Bitcoin’s Price Plummets as Mt. Gox Begins Repaying Creditors

The price of Bitcoin has dropped to its lowest level since February, with the cryptocurrency falling below $55,000 on Friday. This sudden downturn comes as Mt. Gox, a defunct crypto exchange, begins the process of repaying its creditors.

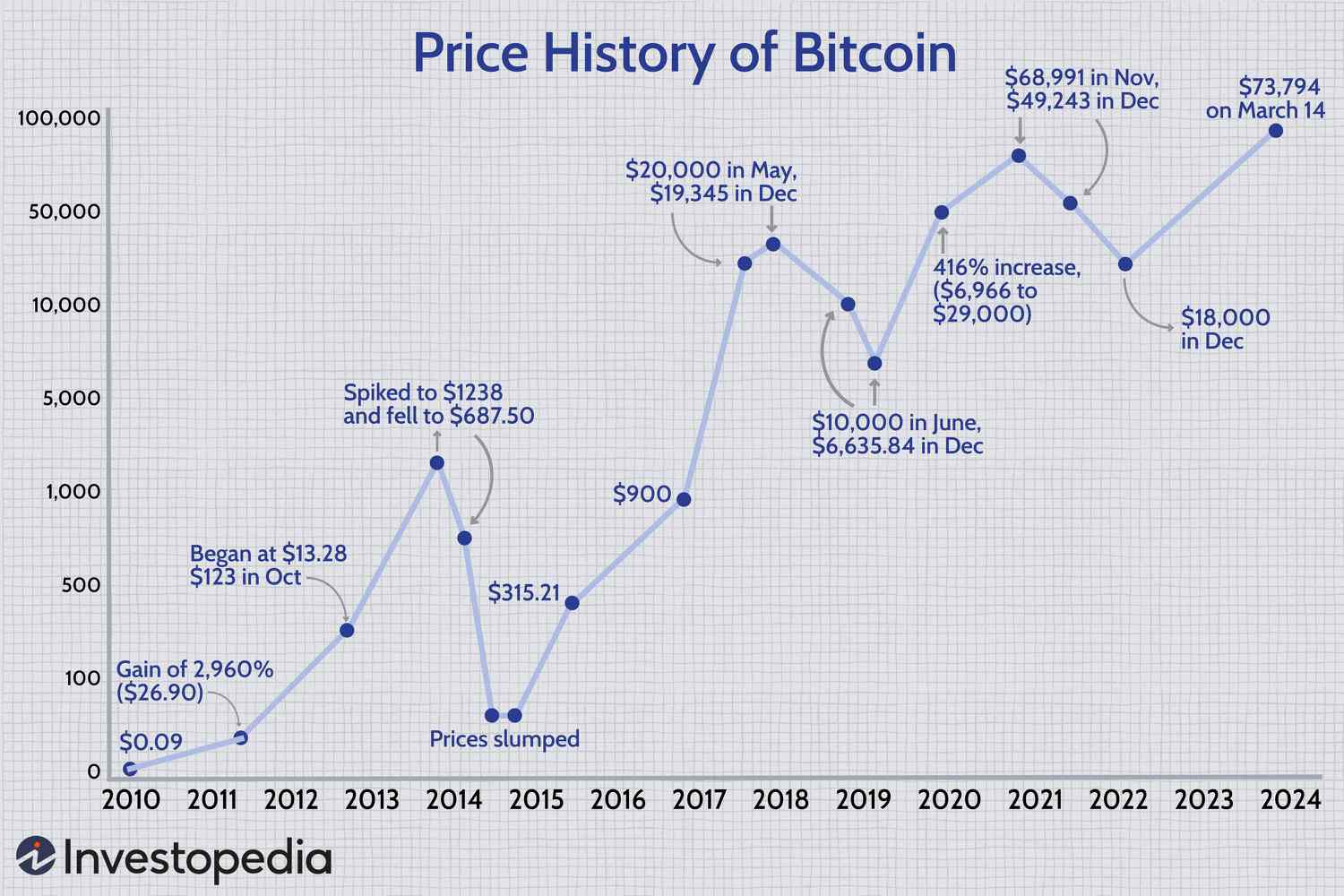

Bitcoin’s price has fallen sharply in recent days.

The price of Bitcoin has fallen over 6.7% in the past 24 hours, with the cryptocurrency’s value tanking more than 11% compared to last week. Other cryptocurrencies have also been hit by the sell-off, with Ether dropping below $2,900 and other tokens such as Binance’s BNB and Solana falling 11% and 5.8%, respectively.

Mt. Gox’s Repayment Process Sparks Concerns

Mt. Gox, which went bankrupt in 2014, has started the process of repaying its creditors in accordance with its “Rehabilitation Plan.” The repayments will be staggered, with creditors receiving around 140,000 Bitcoins (worth $7.6 billion) and 143,000 Bitcoin Cash (BCH) tokens ($42.5 million) in total.

On Thursday evening, Mt. Gox moved around 47,228 Bitcoins ($2.71 billion) from cold storage into a new wallet. The size of the payout has triggered concerns that creditors may move to liquidate a portion of the returned assets, thereby driving down prices.

Mt. Gox’s repayment process has sparked concerns about the impact on Bitcoin’s price.

The Impact on the Crypto Market

The sudden drop in Bitcoin’s price has extended a month of losses for the cryptocurrency. Despite the recent approval of spot Ethereum exchange-traded funds, the market hasn’t seen the same upswing it saw after the approval of Bitcoin ETFs in January.

Since the beginning of June, Bitcoin has fallen almost 20% from around $67,000. Ether has also plummeted about 24% from around $3,700.

The crypto market has seen a significant downturn in recent weeks.

The Future of Bitcoin

The repayment process by Mt. Gox has sparked concerns about the future of Bitcoin. If creditors do decide to liquidate a portion of the returned assets, it could drive prices even lower.

Rachel Lin, co-founder and CEO of SynFutures, a decentralized crypto derivatives exchange, believes that the market expects most Mt. Gox users to dump their tokens, but we might see a bounce back if the selling is lower than anticipated.

Rachel Lin, co-founder and CEO of SynFutures.

The crypto market is known for its volatility, and only time will tell how the repayment process by Mt. Gox will affect Bitcoin’s price in the long run.

Photo by

Photo by