Bitcoin’s Path to New Heights: Insights on Market Trends and Emerging Tokens

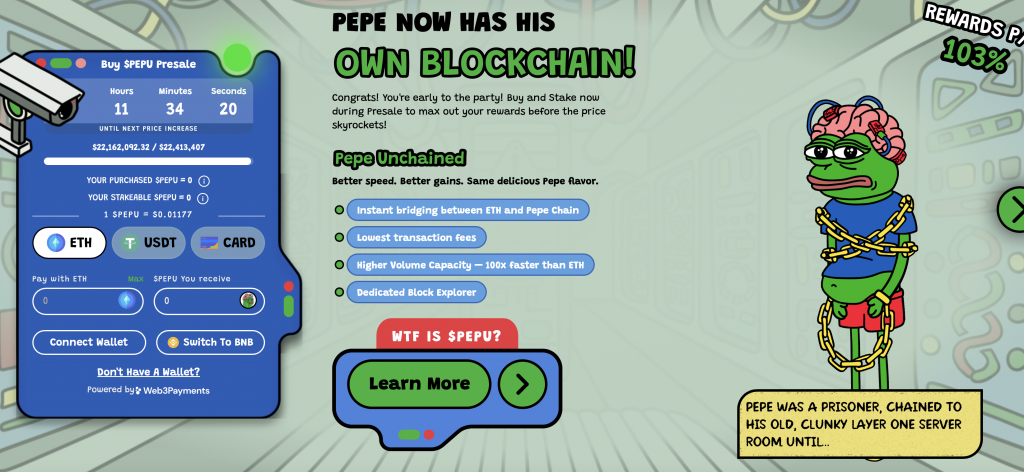

As Bitcoin approaches a pivotal moment, it hovers near a new all-time high, recently remaining just below the $70,000 mark. Despite minor fluctuations, the cryptocurrency market demonstrates resilience, with some major altcoins experiencing similar slight losses. One standout in this environment is Pepe Unchained ($PEPU), which has captured significant investor interest, surpassing an impressive $22 million in its Initial Coin Offering (ICO).

Recent advancements in the crypto market highlight the opportunities that lie ahead.

Recent advancements in the crypto market highlight the opportunities that lie ahead.

The Allure of ICOs

Pepe Unchained stands out not only in its branding but also as the first meme coin to introduce its own Layer 2 solution for Ethereum. Such innovation positions it well to capitalize on the increasing demand within the cryptocurrency space.

Currently, $PEPU is only available through its ICO at a fixed price, with projections that this price will increase multiple times before the token launches on exchanges. Historically, coins launched via ICOs tend to experience explosive growth; for instance, Ethereum soared from $0.31 at its ICO to approximately $2,500 today. Early investors can often see substantial returns, making participation in such launches an attractive proposition.

Pepe Unchained Features

Fast Transactions and High Staking Rewards

Pepe Unchained promises an efficient and cost-effective transaction framework by operating on its dedicated blockchain infrastructure. Noteworthy is its Annual Percentage Yield (APY) for staking, which is reported to exceed 100%—a figure that is drawing significant early investment interest. This limited supply of easily tradable tokens at launch creates perfect conditions for a prospective price surge, thus inviting scrutinized optimism within the crypto community.

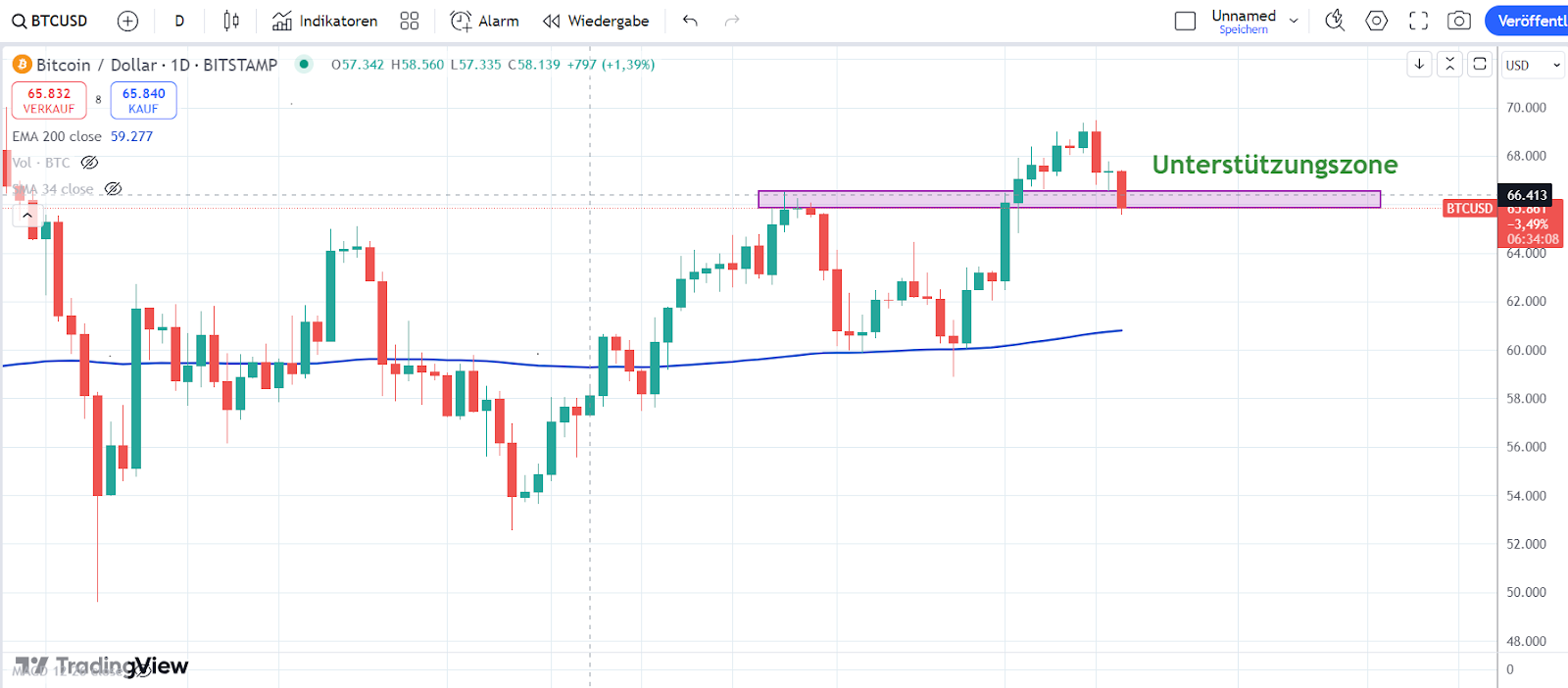

The Bullish Predictions for Bitcoin

Meanwhile, the cryptocurrency market is abuzz with predictions—none more audacious than that of a billion-dollar investment manager, who forecasts Bitcoin could soar to $200,000 by 2025. Although recent weeks have seen a slight correction of about 5%, such fluctuations are expected and reflect a natural consolidation phase. Currently supported by a critical resistance zone, Bitcoin continues to present a viable opportunity for both new and seasoned investors alike.

Forecasts suggest a significant upward movement for Bitcoin.

Forecasts suggest a significant upward movement for Bitcoin.

In order to reach the esteemed $200,000 mark, Bitcoin would need to appreciate by nearly 205%. Whether this trajectory holds true may heavily depend on macroeconomic factors, including the upcoming US election and the anticipated halving event. Should October unveil a sustained bullish trend, it may indeed act as a catalyst for Bitcoin’s resurgence.

Exploring the Relationship Between M2 Money Supply and Bitcoin

Recent trends in the cryptocurrency market also highlight a linkage between Bitcoin’s valuation and M2 money supply. Analysts suggest that an increase in the M2 metric—capturing various cash and near-cash monetary assets—could signify an incoming phase of increased liquidity that benefits Bitcoin in the long run.

Krypto-analyst Michael van de Poppe points out the historical parallels, noting how the M2 money supply surges during Bitcoin’s prior bull markets. If similar trends continue, Bitcoin’s value may enjoy an extended bullish cycle well into the next two years.

Liquidity dynamics play a crucial role in crypto valuation.

Liquidity dynamics play a crucial role in crypto valuation.

A Look at Emerging Coins: Crypto All-Stars

While Bitcoin serves as the cornerstone investment in the digital currency landscape, emerging projects like Crypto All-Stars ($STARS) are gaining traction. Having raised over $2.6 million in its presale, STARS is leveraging the momentum surrounding meme coins while providing a robust staking framework geared towards maximizing user returns.

Early investors can still secure STARS tokens at a favorable price before larger investors enter the fray. The community backing the coin has already exceeded 20,000 followers on social platforms, indicating growing interest and engagement among potential investors.

As attention shifts toward these new projects, it’s vital for investors to remain informed. Significant profits from lesser-known coins—some projecting returns between 1,500% and 2,500%—could well materialize alongside Bitcoin’s anticipated rise.

Conclusion: Navigating Both Opportunity and Risk

Investing in cryptocurrencies is inherently speculative, and as the market continues to evolve, ensuring a well-rounded approach to investment remains crucial. While Bitcoin maintains its status as a leading digital currency, opportunities with other coins such as Pepe Unchained and Crypto All-Stars are worth exploring.

In this ever-shifting landscape, understanding market indicators and trends will be key to thriving in the crypto space in the upcoming months. With the possibility of fresh all-time highs and new projects emerging on the scene, the future for crypto enthusiasts looks promising yet requires caution.

Further Reading

Enjoy the journey in this fascinating world of digital finance!

Photo by

Photo by