Bitcoin’s Resilient Rally: Understanding Recent Market Trends

Bitcoin, often heralded as the bellwether of the cryptocurrency market, is showing signs of a remarkable resurgence. Despite facing regulatory headwinds and macroeconomic challenges, the leading cryptocurrency has defied expectations, recording a significant uptick in price and reshaping market sentiment.

The Current Bitcoin Landscape

Currently, Bitcoin has been making headlines after crossing crucial resistance levels. Analysts and enthusiasts alike have been noting how it seems to be shaking off recent volatility linked to interest rate hikes and geopolitical tensions. Such resilience has reignited investor interest, pushing prices towards a new peak that many believe signals a robust bull market ahead.

Bitcoin price action shows bullish trend

Bitcoin price action shows bullish trend

Reports indicate that the surge is driven by a mix of institutional adoption and retail interest, suggesting that the demand for Bitcoin remains strong even as other markets appear shaky. According to data from various trading platforms, a surge in spot buying among retail investors has helped Bitcoin to withstand bearish pressures.

Institutional Interest and Its Impact

Institutional investment in Bitcoin has seen considerable growth, spurred on by hedge funds and corporate treasuries looking for inflation hedges. Notably, platforms like Coinbase have reported an increase in large trades, indicating a strong belief in Bitcoin’s long-term potential. Such confidence from institutions often trickles down, enhancing overall market sentiment.

Market analysts point out that institutional players tend to hold onto their investments longer than retail traders, which may stabilize prices and reduce volatility. In particular, the recent entrance of traditional financial players into the crypto space signifies a shift in how cryptocurrencies are perceived in the financial ecosystem.

Investor Sentiment and the Future of Bitcoin

Investor sentiment around Bitcoin has also shifted positively, aided by global uncertainties which lead many to consider cryptocurrencies as a safe haven. With many economic experts forecasting various challenges ahead, the narrative surrounding Bitcoin as “digital gold” becomes increasingly pertinent.

“Bitcoin is becoming integral to the investment strategies of many institutions, aligning with long-term perspectives amid market turbulence,” stated one prominent analyst.

Increased activity reflects growing investor confidence

Increased activity reflects growing investor confidence

Moreover, the rise of Alternate Layer-1 protocols and ongoing discussions about Bitcoin’s scalability and environmental impact continue to engage a wider audience. With discussions on how to make Bitcoin transactions more eco-friendly and efficient, innovators in the blockchain space are collaborating to improve technology that supports Bitcoin transactions.

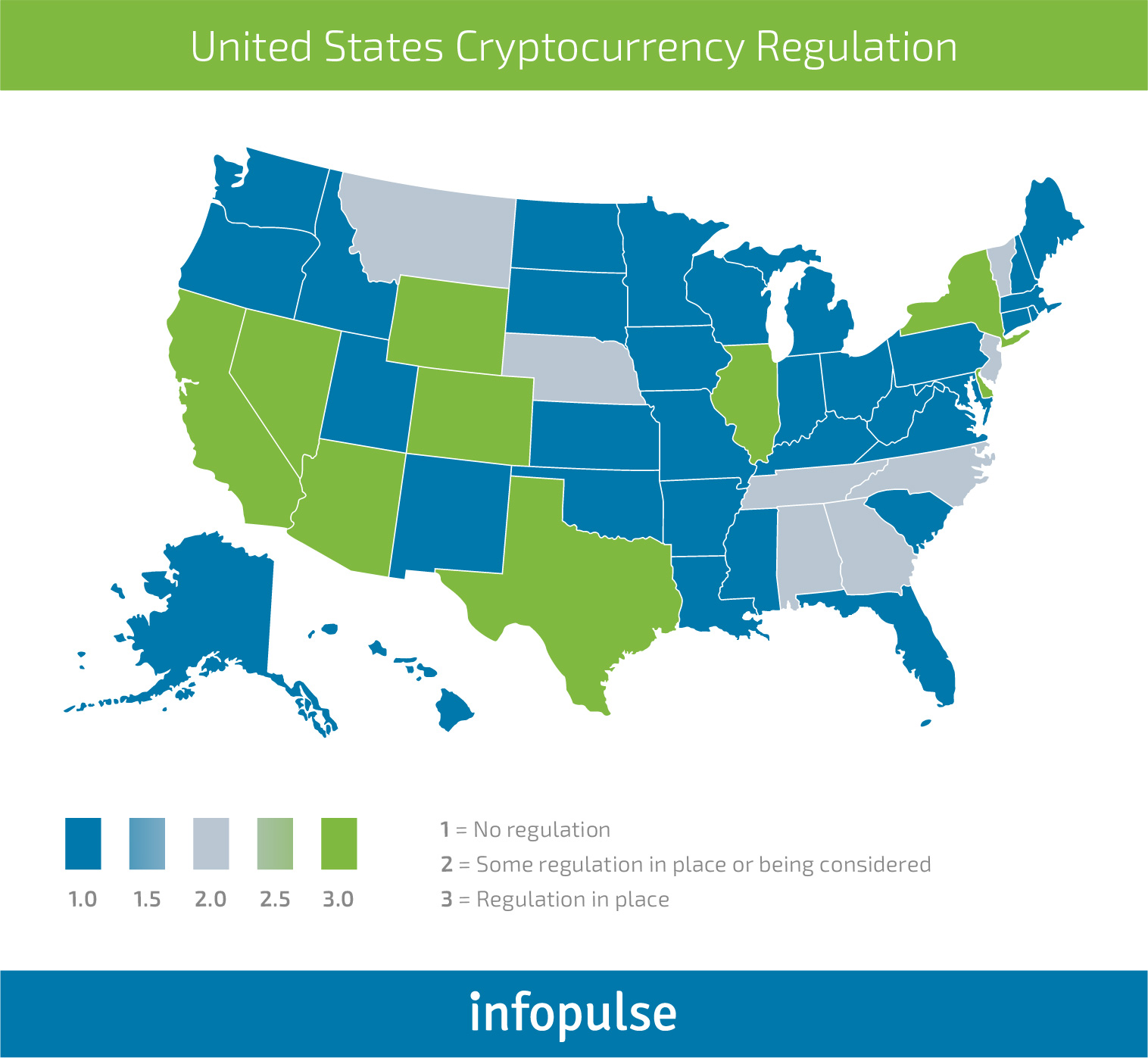

Regulatory Developments and Market Stability

While Bitcoin’s rally is impressive, the specter of regulation remains an ever-present concern. Various governments around the world are grappling with the implications of cryptocurrency, with many vying for a balanced approach that fosters innovation while protecting investors. Recent announcements from the United States Securities and Exchange Commission (SEC) indicate that clearer regulatory frameworks may soon be on the way.

The clarity will likely be a double-edged sword; while regulatory insight could prevent erratic market fluctuations, it may also stifle some of the entrepreneurial creativity that has characterized the cryptocurrency market. Nevertheless, clearer regulations are also seen as a pathway toward wider adoption and could solidify Bitcoin’s status in the financial mainstream.

The shaping regulatory landscape affects market strategies

The shaping regulatory landscape affects market strategies

Conclusion: Navigating the Future

In conclusion, Bitcoin’s trajectory remains an exciting topic within the world of cryptocurrencies. With growing institutional support, a shifting narrative towards digital assets as safe havens, and the ever-changing regulatory landscape, the next chapter for Bitcoin is poised to be transformational. Investors are keenly observing how these factors will converge to further define the future landscape of cryptocurrencies.

As Bitcoin continues to attract attention and investment, the keys to its longevity will be the strength of its network, adaptability to regulatory changes, and its ability to maintain investor and public confidence. For now, Bitcoin enthusiasts can celebrate the return of bullish sentiment as they watch closely what the future holds for this pioneering digital asset.