Bitcoin’s Promising Ascent: A Closer Look at the Recent Surge

The cryptocurrency market has been electrifying lately, with Bitcoin’s price witnessing a steady rise that seems to be fueled by optimistic trends in the financial landscape. As of September 21, BTC increased by 0.25%, marking its fifth consecutive session of gains and closing at $63,384. This upward momentum is primarily driven by substantial inflows into Bitcoin Exchange Traded Funds (ETFs) as investors continue to show increasing interest in this leading cryptocurrency.

The dynamic rise of Bitcoin amid positive market trends.

The dynamic rise of Bitcoin amid positive market trends.

Bitcoin ETF Inflows Signal Growing Institutional Interest

The recent net inflows into the U.S. BTC-spot ETF market have been particularly noteworthy, with reports indicating inflows of $92 million on September 20, following a remarkable $158.3 million the previous day. What does this mean for Bitcoin’s future? It signifies a robust demand for Bitcoin investments, suggesting that institutional investors are increasingly recognizing the value of this digital asset. For example, the Fidelity Wise Origin Bitcoin Fund recorded inflows of $26.1 million, while the ARK 21Shares Bitcoin ETF saw an inflow of $22 million, showcasing diverse institutional strategies aligning with Bitcoin’s prospects.

MicroStrategy’s Major Bet on Bitcoin

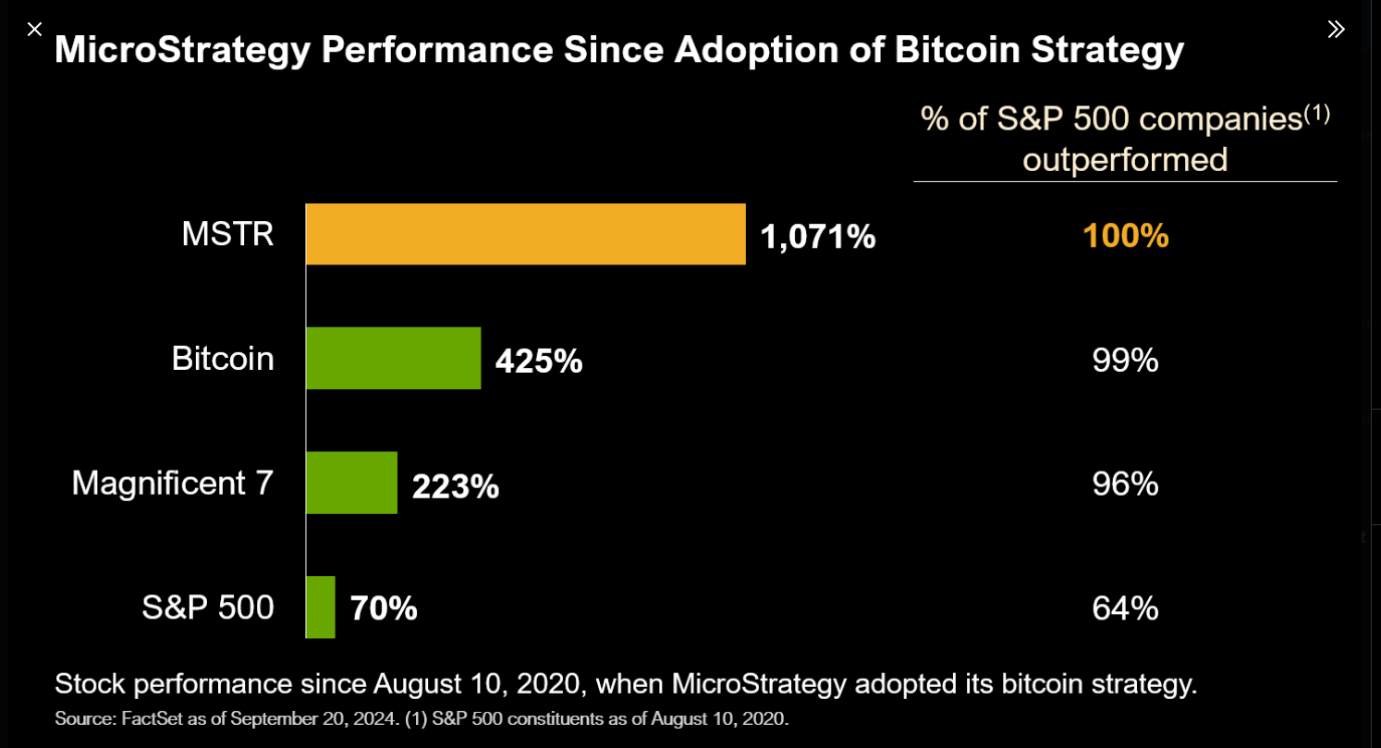

Adding to this bullish connotation, MicroStrategy has been aggressively accumulating Bitcoin. In just two weeks, the firm purchased 25,720 BTC for approximately $1.5 billion, bringing its total holdings to 252,220 BTC. Michael Saylor, MicroStrategy’s founder, has demonstrated confidence in Bitcoin’s ability to outperform traditional assets, showcasing their stock chart relative to Bitcoin and other major indices. His analysis suggests that while the broader market may experience fluctuations, Bitcoin remains steadfast as a premier choice for investors seeking security and potential growth.

MicroStrategy’s strategic Bitcoin accumulation continues to encourage bullish sentiment.

MicroStrategy’s strategic Bitcoin accumulation continues to encourage bullish sentiment.

Regulatory Developments Enhance Market Sentiment

On the regulatory front, the SEC’s recent approval to allow options trading for the iShares Bitcoin Trust (IBIT) has also played a pivotal role in rejuvenating market interest. The increased accessibility to options trading paves the way for more institutional players to enter the market, potentially bolstering Bitcoin’s price even further. Industry analysts view this as a crucial step that could lead to increased liquidity and a more mature trading environment around Bitcoin.

As Eric Balchunas from Bloomberg Intelligence noted, the SEC’s accelerated approval signifies a shift in regulatory attitudes, presenting an environment filled with new opportunities for investors eager to engage with Bitcoin in diverse ways.

Technical Insights and Future Predictions

From a technical analysis standpoint, Bitcoin is positioned well above both the 50-day and 200-day Exponential Moving Averages (EMAs), which are traditionally viewed as bullish indicators. Analysts suggest that crossing the $64,000 resistance level could trigger a surge toward $67,500, allowing Bitcoin bulls to set their sights on the significant $70,000 mark. However, investors should remain vigilant; any regression beneath the $60,365 support level might indicate a reversal in bullish momentum, drawing prices back toward the 50-day and 200-day EMAs.

Current technical analysis denotes promising prospects for Bitcoin but calls for cautious vigilance.

Current technical analysis denotes promising prospects for Bitcoin but calls for cautious vigilance.

Similarly, Ethereum is witnessing its own complex dynamics as it hovers near the crucial 50-day EMA. A dip below this threshold could indicate a retracement towards the $2,403 support level, while a rally above the $2,664 resistance could signify a resurgence towards $3,033.

Conclusion: A Promising Future for Bitcoin

As Bitcoin continues to ascend through this pivotal moment, the interaction between supply-demand dynamics, institutional interest through ETF inflows, and supportive regulatory measures demonstrates a thriving ecosystem for cryptocurrency. The market appears ripe for further exploration as economic indicators, from consumer confidence to inflation data, shape the landscape of investor sentiment. In the face of volatility, the entrenched nature of Bitcoin as a digital asset appears robust, suggesting that this bull run might just be the beginning of a more substantial rally ahead.

For more updates and insights into the cryptocurrency space, interested readers should stay tuned. The market is continually evolving, and the implications for Bitcoin and the broader crypto realm are vast and nuanced.

Further Reading

- Interest Rate Cuts Are Good

- XRP News Today: XRP Outperforms Market Amid SEC Silence on Appeal

- NASDAQ Index, SP500, Dow Jones Forecasts