Bitcoin’s Pre-Halving Danger Zone: A Contrarian View

As the cryptocurrency world buzzes with excitement over Bitcoin’s recent price movements, a different narrative emerges when we take a closer look at the data. While many are celebrating the bull run, I argue that Bitcoin is entering a dangerous phase that investors should approach with caution.

The Pause in the Bull Run

Bitcoin’s recent pause near the $67,000 support level has prompted traders to reassess their positions. This breather in the bull run offers a moment of reflection amidst the frenzy of the crypto market.

Bitcoin Pre-Halving Danger Zone

Bitcoin Pre-Halving Danger Zone

Analysts’ Warnings

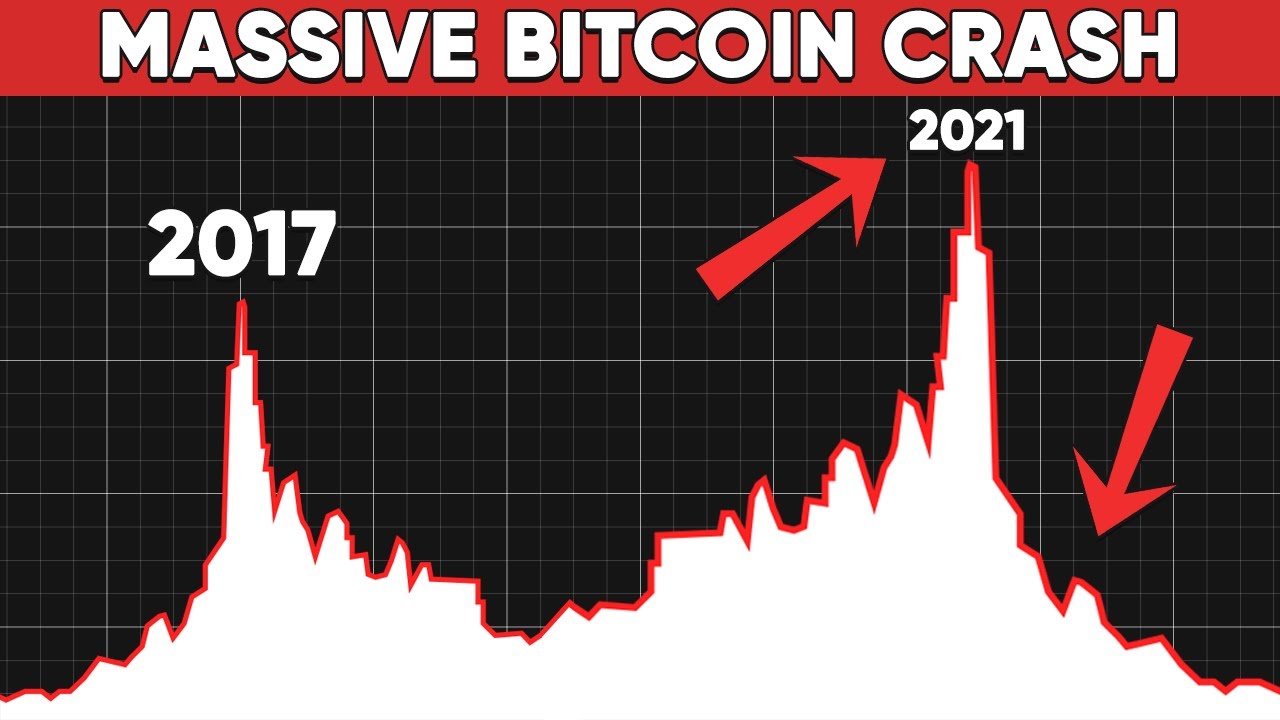

Analysts at Crypto Chiefs highlight the significance of Bitcoin’s struggle to maintain levels above $69,000. The resistance at the 2021 all-time high poses a challenge, indicating a potential shift in market dynamics.

Historical Pre-Halving Patterns

Drawing on historical data, market analyst Rekt Capital points out the recurring pre-halving retraces in Bitcoin’s price. These retraces, occurring 14-28 days before halving events, have historically led to significant market movements.

Expert Insights

Founder of MN Trading, Michaël van de Poppe, expresses caution regarding Bitcoin’s future price action. He suggests that the upside potential pre-halving may have peaked, hinting at a possible downward trend.

Contrarian Perspective

While many anticipate a parabolic move higher for Bitcoin, market analyst Moustache offers a contrarian view. By analyzing Bitcoin’s historical cycles, he predicts a potential parabolic move despite short-term uncertainties.

Altcoin Market Reaction

The altcoin market mirrors Bitcoin’s retracement, with meme coins experiencing significant fluctuations. This divergence from Bitcoin’s dominance underscores the complexity of the current market environment.

Conclusion

As Bitcoin teeters on the edge of the pre-halving danger zone, investors face a critical juncture. While optimism pervades the market, a contrarian perspective suggests a more nuanced approach to navigating the evolving crypto landscape.

Stay tuned for more updates on Bitcoin and the cryptocurrency market.