Bitcoin’s Post-ETF High: What’s Next for Investors?

As the second quarter of the year draws to a close, Bitcoin investors are left wondering what’s next for the cryptocurrency after it retreated from its all-time highs registered during the height of the ETF mania. The original cryptocurrency is down about 13% since March, a sharp contrast from the 67% and 57% surges seen, respectively, in the previous two quarters. Bitcoin, which reached a record $73,798 on March 14, is closing the quarter at around $61,000.

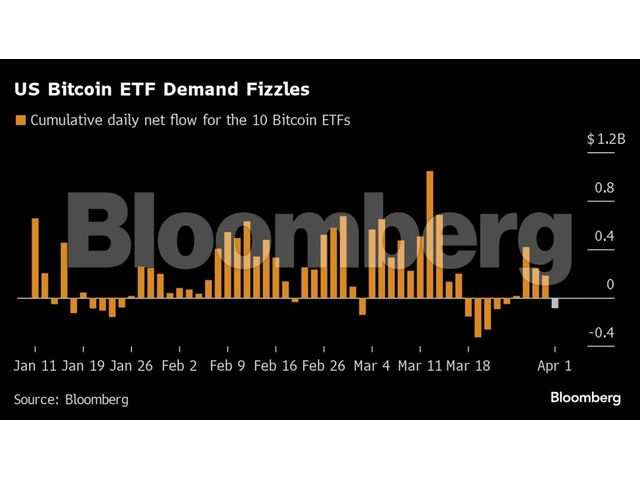

A graphic representation of the Bitcoin ETF mania

A graphic representation of the Bitcoin ETF mania

The downturn has raised the question of whether cracks in momentum trades such as Bitcoin point to a tougher outlook for risk appetite as the prospect of higher-for-longer interest rates hangs over financial markets. According to Austin Reid, global head of revenue and business at FalconX, “A lot of people in the market have questions that are mostly anchored on concerns from a macro perspective.” Reid added, “So I think there’s just some short-term uncertainty being reflected within the crypto market, as we’re seeing in some other asset classes too.”

“A lot of people in the market have questions that are mostly anchored on concerns from a macro perspective. So I think there’s just some short-term uncertainty being reflected within the crypto market, as we’re seeing in some other asset classes too.” - Austin Reid, FalconX

One of the best measures of the waning interest may be the slowing of demand for the US ETFs allowed to hold Bitcoin, which were approved by the Securities and Exchange Commission in January. Investors poured about $2.6 billion into Bitcoin funds in the second quarter, compared with around $13 billion in the first three months of the year, according to data compiled by CoinShares.

A graph showing the slowdown in Bitcoin ETF demand

A graph showing the slowdown in Bitcoin ETF demand

Matthew O’Neill, co-director of research at Financial Technology Partners, attributes the slowdown to natural price correction after the rally. “There was a lot of euphoria around the release of the ETFs, and then there was a natural price correction after the rally,” O’Neill said.

“There was a lot of euphoria around the release of the ETFs, and then there was a natural price correction after the rally.” - Matthew O’Neill, Financial Technology Partners

As investors ponder what’s next for Bitcoin, many are left wondering if the ETF mania is truly over, or if this is just a temporary setback for the cryptocurrency. Only time will tell if Bitcoin can regain its momentum and continue to rise to new heights.

An image representing the uncertainty of Bitcoin’s future

An image representing the uncertainty of Bitcoin’s future