at around $58.50 at that time, resulting in a total amount of $2.1 billion.

Genesis sells GBTC shares

Genesis sells GBTC shares

The funds raised from the sale will be used to purchase 32,041 Bitcoin at a price of $65,685 per BTC. The Bitcoin acquired by Genesis is currently worth around $2.18 billion. This move is part of the company’s efforts to repay its creditors.

Genesis acquires Bitcoin

Genesis acquires Bitcoin

The recent surge in Bitcoin’s price has also led to a significant increase in the value of the Grayscale Bitcoin Trust (GBTC). The trust, which holds a significant amount of Bitcoin, has seen its value increase by over 10% in the past week.

GBTC value surge

GBTC value surge

As the cryptocurrency market continues to evolve, it will be interesting to see how companies associated with the industry perform in the coming months. Will Bitcoin’s resurgence lead to a sustained rally in crypto stocks? Only time will tell.

Crypto market evolution

Crypto market evolution