Bitcoin’s Price Plunge: A Critical Period Ahead?

The world’s largest cryptocurrency, Bitcoin, has fallen sharply to a two-month low, breaking past a key support level as uncertainty over several points of selling pressure, chiefly defunct exchange Mt Gox, saw traders remain averse towards the token. The cryptocurrency took little support from weakness in the dollar, which fell amid increased bets on interest rate cuts by the Federal Reserve. Broader crypto prices also followed Bitcoin lower.

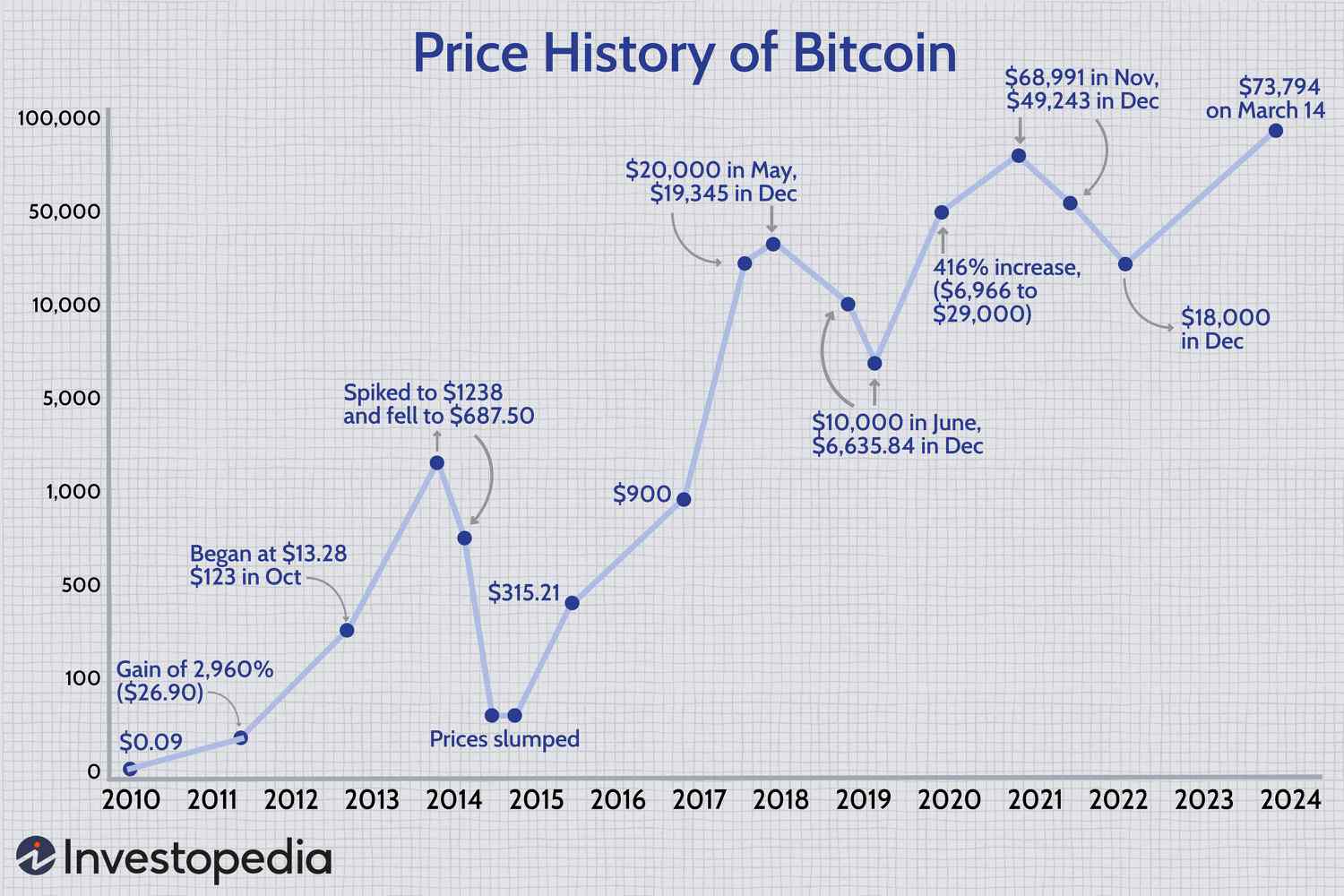

At the time of writing, Bitcoin fell 5% to $57,722.0, just above the session’s low of $57,053. The liquidators of Mt Gox said they will begin returning Bitcoin stolen during a 2014 hack to clients from early July. While the scale of the distribution remained unclear, traders bet that given Bitcoin’s massive price appreciation in the past decade, most receivers of the token would be inclined to sell.

Bitcoin’s price plunge

Such a scenario presents a large amount of selling pressure on Bitcoin. Several major whales were seen mobilizing Bitcoin on exchanges for a sale, while the token was also pressured by reported selling of confiscated tokens by the German government. Fears of a mass sale saw traders turn largely averse towards the world’s biggest cryptocurrency. This selling pressure spilled over into broader crypto markets, even as recent data showed some improvement in capital flows into crypto.

Despite these losses, new analysis from Glassnode suggests the Bitcoin market remains remarkably robust. According to the on-chain analytics platform, aggregate investor profitability is still strong, with the average coin holding a 2x profit multiple. Glassnode’s analysis reveals that the average coin in profit holds an unrealized gain of $41,300, with a cost basis of approximately $19,400, while the average coin in loss holds an unrealized loss of $5,300, with a cost basis of around $66,100. This divergence highlights potential sell-pressure points as investors weigh realizing gains against mitigating losses.

The average cost basis per active investor remains around $50,000, Glassnode said, a key level the market needs to stay above to maintain the macro bull market.

Bitcoin market analysis

Broader crypto prices also retreated on Thursday and have also suffered over the past week. World no.2 token Ether fell 5.4% to $3,161.49 as traders largely disregarded recent speculation over a spot Ether exchange-traded fund. Ether touched an over one-month low, having largely wiped out gains made in May on hype over a spot ETF.

XRP, SOL, and ADA slid between 4% to 8%, while among meme coins, SHIB and DOGE shed around 8% each. Crypto prices took little support from weakness in the dollar, which fell as a swathe of weak labor market and business activity readings pushed up expectations of interest rate cuts by the Fed.

Hawkish signals from the minutes of the Fed’s June meeting somewhat tempered this optimism, while several Fed officials also sounded caution over interest rate cuts. Focus was now on key nonfarm payrolls data due on Friday, which is set to offer more definitive cues on the labor market.

Crypto market analysis

Federal Reserve chair Jerome Powell has warned of a ‘critical period’ for the Fed, calling deficit levels ‘unsustainable.’ ‘The level of debt we have is completely sustainable but the path we are on is unsustainable,’ Powell said during the European Central Bank’s Portugal conference, adding the Biden administration was taking excessive risks by ‘running a very large deficit at a time when we are at full employment’ and said ‘you can’t run these levels in good economic times for very long.’

In May, Treasury secretary Janet Yellen issued a serious warning over the spiraling $34 trillion U.S. debt pile that some think could help propel the Bitcoin price to $1 million over the next 18 months.

Federal Reserve warning

Bitcoin, crypto, and stock market traders have been closely watching the Fed for signs it will begin cutting interest rates in recent months, with analysts forced to dial back expectations of around seven cuts in 2024 to just one or two.

‘Getting the balance on monetary policy right during this critical period, that’s really what I think about in the wee hours,’ Powell said in response to a question about his top worries.

Bitcoin’s price plunge

The Bitcoin price and crypto market has suffered a major crash over the last 24 hours, with the Bitcoin price diving well under $60,000 and wiping $200 billion from the combined crypto market since July 1. Ethereum and the rest of the major market are down more steeply than Bitcoin, with Ethereum rival Solana, the Telegram-linked Toncoin, and the meme-based Dogecoin all down almost 10% since this time yesterday.

Crypto market crash

One factor in Bitcoin’s price movements is the U.S. interest rate. As rates fall, the attraction of riskier investments such as cryptocurrencies increases. The minutes of the Federal Reserve meeting released Wednesday showed policymakers led by Chairman Jerome Powell do not want to cut rates until more data emerges to give them greater confidence that inflation is moving sustainably to their 2% target.

That may come as early as tomorrow, when the Labor Department releases its non-farm payrolls figure for June. ‘We believe hawkish comments from Jerome Powell and the ongoing selling pressure are likely to push BTC down to 52,000,’ Valentin Fournier, a digital assets analyst at advisory firm brn, said in an email. ‘However, we recommend viewing this as a buying opportunity, as improving regulations around cryptocurrencies and cooling inflation in the US have not been fully priced in and are likely to bring strong momentum once investors shift focus to a longer-term vision.’

Bitcoin’s price plunge

The sell-off may run out of steam if the payrolls data shows the labor market weakened in June. The figure is forecast to show payrolls increased by 195,000, a notable slowdown from 272,000 a month before, according to FXStreet. The jobless rate is forecast to have held steady at 4.0%, while average hourly earnings are projected to have slowed to 3.9% from 4.1% year-on-year.

The bull market progression can be identified by a rising trendline connecting October and January lows. BTC’s latest break below the 200-day line has put the focus on the bull market trendline support at $57,590. A close (midnight UTC) below that level could lead to further selling and downward price momentum, as traders often use trendline breakdowns as indicators to make trading decisions.

Bitcoin trendline