Bitcoin’s Breakout: Is a New Bull Market on the Horizon?

Bitcoin is making waves as it appears to be solidifying its position above critical support levels, paving the way for potential bullish trends. This promising development comes from insights shared by renowned crypto strategist Rekt Capital, who has a knack for predicting market movements, including the recent pre-halving correction observed in Bitcoin prices.

The Importance of Support Levels

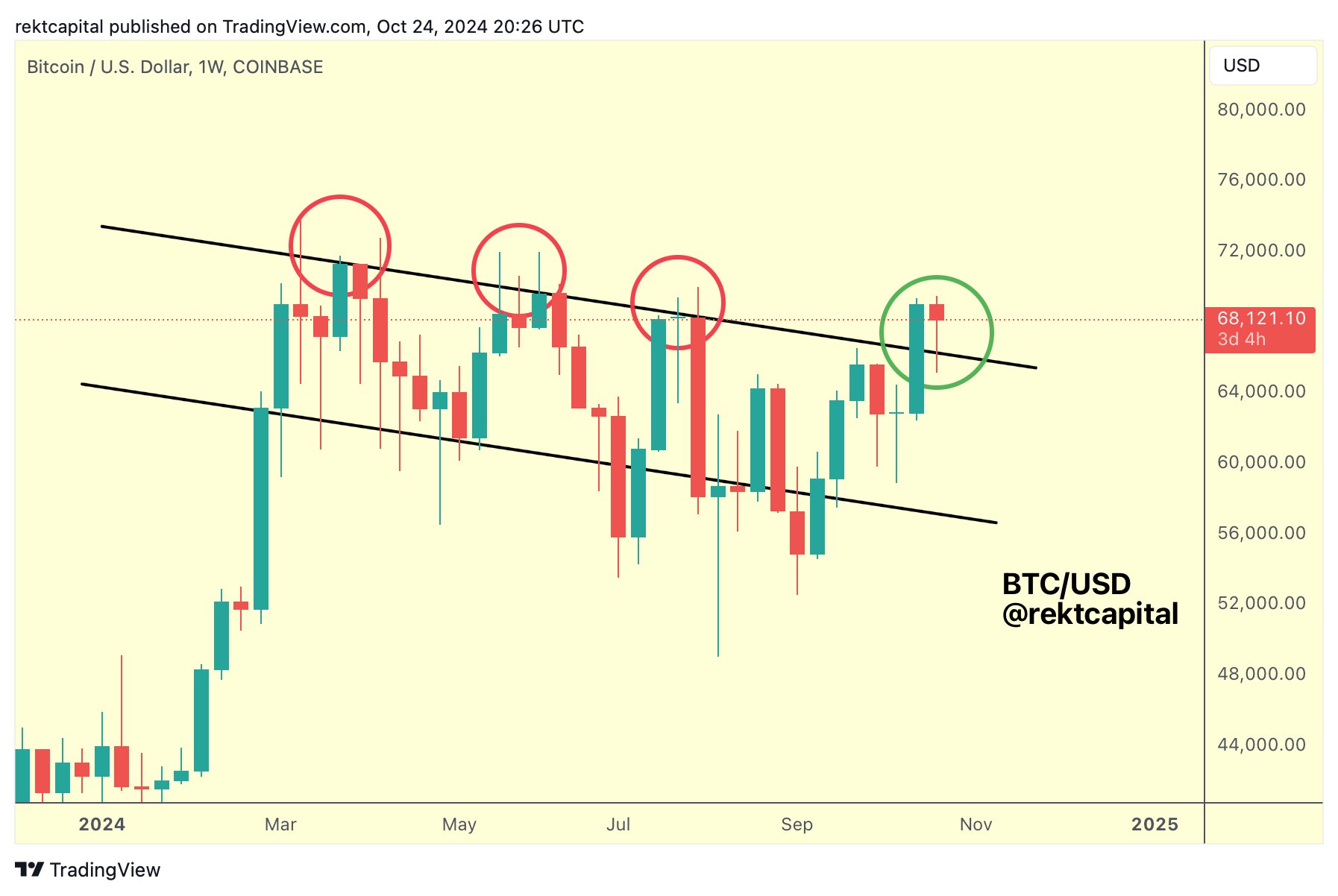

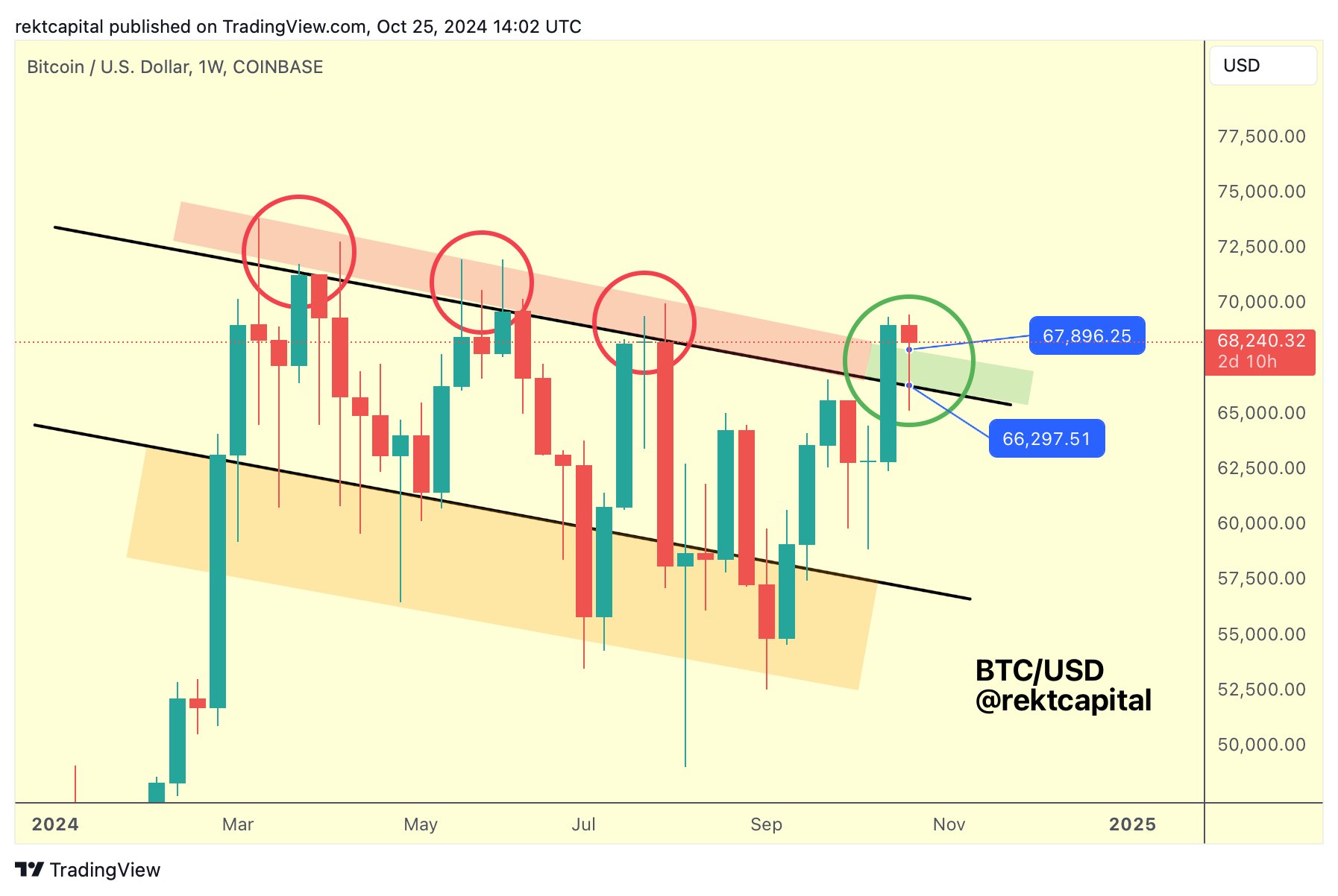

In the latest analysis, Rekt Capital noted that Bitcoin seems to be converting an old resistance into a solid support level. He remarked, > “The old downtrend is now acting as support. Looks like textbook post-breakout confirmation.”

For the momentum to carry forward, Bitcoin will need to achieve some significant closing prices this week. According to Rekt, a bullish close above approximately $66,300 would confirm the breakout, while a powerful close above $67,900 could signify a very strong bullish signal for investors.

Current Market Metrics

As of the time of writing, Bitcoin has surged to around $66,989, indicating it is already hovering near these pivotal levels. Rekt also highlighted Bitcoin’s performance in comparison to its historical behavior following halving events.

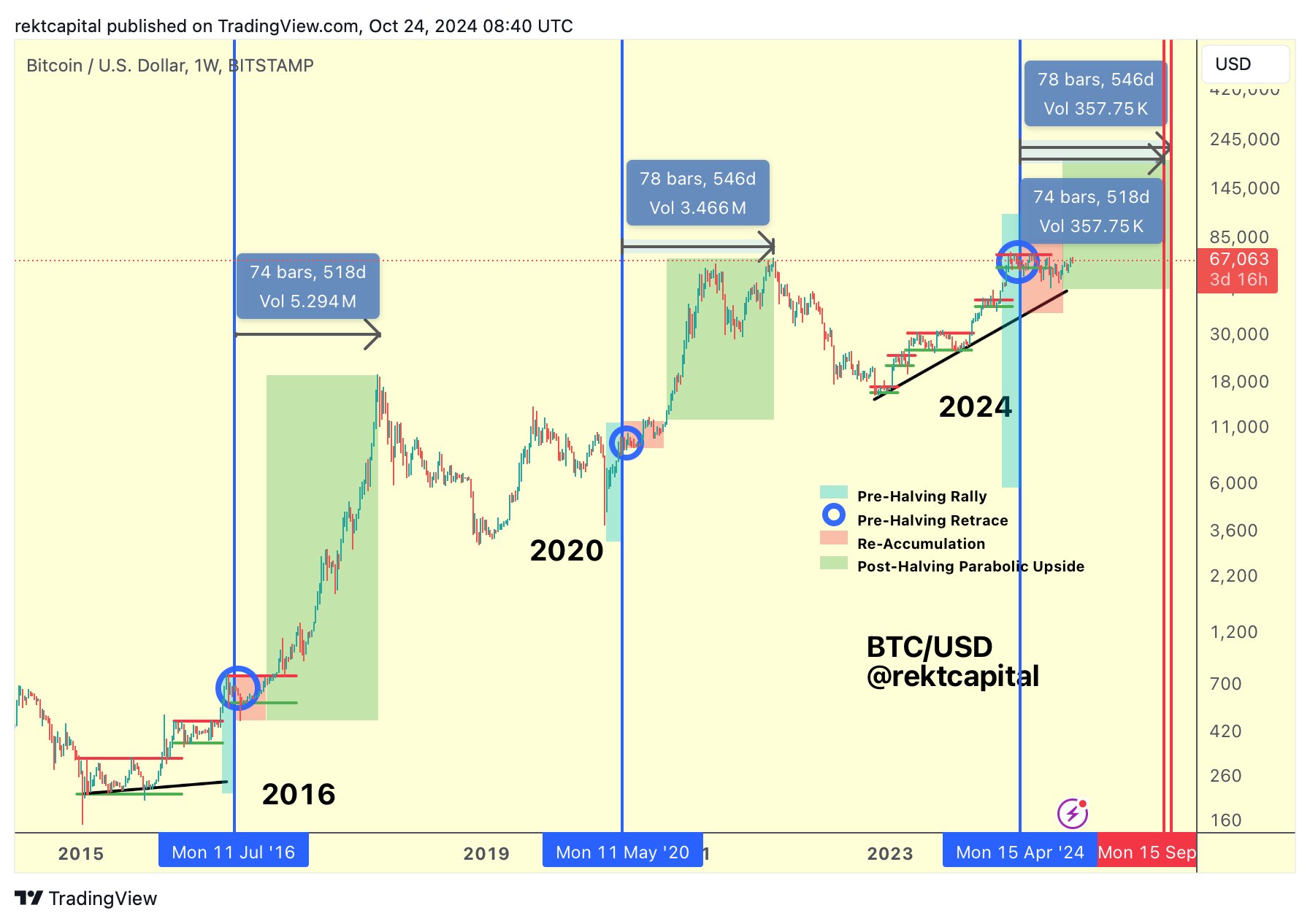

Digging deeper into the halving cycle, he noted that Bitcoin is more than a month ahead compared to prior cycles, a promising sign for enthusiasts. Historically, after halving events, Bitcoin peaked approximately 518 to 546 days later, based on previous cycles in 2015-2017 and 2019-2021. If past trends continue, this could mean a peak for Bitcoin could materialize around September or October of 2025.

Rekt stated that, “Currently, Bitcoin is still accelerating in this cycle by approximately 35 days or so. So the longer Bitcoin consolidates after the halving, the better it will be for resynchronizing this current cycle with the traditional halving cycle.” This perspective encourages investors to remain optimistic, suggesting that patience during this consolidation phase may ultimately yield fruitful returns.

Navigating the Volatile Market

In the broader context of the cryptocurrency market, volatility remains a key risk factor. Bitcoin’s recent price fluctuations have raised eyebrows, prompting analysts to remind investors to exercise caution. Therefore, it is essential to maintain a balanced view and prepare for unexpected market shifts.

Despite this cautionary note, many traders are recognizing the potential for significant price movements in the upcoming months. The crypto community remains lively with speculation that Bitcoin may soon embark on a journey towards six figures, spurred by recent ETF inflows which have reached a staggering $20 billion, as noted by prominent analysts.

Conclusion: What Lies Ahead for Bitcoin?

As Bitcoin continues to stabilize above its critical support levels, market watchers will be keenly monitoring its performance in the coming week. The indicators suggest a potentially bullish trajectory, but as always in the crypto realm, unpredictability is the norm. Investors should remain informed and adaptable in this ever-evolving landscape.

For those looking to keep their fingers on the pulse of Bitcoin and cryptocurrency updates, subscribing to reliable news platforms is a prudent step in navigating these turbulent waters.

Stay tuned for further developments in the cryptocurrency market!

Stay updated with the latest crypto news and insights.

Stay updated with the latest crypto news and insights.