Bitcoin’s Path to $1 Million: Experts Forecast a Decade of Growth Amid Crypto Boom

The world of cryptocurrency is abuzz with excitement as experts predict that Bitcoin could hit $1 million per token by 2033. This bold forecast comes from a new report by Bernstein, a global investment firm. According to the report, Bitcoin’s price will surge to $200,000 by 2025, $500,000 by 2029, and eventually reach $1 million in just over a decade.

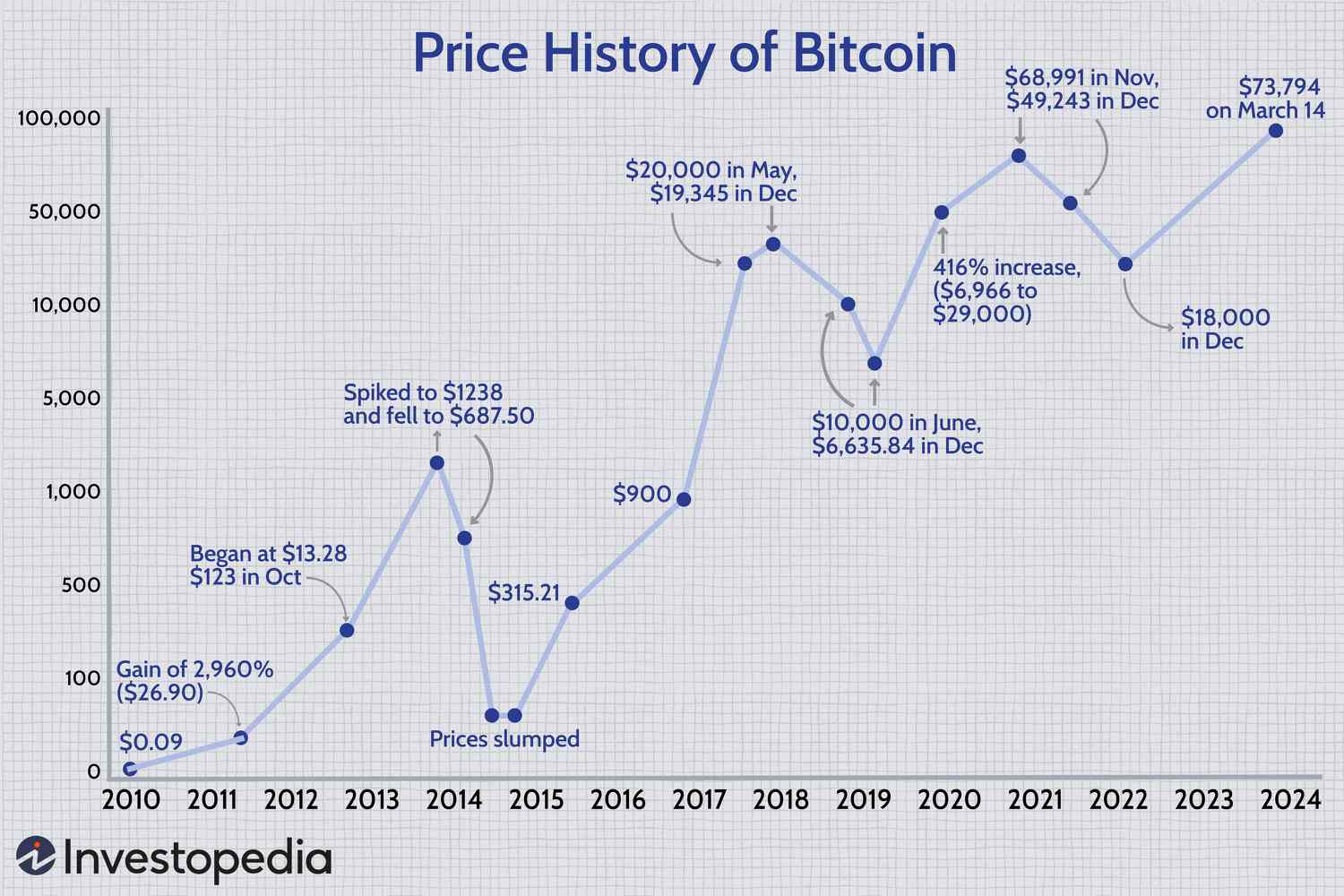

Bitcoin’s price surge

This decade-long rally will be driven primarily by institutional investors, who are expected to flock to Bitcoin as ETFs are approved at major wirehouses and private bank platforms. The growing distrust in traditional institutions is also expected to play a significant role in Bitcoin’s growth, as people seek alternative assets that are decentralized and less susceptible to government control.

The Growing Distrust in Government and Its Potential Impact on Bitcoin

The lack of trust in traditional institutions is a significant hurdle that Bitcoin needs to overcome. However, this distrust could ultimately work in Bitcoin’s favor. A recent survey by the Partnership for Public Service found that only 23% of Americans trust the federal government, down from 35% in 2022. This lack of trust could drive people towards decentralized assets like Bitcoin.

Distrust in government

Mt. Gox Selling Pressure Could Be Less Than Feared

The trustee for the defunct Mt. Gox crypto exchange has announced that it will begin returning more than 140,000 BTC to clients whose assets were stolen in a 2014 hack. This news has sent shockwaves through the crypto market, with many predicting a significant sell-off. However, some analysts believe that the selling pressure could be less than feared.

According to Alex Thorn, head of research at Galaxy, fewer coins will be distributed than people think, and this will cause less bitcoin sell pressure than market expects. Thorn believes that 75% of creditors will take the “early” payout in July, meaning a distribution of about 95,000 coins. Of that, Thorn thinks 65,000 coins will be going to individual creditors, who may prove more “diamond-handed” than most expect.

Mt. Gox selling pressure

Ethereum ETFs: The Next Big Thing?

Ethereum has long been overshadowed by Bitcoin, but that could be about to change. ETFs that track the world’s number two crypto are coming, with several firms waiting for the green light from the Securities and Exchange Commission (SEC). The big question is: Will people buy in?

Ethereum has some advantages over Bitcoin, like smart contracts and decentralized apps. However, it lacks Bitcoin’s compelling story and star power, and its daily trading volume is roughly half that of Bitcoin’s. These factors could sway investor interest as Ethereum ETFs hit the market.

Ethereum ETFs

Conclusion

The world of cryptocurrency is on the cusp of major changes, from Bitcoin’s potential price explosion to Ethereum’s ETF prospects and the AI revolution. Growing distrust in traditional systems, coupled with regulatory developments and changing investment trends, points to a new era of financial innovation.

Crypto boom

Photo by

Photo by