Bitcoin’s Recent Weakness: A Warning Sign for the S&P 500?

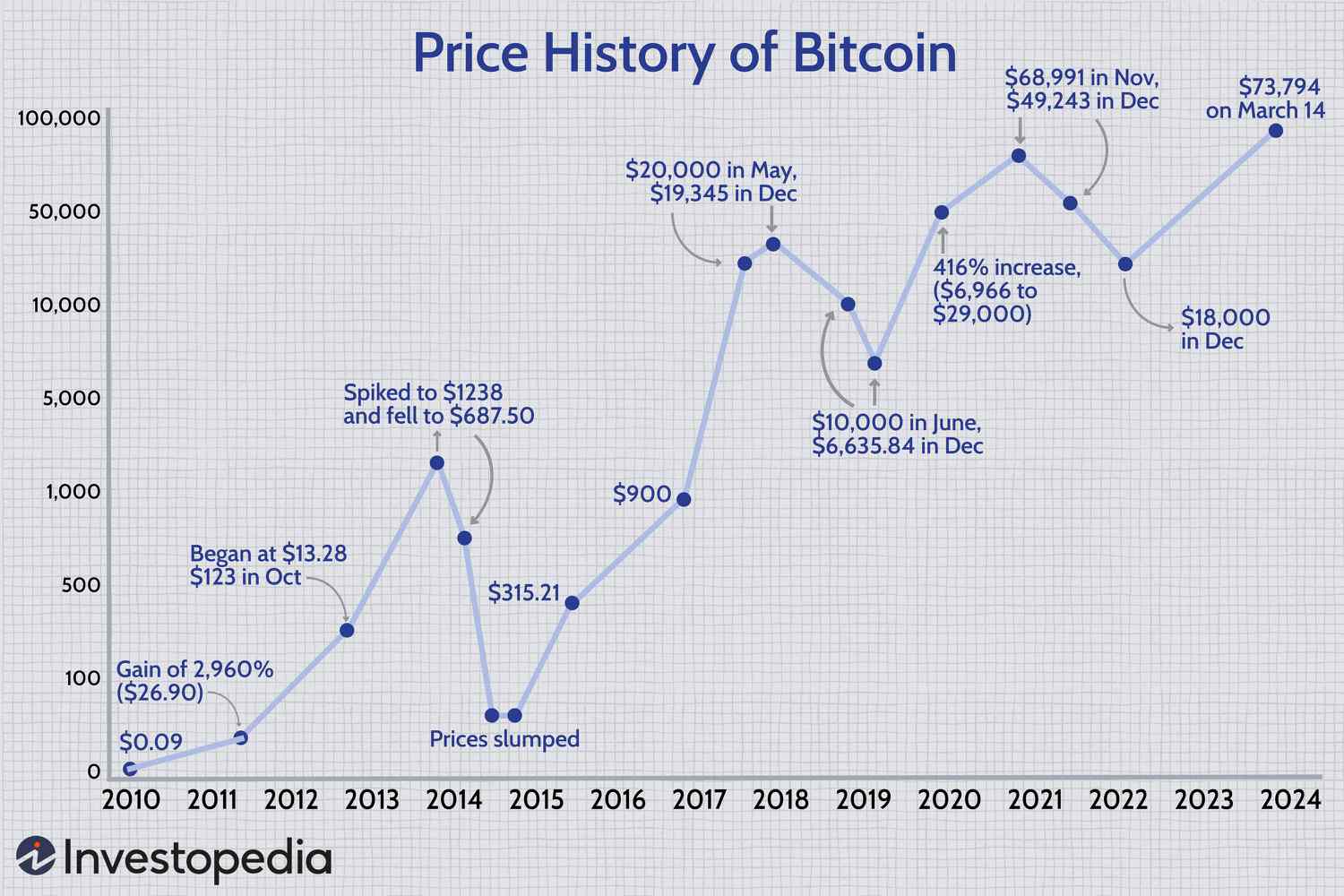

The recent struggles of Bitcoin to hold the $70,000 mark may be signaling an imminent correction in the S&P 500, according to Stifel’s chief equity analyst Barry Bannister. Historically, the S&P 500 has averaged flat for about six months after Bitcoin peaks, and past cycles point to a topping in the benchmark stock index.

“Weakening bitcoin … signals an imminent S&P 500 summer correction and consolidation phase,” Bannister said.

The S&P 500 briefly touched 5,500 for the first time last week, and Bannister believes it could fall to 4,750, a roughly 13% drop from current levels, by the end of the summer. High beta tech stocks such as Nvidia are especially vulnerable heading into the third quarter.

Bitcoin’s recent struggles

Many see Bitcoin as “digital gold,” but Bannister views it as a speculative instrument driven by excess dollar liquidity. As such, it’s always been sensitive to dovish Federal Reserve pivots. In 2020, it became closely correlated with the Nasdaq 100 when the central bank injected trillions of dollars of rescue money into the economy during the Covid-19 crisis.

Currently, the market finds itself in an asset bubble now that the “corona-cash” has migrated from consumers to corporations. “Mopping up that liquidity has just begun (and may never be accomplished), but since that dump we have seen politically destabilizing sequential bubbles which first inflated consumer prices and now asset prices,” Bannister said.

The asset bubble

Expectations for a summer correction aren’t based on Bitcoin alone, however. Stifel expects “a case of moderate stagflation” - a combination of high inflation, high unemployment, and stagnant demand - to tighten financial conditions and expose the S&P’s high price-earnings ratio. Bannister also said investors may be in a “full-fledged bubble/mania mode which looks past our concerns.”

“Timing is everything,” he wrote. “Past bubbles since the 19th century indicate the S&P 500 could well rise to ~6,000 at year-end 2024 and then round trip to near where 2024 began five quarters later, by ~1Q26 (S&P 500 ~4,800).”

The S&P 500’s potential trajectory

In conclusion, Bitcoin’s recent weakness may be signaling an imminent correction in the S&P 500. With the market in an asset bubble and expectations of a summer correction, investors should be cautious and prepared for a potential downturn.

Photo by

Photo by