Bitcoin’s Mid-Year Slump: What’s Behind the Cryptocurrency’s Recent Decline?

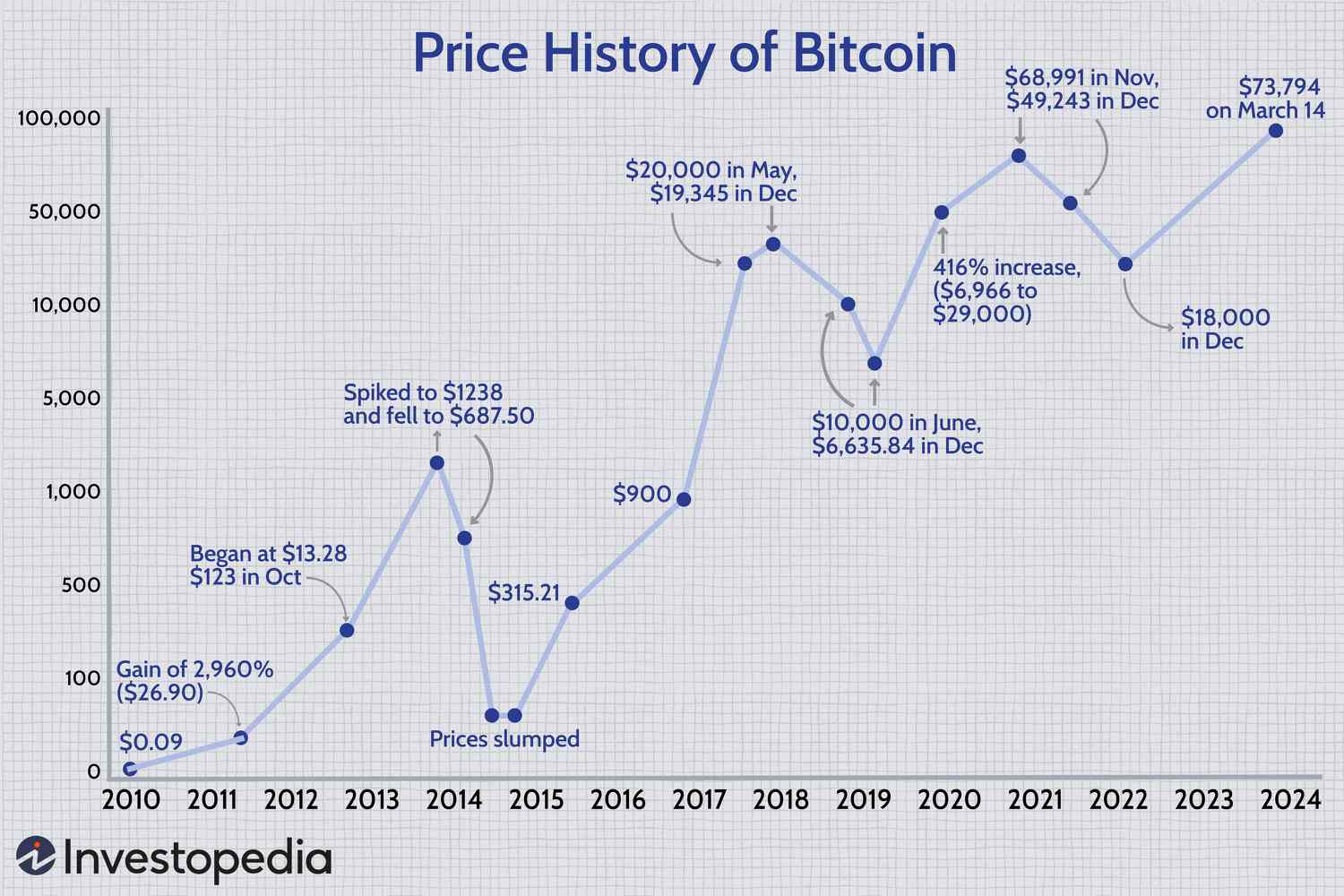

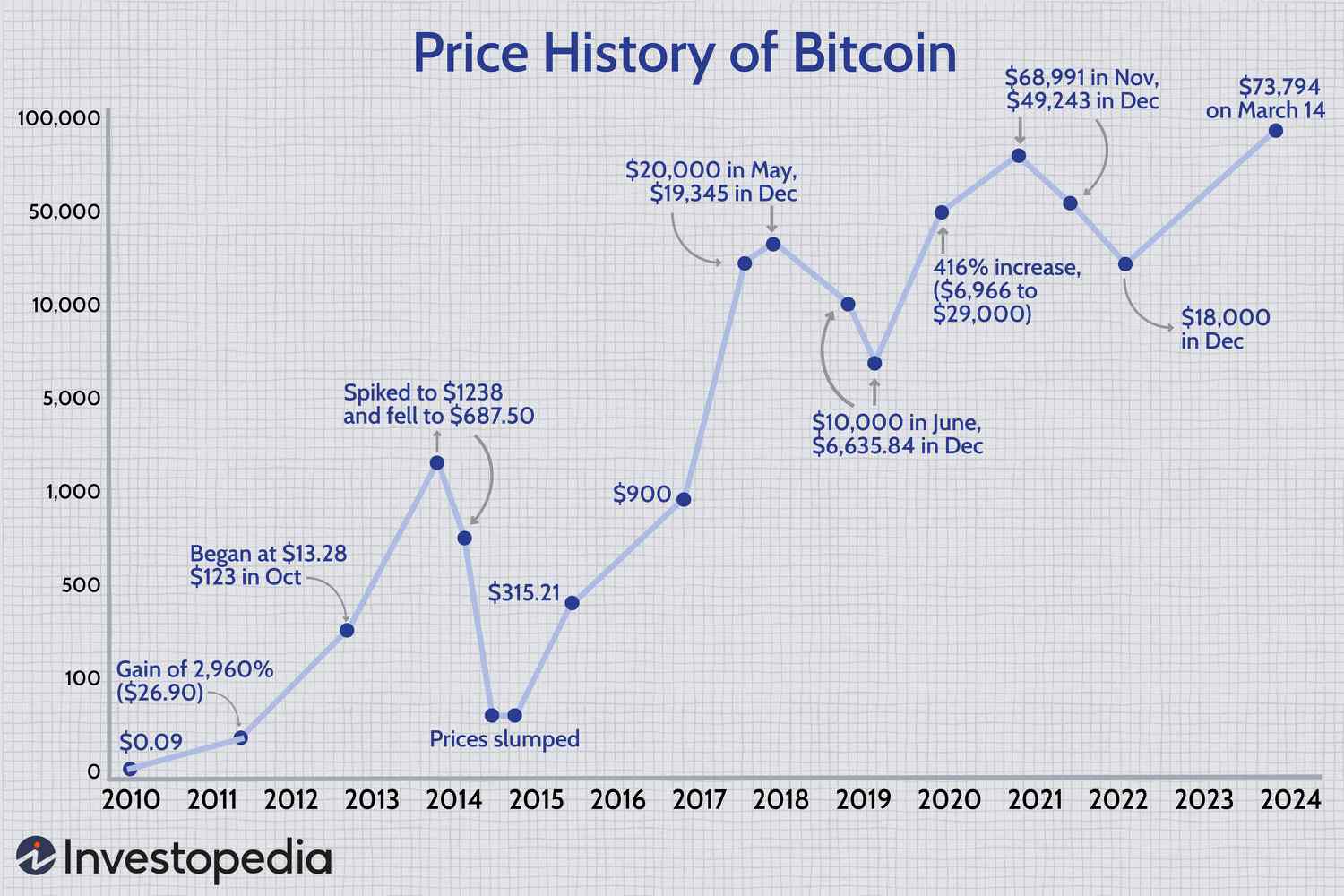

Bitcoin’s value has taken a hit in recent days, with the cryptocurrency falling to its lowest price since May 3. This marks a significant downturn in what has otherwise been a strong year for Bitcoin, with the cryptocurrency still up 42% year-to-date despite the recent losses.

Bitcoin’s price has taken a hit in recent days.

Bitcoin’s price has taken a hit in recent days.

The recent losses are thought to be linked to anticipated sales of nearly $9 billion worth of Bitcoin by creditors of the long-shuttered Japanese exchange Mt. Gox, as well as the German government’s reported sale of hundreds of millions of dollars worth of the cryptocurrency.

“The crypto bears have become louder again,” Bernstein analysts Gautam Chhugani and Mahika Sapra wrote to clients Monday. “After months of Bitcoin ETF euphoria, the market suddenly feels bearish.”

Other cryptocurrencies have also felt the pinch, with Ether, Binance coin, and Solana all falling by 2.8% or more on Monday.

The cryptocurrency market has taken a hit in recent days.

The cryptocurrency market has taken a hit in recent days.

Despite the recent downturn, Bitcoin is still up almost 300% since the end of 2022, with much of its gains stemming from hype about the spot Bitcoin exchange-traded funds.

The approval of spot Bitcoin exchange-traded funds has driven much of Bitcoin’s gains this year.

The approval of spot Bitcoin exchange-traded funds has driven much of Bitcoin’s gains this year.

Bitcoin withdrawals at crypto exchanges have also outnumbered deposits by $522 million from Wednesday to Sunday, according to FactSet data, indicating that a number of Bitcoin holders are cashing out on their investments.

Bitcoin withdrawals have outnumbered deposits in recent days.

Bitcoin withdrawals have outnumbered deposits in recent days.

Despite the recent losses, Bernstein analysts maintain a highly bullish $200,000 price target for Bitcoin, expecting prices to more than triple.

Bernstein analysts expect Bitcoin’s price to more than triple.

Bernstein analysts expect Bitcoin’s price to more than triple.

The recent downturn in Bitcoin’s value serves as a reminder of the cryptocurrency’s volatility, and the need for investors to approach with caution.

Bitcoin’s value can be volatile, and investors should approach with caution.