Bitcoin’s Recent Slump: What’s Behind the Sudden Drop?

The cryptocurrency market has been experiencing a significant downturn, with Bitcoin tumbling towards $62,000 and major tokens experiencing a drop of up to 7.5% in the past 24 hours. This sudden slump has led to the liquidation of over $150 million in bullish bets, leaving many investors wondering what’s behind this sudden drop.

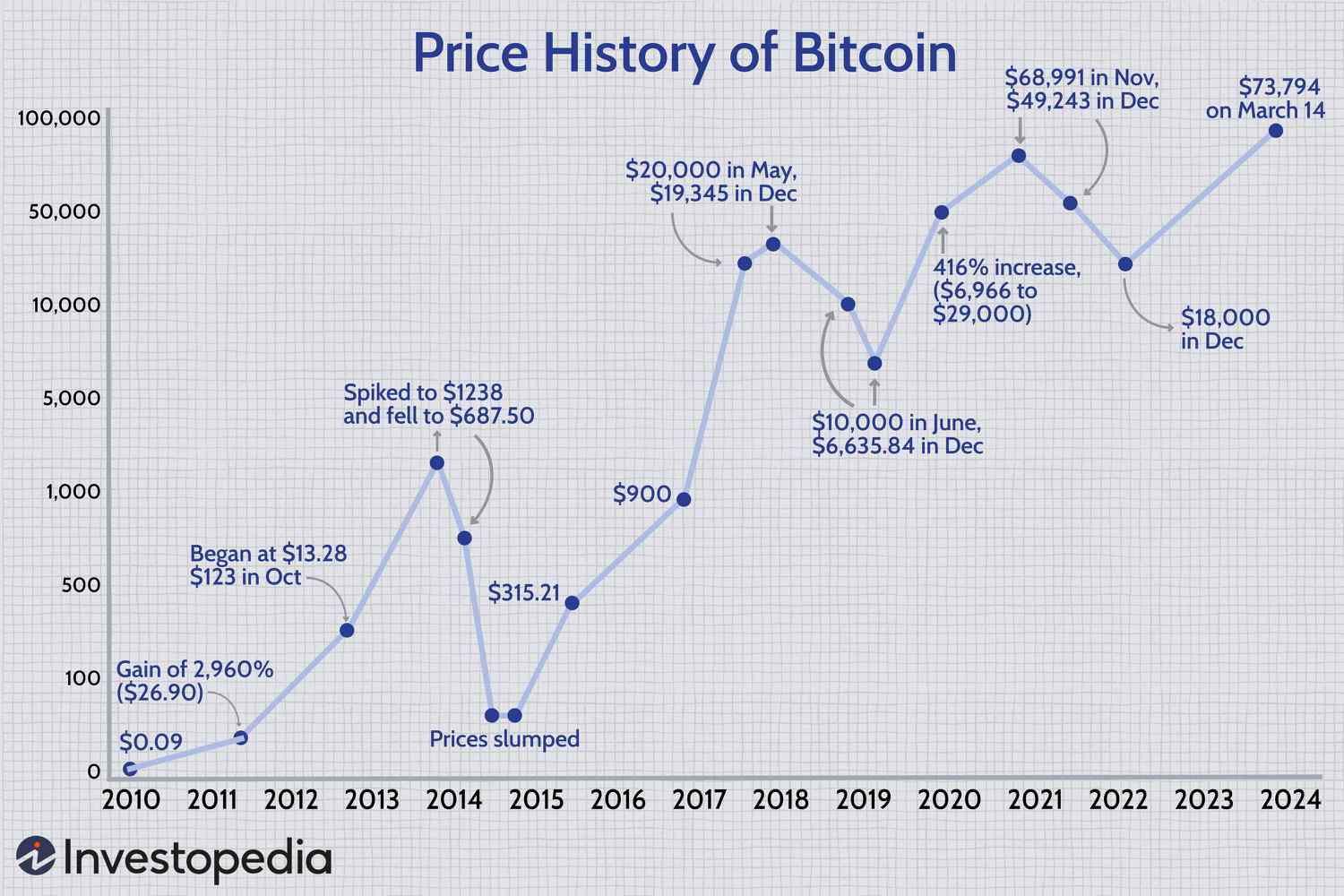

Bitcoin’s recent price action

One of the main factors contributing to this decline is the large sales from Bitcoin miners. According to QCP Capital, miners have been under tremendous pressure to sell given higher breakeven prices post-halving. This has led to a significant decrease in miner BTC holdings, which have dropped to the lowest level in 14 years.

Miner BTC holdings have dropped significantly

Another factor contributing to the market’s decline is the German government’s recent move to sell a significant amount of BTC to exchanges. This has spooked the market, leading to a new large pool of supply. As reported earlier, the German Federal Criminal Police Office (BKA) had seized almost 50,000 BTC from a piracy site in 2013 and started moving tens of millions worth of BTC to crypto exchanges such as Coinbase and Kraken last week.

The German government’s recent BTC sale has spooked the market

The broader market sentiment has also been influenced by the dollar’s strength and a strong U.S. technology index market. This has led to a decline in Bitcoin prices, which have generally suffered in the past few weeks amid $1 billion in sales from large holders.

Dollar strength has contributed to Bitcoin’s decline

U.S.-listed Bitcoin exchange-traded funds (ETFs) have also recorded over $1 billion in net outflows last week, further exacerbating the decline.

Bitcoin ETF outflows have contributed to the decline

In conclusion, the recent slump in Bitcoin’s price can be attributed to a combination of factors, including large sales from Bitcoin miners, the German government’s BTC sale, and the broader market sentiment influenced by the dollar’s strength and a strong U.S. technology index market.

“Miners have been under tremendous pressure to sell given higher breakeven prices post-halving.” - QCP Capital