Bitcoin’s Recovery Stalls as Mt. Gox Fears Rattle Crypto Market

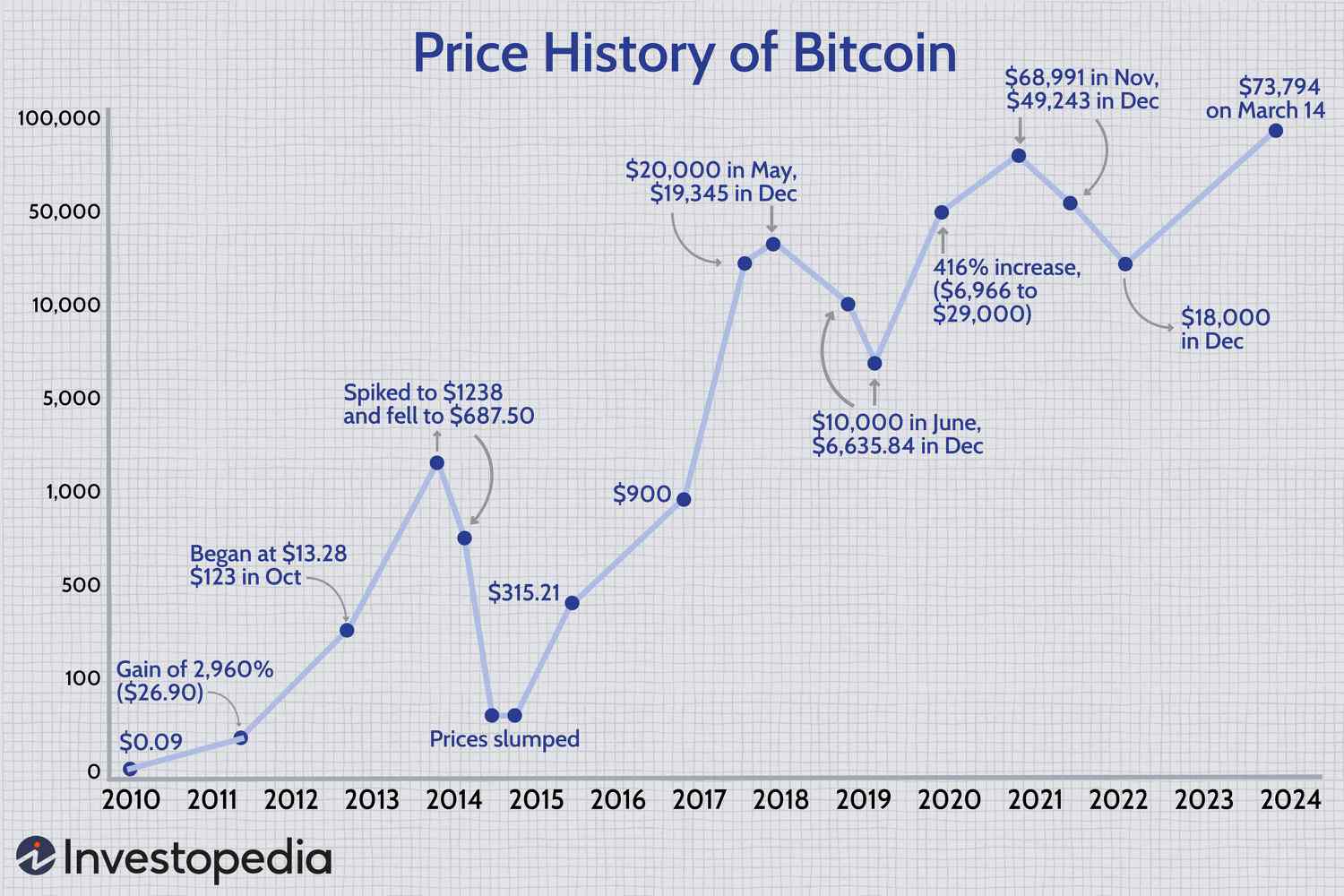

The cryptocurrency market is in a state of flux, with Bitcoin prices plummeting to a four-month low. The world’s leading digital asset has seen its value drop by around $18,000 from its all-time high of nearly $74,000 in March, a loss of about one-fifth. This downturn has had a ripple effect on the entire crypto market, with other major tokens such as Ether, Binance’s BNB, Solana, XRP Ripple, Dogecoin, and Cardano’s Ada also experiencing significant losses.

Bitcoin prices have been on a downward trend

The main culprit behind this market crash is the looming threat of selloffs from the German government and creditors of bankrupt crypto exchange Mt. Gox. The exchange, which was once one of the biggest crypto platforms in the world, filed for bankruptcy a decade ago after hackers stole most of its crypto assets between 2011 and 2014. Today, the bitcoin haul would be worth north of around $58 billion, according to CNBC. The exchange managed to recover some funds after declaring bankruptcy, tokens worth around $9 billion today, and markets have responded to what is expected to be a massive Bitcoin selloff as creditors cash out at a much higher price than when they lost the crypto tokens.

“The path forward for Bitcoin is uncertain, and the market is bracing for impact.” - [Author’s Name]

The German government’s decision to hastily sell off hundreds of millions of dollars worth of Bitcoin for fiat currency has also added to the uncertainty in the market. Berlin has been sending its cryptocurrency reserves to exchanges like Coinbase, Bitstamp, and Kraken since June as the European government offloads and liquidates assets it has seized from various criminal groups. The transfers have added to concerns about significant selloffs in the market, and according to Arkham Intelligence, Germany reportedly still holds around $2.2 billion worth of Bitcoin.

Mt. Gox, once one of the biggest crypto exchanges in the world

As the crypto market continues to navigate these uncertain times, one thing is clear: the fate of Bitcoin and the entire cryptocurrency ecosystem hangs in the balance. Will the market be able to recover from this downturn, or will the looming threats of Mt. Gox and the German government’s selloffs prove too much to overcome?

The crypto market is in a state of flux

Only time will tell, but one thing is certain: the world will be watching with bated breath as the crypto market continues to evolve and adapt to these new challenges.