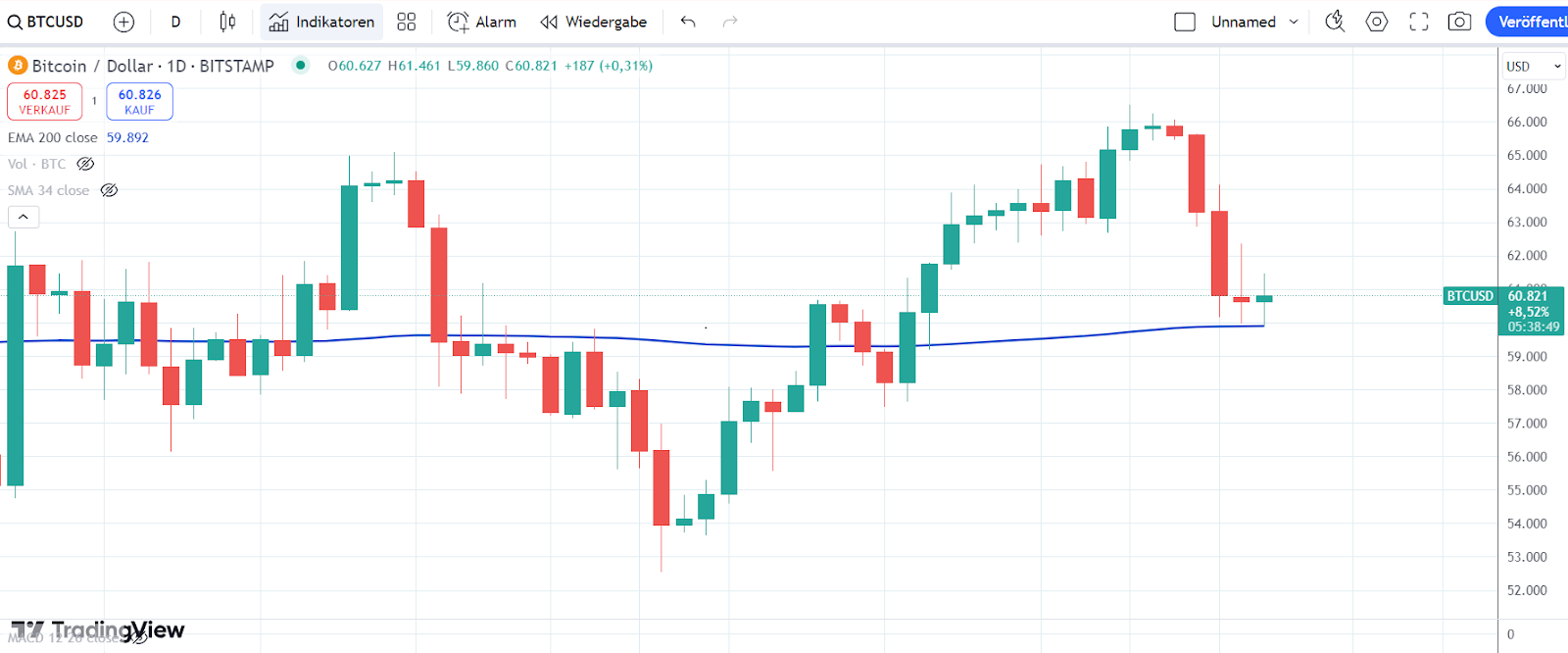

The Bitcoin Market: October’s Promising Turnaround?

As October unfolds, the cryptocurrency market finds itself on a rollercoaster of volatility, particularly with Bitcoin, the largest and most established cryptocurrency. Despite high expectations at the onset of the month, recent market trends have led to significant declines, particularly a drop of over 7.6% since the end of September. This downturn comes amid rising tensions in the Middle East, particularly between Israel and Iran, which has caused waves of uncertainty across financial markets including cryptocurrencies.

The price of Bitcoin has recently seen a notable decline, raising concerns among investors.

The price of Bitcoin has recently seen a notable decline, raising concerns among investors.

However, it is premature to pass judgment on the entire month based on a few days of negative performance. Historically, every bull market for Bitcoin began in October, making the potential for recovery significant as we progress through the month. Investor sentiment could shift dramatically, especially as the US labor market data is released on the first Friday of the month—a critical event that often influences market trends and investor actions.

Anticipating a Market Shift

As Michaël van de Poppe, a renowned crypto analyst with over 720,000 followers, recently pointed out, the correction seen in the first week of October is relatively normal given the context of upcoming economic indicators. In a recent tweet, he stated:

“Bitcoin is in correction during the first week of October. It is quite normal as it is the week of employment data. We anticipate a reversal next week, so declines should be viewed as buying opportunities!”

His analysis suggests that investors should view these fluctuations not with despair but as potential entry points for future gains. As the market approaches the labor data release, the anticipation could herald a resurgence in Bitcoin’s price.

Analysts believe that the upcoming economic indicators could significantly influence Bitcoin’s performance.

Analysts believe that the upcoming economic indicators could significantly influence Bitcoin’s performance.

Emerging Opportunities in a Downturn

In an intriguing twist, the cryptocurrency $IBIT, introduced by BlackRock, is defying the downward trend seasoned by 242 million US dollars in outflows from other Bitcoin-spot ETFs. With a robust asset under management totaling 23 billion US dollars, the iShares Bitcoin Trust has seen inflows surpassing 40 million US dollars, indicating a notable confidence in its future performance even amidst broader market caution.

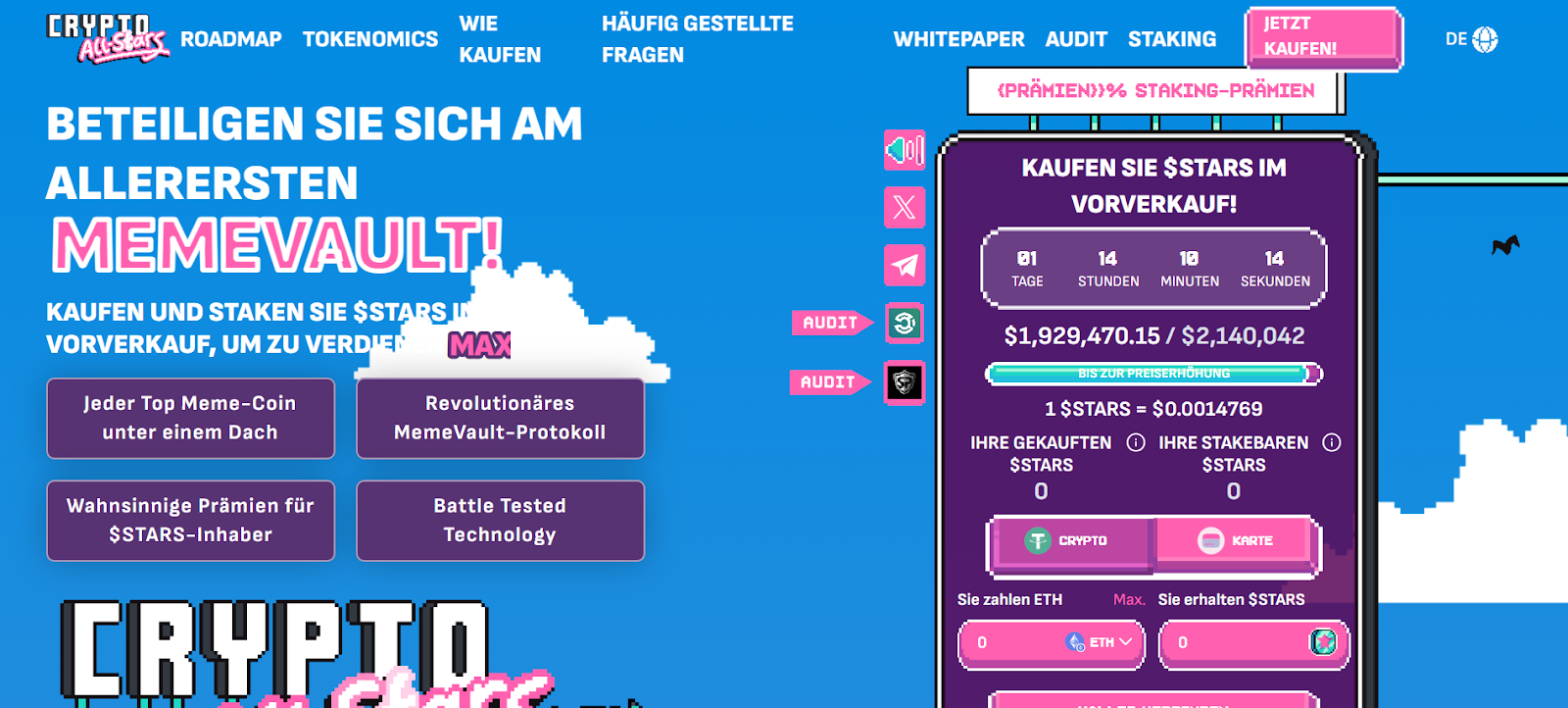

Moreover, as bullish indicators emerge with institutional confidence, investors are also turning their eyes towards new projects, particularly Crypto All-Stars ($STARS). This innovative token is linked to MemeVault, a groundbreaking staking protocol that allows diverse cryptocurrencies to be staked in a single pool, irrespective of their underlying blockchain.

Crypto All-Stars: The Dawn of a New Era?

Crypto All-Stars has rapidly garnered attention, drawing nearly 18,000 enthusiastic investors eager to see its success unfold. Stakeholders have already invested close to 2 million US dollars in $STARS, fueling its presale and escalating interest. Analysts suggest this surge is merely a precursor to a more significant increase following its trading debut, with predictions estimating price targets ranging from x10 to x25.

Furthermore, the current annual yield for staking $STARS is an impressive 772%, positioning it as a high-potential opportunity for those looking to diversify their cryptocurrency portfolios. Given the various factors at play, this project could revolutionize how meme coins are staked and traded across the market, offering a unique solution for investors looking to capitalize on emerging opportunities.

Crypto All-Stars is emerging as a key player within the cryptocurrency ecosystem.

Crypto All-Stars is emerging as a key player within the cryptocurrency ecosystem.

Conclusion: Navigating the Uncertain Terrain

With a perfect storm of market correction, geopolitical tension, and potential economic indicators ahead, October indeed holds promise for Bitcoin and its surrounding ecosystem, including upstarts like $STARS. While the current price movements may initially seem daunting, opportunities for recovery and growth abound for astute investors willing to navigate this turbulent but potentially rewarding landscape. Whether through traditional ETFs like $IBIT or innovative tokens like Crypto All-Stars, the cryptocurrency world remains ripe with possibilities for those armed with the right information and foresight.

As always, speculation carries risks, and investors should conduct thorough due diligence before diving into these turbulent waters. Yet, one thing remains certain: the world of cryptocurrency is as dynamic and unpredictable as ever, promising both challenges and substantial rewards.

Daring to Dream

As we brace for the coming weeks, the crypto community watches closely, eager for signals of recovery. With the right strategies and beliefs in innovative projects, October could indeed herald a new era for Bitcoin and its allied tokens. Investors must remain vigilant, prepared to seize opportunities as they arise. The journey is just beginning.

Photo by

Photo by