Bitcoin’s Price Plunge: A Perfect Storm of Mt. Gox Repayments and German Government Sales

The cryptocurrency market has been experiencing a tumultuous week, with Bitcoin’s price plummeting by nearly 3% to $56,682.90. This marks the first time the world’s largest cryptocurrency has traded below the $55,000 level since February 27. The ripple effect has been felt across the market, with rival token Ether sinking around 5% to $2,971.68.

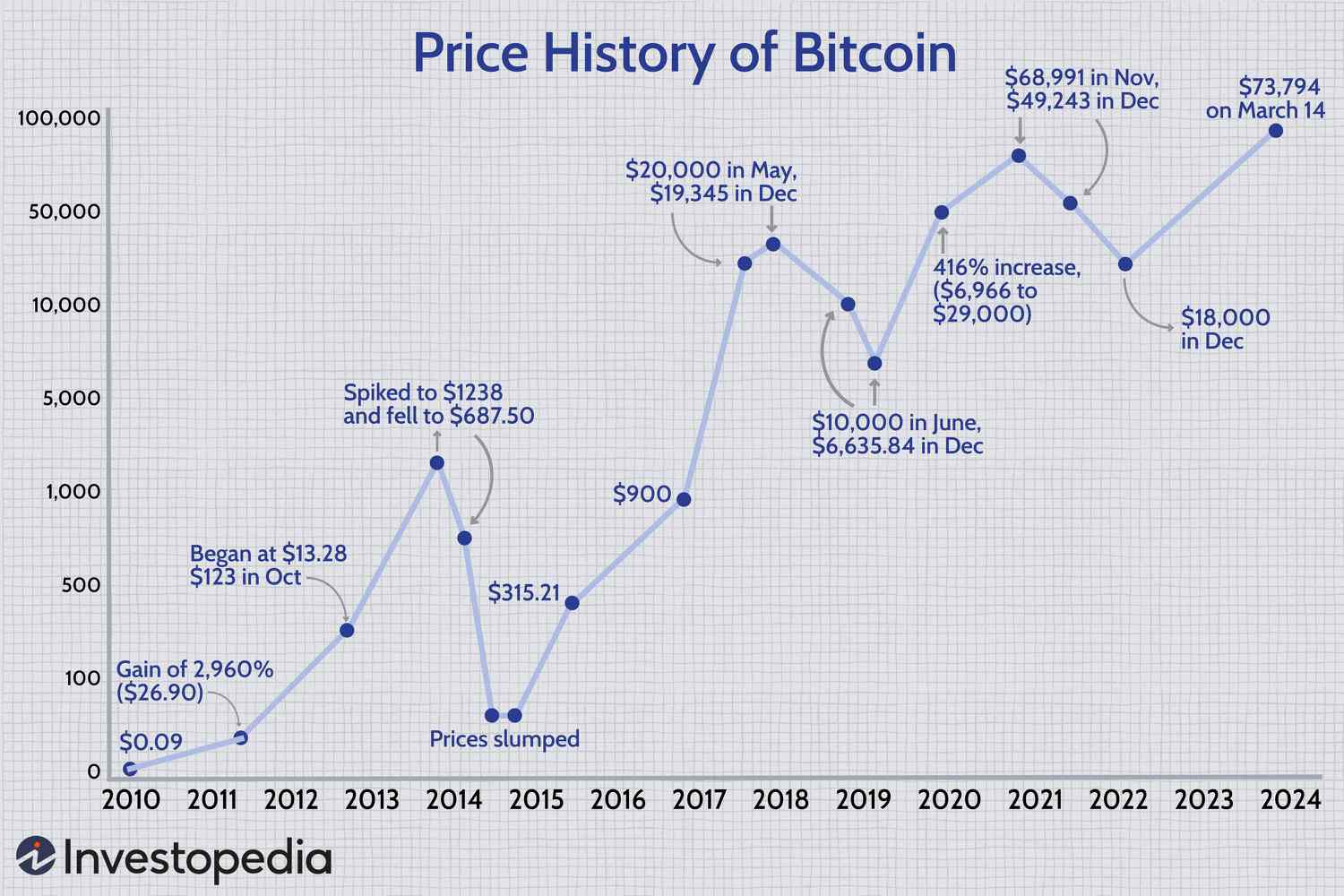

Bitcoin’s price chart showing the recent slump

Bitcoin’s price chart showing the recent slump

The primary catalyst behind this downturn is the payout of nearly $9 billion to users of collapsed Bitcoin exchange Mt. Gox. The trustee for the Mt. Gox bankruptcy estate, Nobuaki Kobayashi, announced that repayments in Bitcoin and Bitcoin Cash had begun, with creditors receiving funds through designated crypto exchanges.

“The remaining funds will be returned to creditors once a series of conditions is met, including confirming the validity of registered accounts and completing discussions between the trustee and the designated crypto exchanges.” - Nobuaki Kobayashi

This massive influx of coins onto the market is expected to lead to significant selling action, putting downward pressure on prices. The situation is further exacerbated by the German government’s sale of roughly 3,000 Bitcoins, worth approximately $175 million, seized in connection with the movie piracy operation Movie2k.

The German government still holds over 40,000 Bitcoins worth over $2 billion

The German government still holds over 40,000 Bitcoins worth over $2 billion

Despite the current turmoil, industry insiders remain optimistic about Bitcoin’s prospects, expecting prices to climb again toward the end of the year once the near-term selling pressure from the Mt. Gox repayments lifts. Analysts at crypto data and research firm CCData believe that Bitcoin hasn’t yet reached the top of its current appreciation cycle and is likely to hit a fresh all-time high.

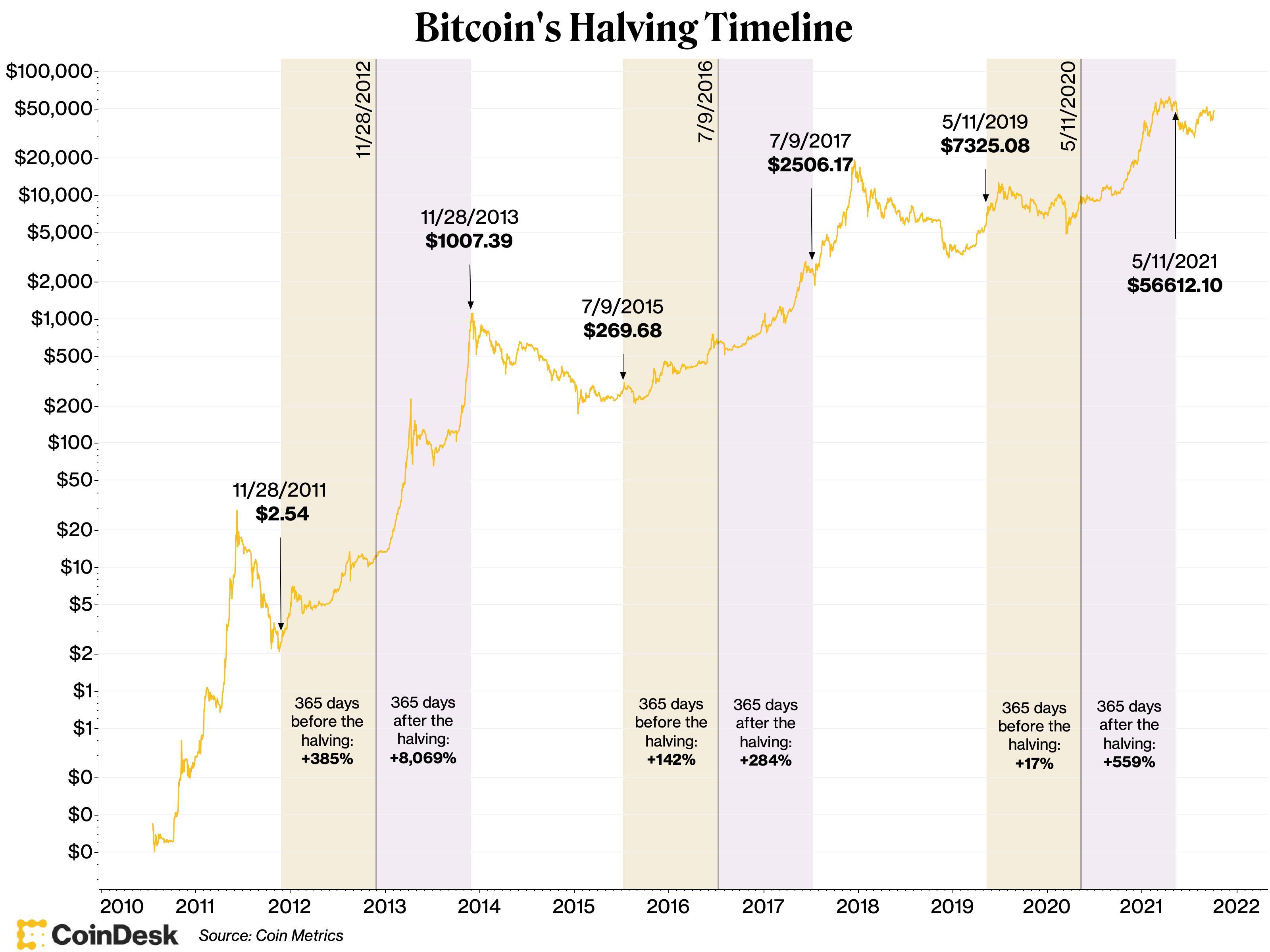

The last Bitcoin halving event took place on April 19 this year

The last Bitcoin halving event took place on April 19 this year

Historical market cycles have shown that Bitcoin’s halving event, which cuts the supply of new Bitcoins to the market, has always preceded a period of price expansion that can last between 12 and 18 months. With the last halving event taking place in April, the current cycle is expected to expand further into 2025.

In conclusion, the recent price slump in the cryptocurrency market can be attributed to a perfect storm of Mt. Gox repayments and German government sales. However, with historical market cycles and analyst predictions pointing toward a bright future, it’s essential to take a step back and assess the bigger picture.