Bitcoin’s Recent Plunge: A Crisis or a Correction?

The recent downturn in the cryptocurrency markets has caused quite a stir, with Bitcoin and various altcoins experiencing a dramatic decline. In the last 24 hours alone, approximately $500 million in positions were liquidated across the board, raising concerns among investors about the sustainability of the current market rally.

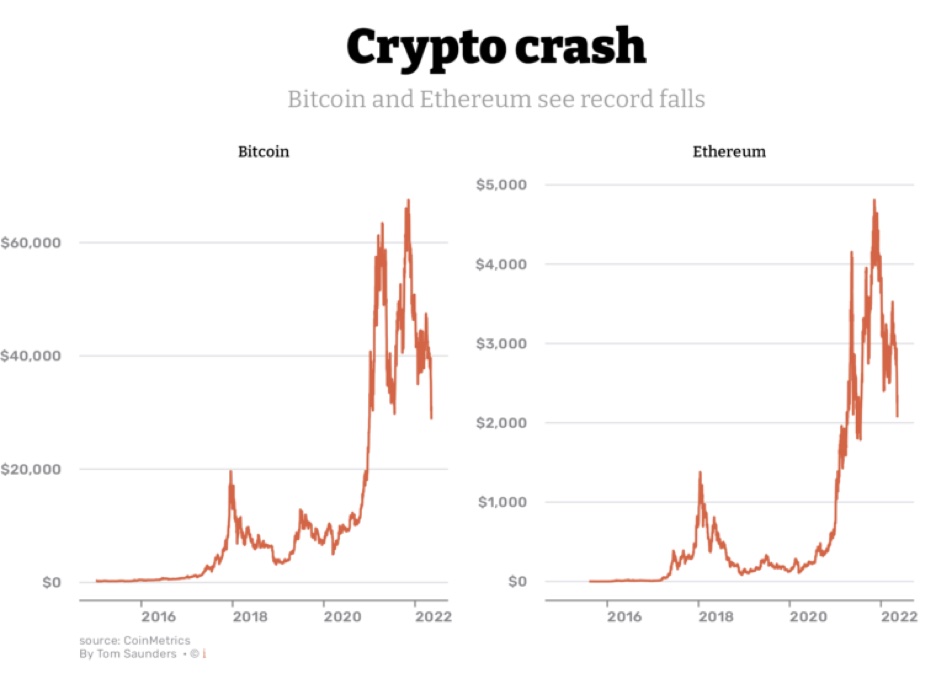

An overview of recent Bitcoin market fluctuations

After weeks of bullish sentiment dominating the Bitcoin price action, signs indicate that the bears may now be taking control. Bitcoin, once positioned near $102,000, quickly fell to $96,500, and further dipped to a new weekly low of $92,827. Such volatility has sparked discussions regarding the future trajectory of the cryptocurrency market, especially as we approach the new year.

Understanding the Drivers Behind the Downturn

What has catalyzed this sudden market correction? Rumors have surfaced that the US government may be preparing to liquidate a substantial amount of 69,370 BTC, originally seized in 2013 from the Silk Road marketplace. This potential sale, valued at roughly $6.5 billion, could significantly impact the market dynamics.

As market observers note, any anticipated government sale could create undue pressure, setting a bearish tone for what investors hoped would be a continuing bullish trend. As one industry analyst remarked, it is indeed an “interesting situation” given the changing political landscape in the U.S. and the previous administration’s stance on maintaining seized Bitcoins as a strategic reserve.

Market analysts assess the implications of Bitcoin’s sudden drop

Market analysts assess the implications of Bitcoin’s sudden drop

Bearish Trends and Future Predictions

Despite the current turbulent market conditions, analysts from platforms like CryptoQuant see potential for recovery. However, they caution that the overall trend may remain downward in the medium term. Predictions suggest that the peak of the bull run could arrive around the first half of 2025, challenging investors to reassess their strategies while maintaining their bullish outlooks for potential increases in Bitcoin and altcoin valuations.

Among the altcoins, recent data shows that the global crypto market capitalization has dropped by about 2.3%, now resting at approximately $3.27 trillion. Notably, altcoins such as ai16z and AIOZ Network have suffered greatly, with losses exceeding 20% within just one day.

The Case for Altcoins: Diversification and Opportunities

While Bitcoin often garners the majority of attention, the landscape of altcoins remains rich with options. As the market continues to mature, the growing appeal of digital currencies like Ethereum, Litecoin, and emerging entities like Solana provides ample diversity for investment.

Each of these altcoins addresses various limitations of Bitcoin. For instance, Ethereum shines with its smart contract framework fostering decentralized applications. Solana impressively processes up to 1,500 transactions per second, enhancing user experiences and scalability.

Investors eager to diversify their portfolios should evaluate altcoins critically, assessing factors like adoption rates, security protocols, and technological innovations. Resources like 99Bitcoins provide insightful analyses of promising investments and emerging trends in the altcoin market, guiding informed financial decisions.

Exploring the diverse opportunities within the altcoin sector

Exploring the diverse opportunities within the altcoin sector

Emerging Trends and Regulatory Influences

As we move forward, understanding the regulatory environment is crucial. Various international policies change how cryptocurrencies are perceived and traded. For instance, recent regulations in Thailand have significantly influenced altcoin valuations, while political endorsements in major economies have sparked renewed interest from global investors.

The Future of Cryptocurrency Investments

In conclusion, while the Bitcoin market faces a tumultuous period, the broader implications for altcoins offer a glimmer of hope for thoughtful investors. The call to action is clear: staying informed and adaptable will be paramount in navigating the complexities of cryptocurrency investments as we transition into 2025. Investors should remain vigilant, not only concerning Bitcoin’s performance but also as they explore the innovative horizons presented by altcoins.

Further Reading and Resources

- Explore altcoins to invest in at 99Bitcoins

- Investigate Bitcoin’s historical fluctuations

- Analyze the impact of cryptocurrency regulations

Cryptocurrency awaits its next chapter, with plenty of opportunities ahead for those willing to engage thoughtfully and strategically.