Bitcoin’s Record-Breaking Milestone: The BlackRock ETF Revolution

2024 has already made significant waves in the cryptocurrency arena, and one of the standout developments has undoubtedly been the rise of Spot Bitcoin ETFs. These investment vehicles have not only met but far exceeded the expectations of many experts, reshaping the landscape of digital assets. Notably, Bloomberg analyst Eric Balchunas highlighted the tremendous success of BlackRock’s Bitcoin ETF, showcasing its performance on a global stage.

A New Benchmark for Capital Inflows

As the world’s largest asset manager with over $10 trillion under management, BlackRock was poised to dominate the market with its Bitcoin ETF, designated as $IBIT. However, what has transpired is beyond mere expectations—according to Balchunas, this ETF has surpassed all other Bitcoin ETFs and even outperformed all ETFs globally regarding capital inflows in the last week alone. This meteoric success is reshaping the crypto markets, allowing Bitcoin to reach stunning new all-time highs while altering the overall market structure.

The unprecedented adoption of Bitcoin ETFs is changing investor dynamics.

The unprecedented adoption of Bitcoin ETFs is changing investor dynamics.

One of the most striking facets of this change is the continuously increasing dominance of Bitcoin in the market. As Bitcoin retains a robust position, many investors remain hopeful for the next Altcoin season, but the current data suggests that Bitcoin’s supremacy is solidifying rather than diminishing.

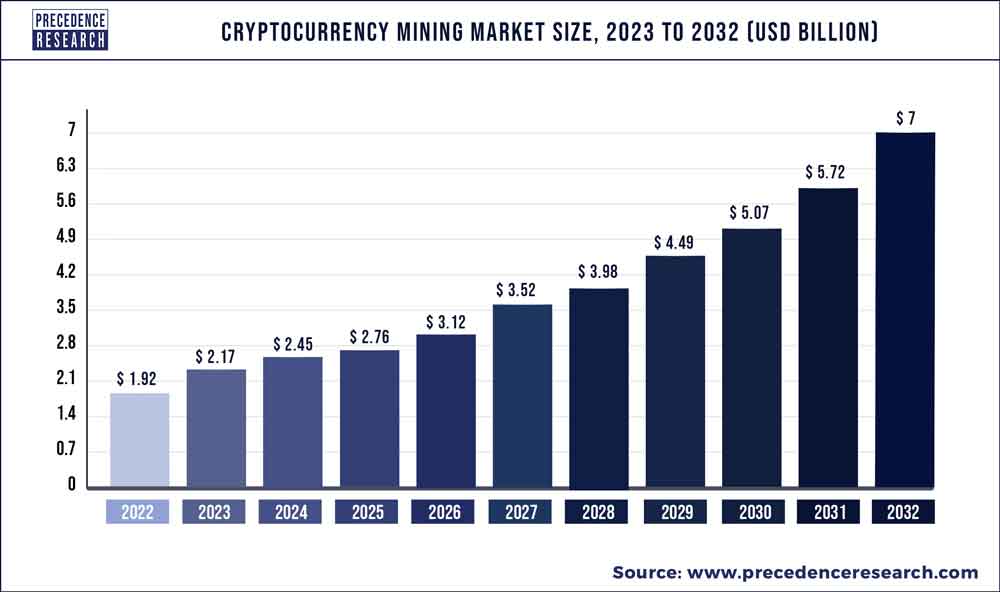

The Future of Capital Inflows Looks Bright

The narrative surrounding Bitcoin ETFs, and specifically the BlackRock ETF, appears to be just getting started. Investment decisions among large institutional players are often meticulous and come after thorough evaluations. As these institutional investors look to diversify their portfolios in the coming years, the probability of increased allocations towards cryptocurrencies, particularly Bitcoin, grows significantly. This suggests that Bitcoin’s dominance is likely to remain above 40%, with little sign of decline.

Institutional interest in Bitcoin continues to rise, signaling strong market confidence.

Institutional interest in Bitcoin continues to rise, signaling strong market confidence.

Should We Consider Crypto Allstars?

While Bitcoin’s market share is anticipated to stay elevated, it’s also critical to recognize that undervalued coins can experience explosive growth. The new player in the market, Crypto Allstars, tagged as $STARS, is garnering immense investor interest. With the potential for price surges in the range of thousands to tens of thousands of percent, those looking for the next big opportunity should keep a close eye on this emerging asset.

“The future looks promising, especially with new entrants ready to make a splash.”

In conclusion, we are witnessing a paradigm shift in the investment world, one where Bitcoin is reclaiming its throne while new contenders are poised for explosive success. Whether you are a die-hard Bitcoin enthusiast or looking for the next big thing in crypto, the landscape is more dynamic than ever.

Explore More about Crypto Allstars and Get in Early

If you’re interested in the innovative shifts in crypto or eager to invest in new opportunities like Crypto Allstars before it hits its peak, check out more information about it here. Don’t miss out on the chance to get involved at the ground level before the price rockets.

Stay ahead of the curve in the evolving cryptocurrency market.

Stay ahead of the curve in the evolving cryptocurrency market.

With developments like BlackRock’s ETF and the rising interest in altcoins, the cryptocurrency market offers an array of prospects that investors need to explore thoroughly. Strap in—it’s going to be an exciting journey ahead in 2024!