Bitcoin’s Price Plunge: What’s Behind the Sudden Drop?

The price of Bitcoin has fallen below $58,000 for the first time in two months, with several other major cryptocurrencies slumping as well. This sudden drop has left many wondering what’s behind the decline.

Concerns about the impact of the defunct Mt. Gox exchange returning a large amount of Bitcoins to its creditors have been cited as a major factor. The administrators of Mt. Gox have started the process of paying out its creditors in crypto tokens, including nearly 140,000 Bitcoins worth around $8 billion. This large payout, which will happen in stages, has triggered concerns that the creditors may attempt to liquidate some of their returned crypto assets and drive down their prices.

Bitcoin’s price has fallen below $58,000 for the first time in two months.

Bitcoin’s price has fallen below $58,000 for the first time in two months.

The price of Ether was down more than 5.4% and dropped below $3,200, while other popular tokens such as Binance’s BNB, Solana, and Dogecoin were down 6.1%, 8.8%, and 7.2% respectively.

The slump comes amid concerns about the administrators of the defunct Mt. Gox exchange starting the process of paying out its creditors in crypto tokens—including nearly 140,000 Bitcoins worth around $8 billion.

The state of the U.S. presidential election has also been cited as a factor in the decline. Biden’s shaky performance in the first debate has led to calls for him to exit the race, and some analysts believe that the possibility of a stronger Democratic candidate replacing Biden could be impacting crypto prices.

The defunct Mt. Gox exchange is at the center of the controversy.

Big Number

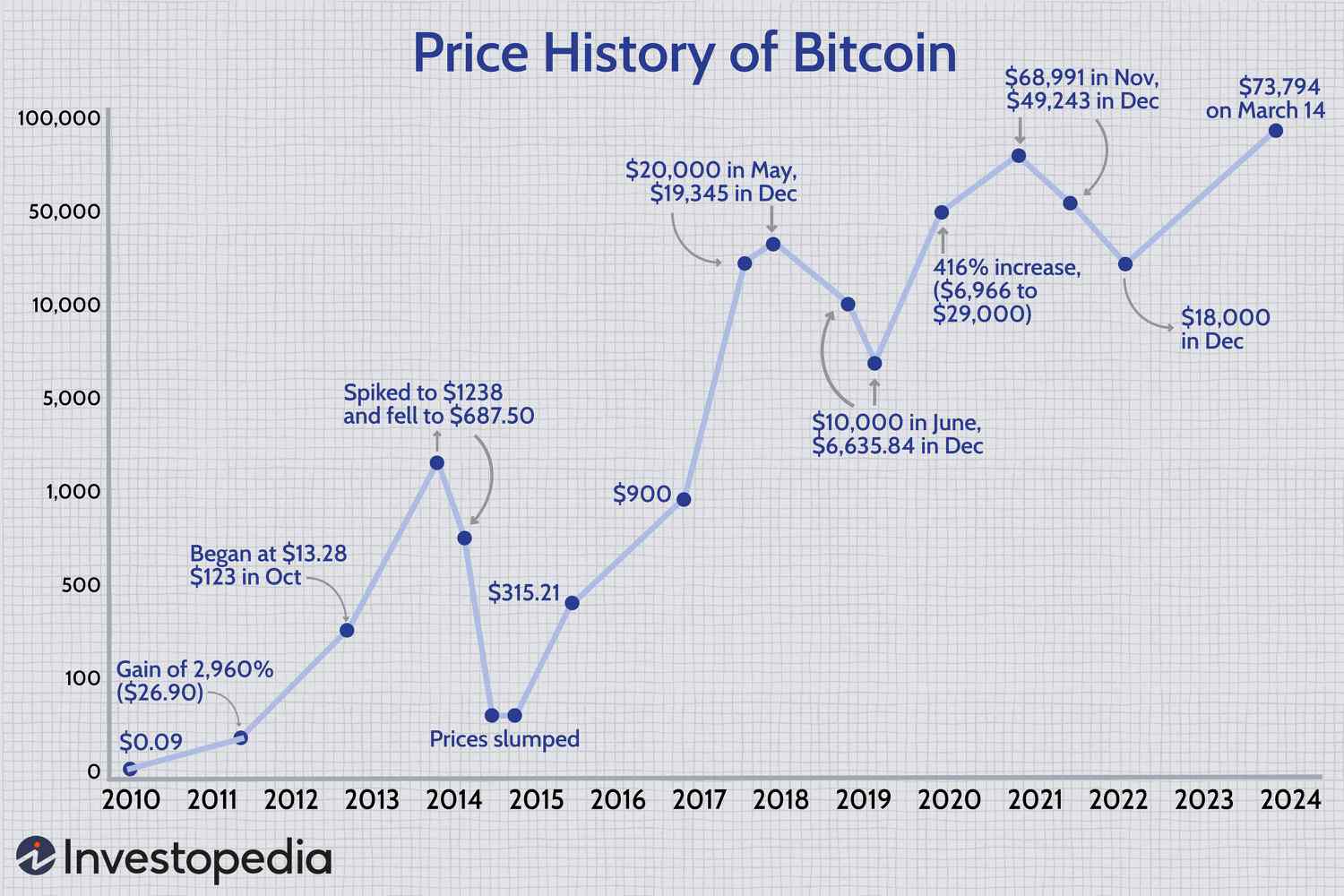

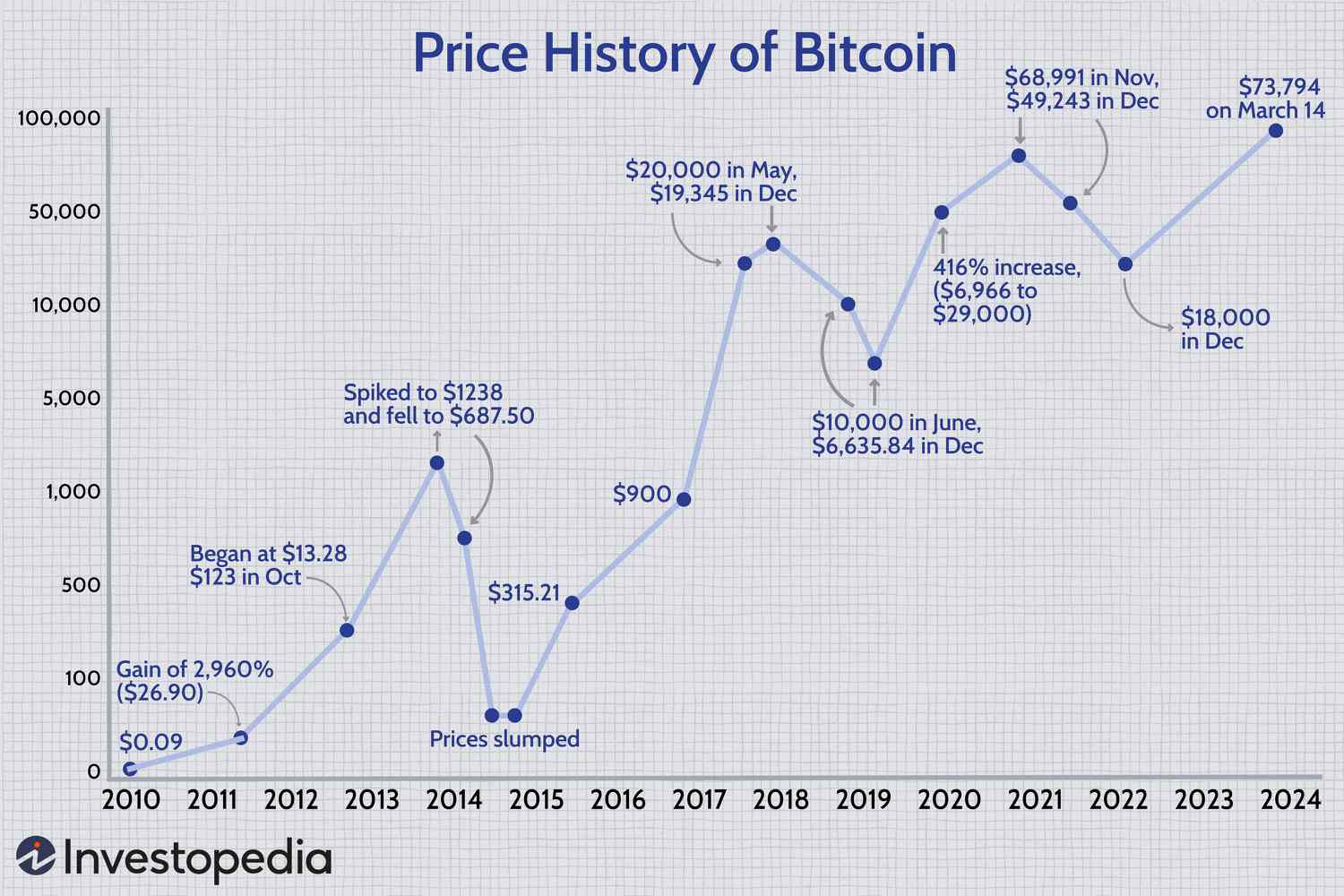

18.31%. That is how much the price of Bitcoin has fallen in the past 30 days. The slump comes after the token reached an all-time high of above $73,700 in March, largely driven by regulatory approval and the launch of spot Bitcoin exchange-traded funds.

As the crypto market continues to fluctuate, one thing is certain: the price of Bitcoin is on a downward trend. But what does this mean for the future of cryptocurrency? Only time will tell.