Can Bitcoin Revolutionize the Role of Central Banks?

In the world of finance, the emergence of Bitcoin has sparked intense debates about the future of central banks and traditional fiat currencies. Let’s delve into the potential impact of Bitcoin on the established financial infrastructure.

Bitcoin and Central Banks

Bitcoin and Central Banks

Bitcoin, the pioneering decentralized digital currency unveiled in 2009, revolutionized the concept of online transactions by enabling direct peer-to-peer payments without intermediary financial institutions. The fundamental question that looms large is whether Bitcoin has the capacity to supplant central banks and their fiat currencies.

The Crucial Role of Central Banks

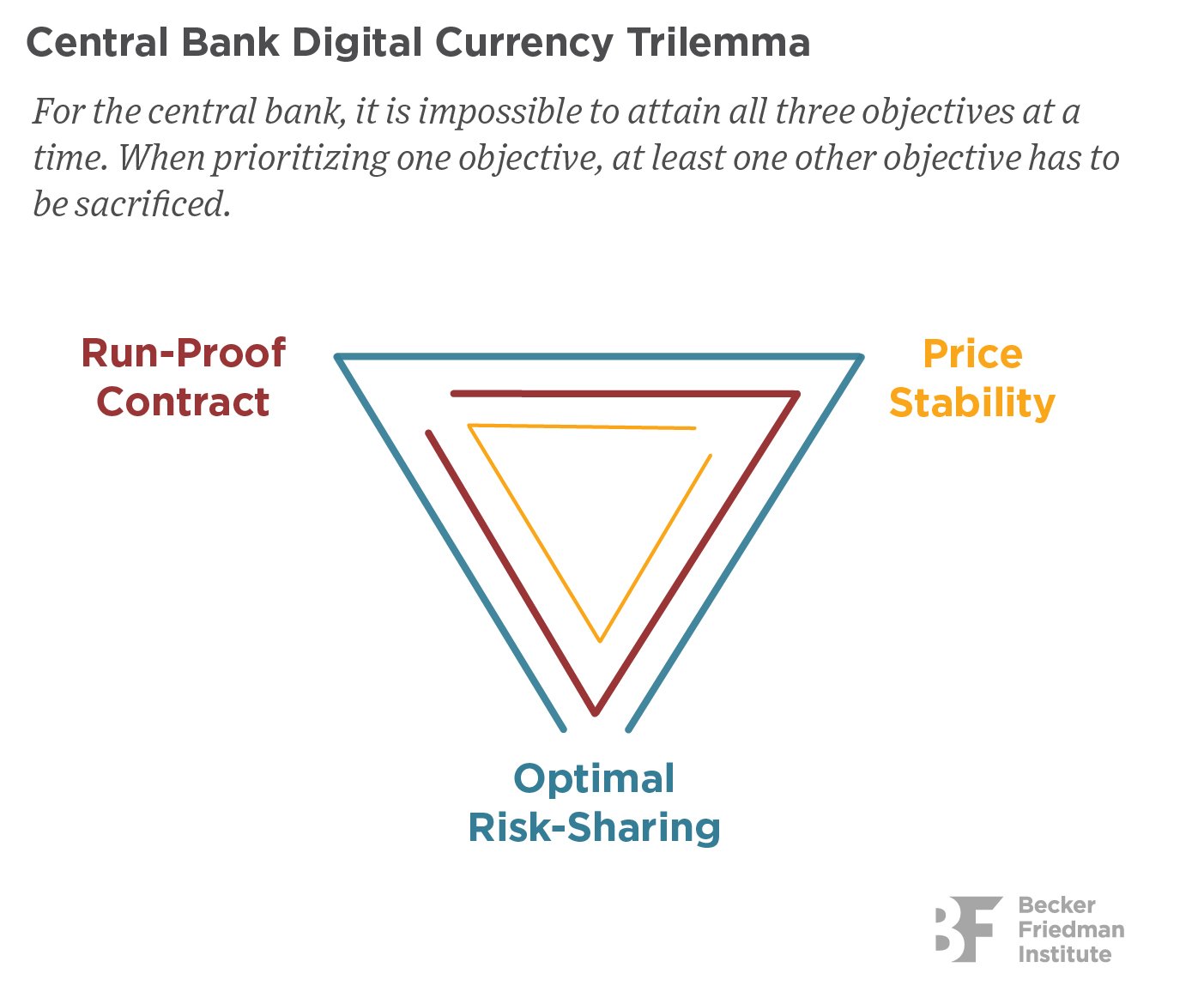

Central banks serve as the backbone of national economies, wielding significant influence in areas such as employment maintenance, price stabilization, and financial system resilience. Each country’s central bank, like the Federal Reserve in the United States and the Bank of England in the United Kingdom, operates under a unique mandate tailored to its economic landscape. These institutions leverage monetary policy tools, including money supply regulation and interest rate adjustments, to fulfill their objectives.

Central banks are pivotal in ensuring economic stability and growth.

Addressing Historical Financial Challenges

Before the advent of central banks, financial systems grappled with a myriad of issues, including currency chaos and fraudulent practices. The absence of centralized regulation led to the proliferation of non-bank entities issuing various currencies, resulting in fluctuating exchange rates and economic instability. The establishment of the Federal Reserve in 1913 marked a significant milestone in enhancing monetary stability and financial security.

Ensuring Financial Stability

Ensuring Financial Stability

Evaluating Bitcoin’s Disruptive Potential

While some proponents advocate for Bitcoin’s capacity to replace central banks, several challenges impede this transition. Firstly, widespread adoption necessitates user comprehension, which remains a barrier due to the technical complexities associated with cryptocurrency usage. Moreover, the susceptibility of graphic user interface wallets to cyber vulnerabilities poses security risks, potentially compromising user assets.

Additionally, Bitcoin’s convertibility across global jurisdictions introduces complexities, requiring unanimous acceptance by governments and central banks to displace traditional currencies. The finite supply of Bitcoin, designed to mitigate inflation risks, presents a paradox as its value is contingent on fiat currency conversion rates.

Bitcoin’s adoption as a primary financial system remains uncertain.

Future Prospects and Realities

Despite its meteoric rise as a speculative asset, Bitcoin’s trajectory towards mainstream financial integration remains uncertain. While attracting investors seeking exponential returns, Bitcoin’s intrinsic volatility and regulatory uncertainties underscore the challenges of displacing established financial frameworks.

As the financial landscape continues to evolve, the coexistence of Bitcoin alongside traditional currencies underscores the dynamic nature of modern finance.

This article explores the intricate interplay between Bitcoin and central banks, shedding light on the complexities of financial innovation and regulatory frameworks.