Bitcoin’s Future: A Path to $150,000

The world of cryptocurrency is known for its unpredictability, but one thing is certain - Bitcoin is here to stay. With its limited supply and growing demand, the top cryptocurrency is set to continue its upward trend. In this article, we’ll explore the factors driving Bitcoin’s price and why it could reach a staggering $150,000 by 2030.

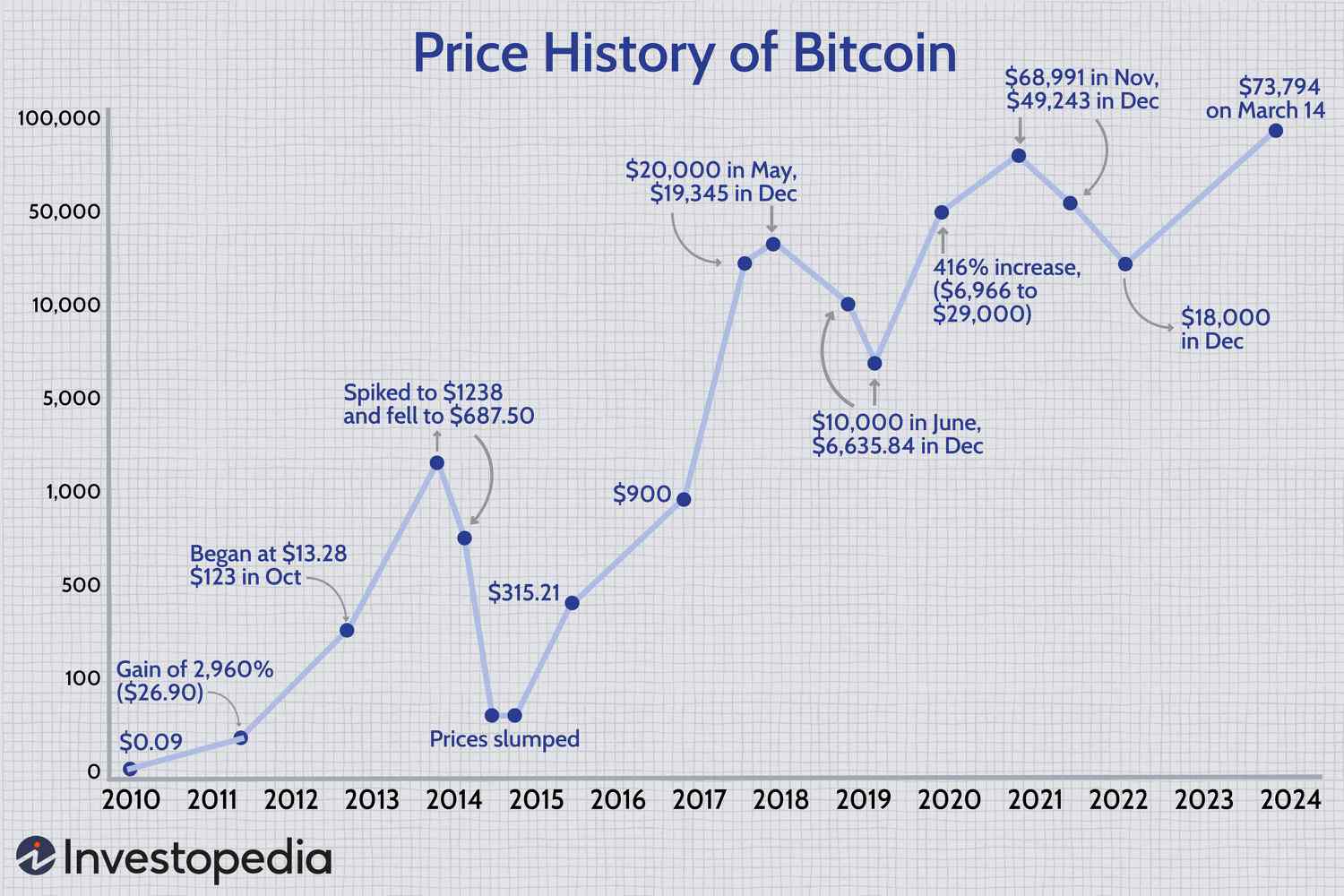

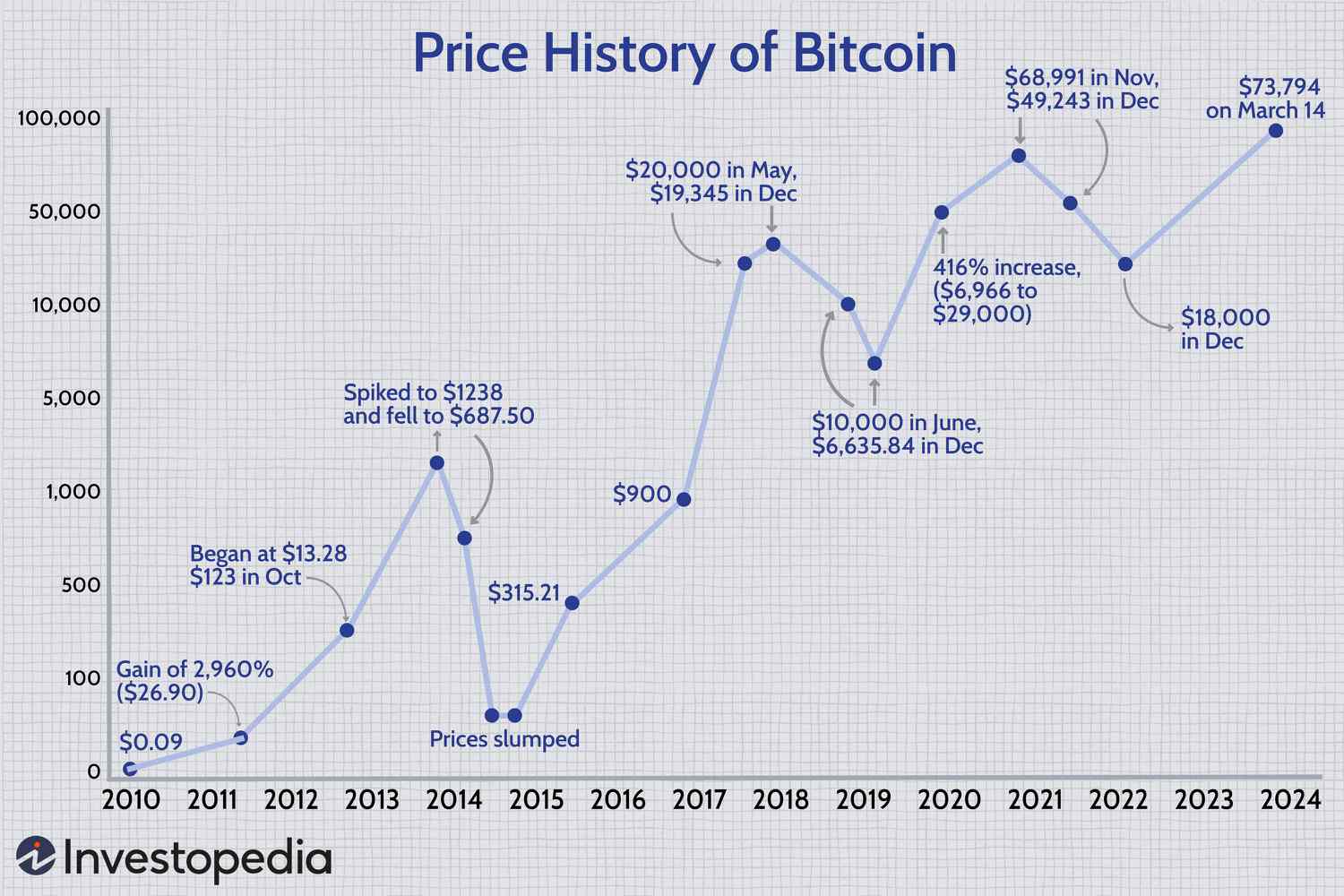

A visual representation of Bitcoin’s price growth

A visual representation of Bitcoin’s price growth

Diminishing Returns

It’s essential to recognize that Bitcoin’s forward returns will likely be much less than its monumental rise to its current level. This asset isn’t flying under the radar anymore. So, Bitcoin’s appreciation will probably decelerate in the years ahead.

“The supply cap of Bitcoin is a compelling trait.”

Rising Demand

In my opinion, the key factor that will drive Bitcoin’s price is the simple fact that more market participants will own it – individual and institutional investors, as well as corporations and governments. Rising demand should, in theory, boost Bitcoin’s price over the long run.

Institutional investors are taking notice of Bitcoin

Institutional investors are taking notice of Bitcoin

Mental Preparation

My bullish postulation that Bitcoin will get to $150,000 per coin by the end of the decade is far from a certainty. There’s a lot of uncertainty, as is usually the case with newer technologies.

For investors, the best way to approach this asset is by properly sizing your position in it. Don’t invest more money in Bitcoin than you’re willing to lose. This could result in a person allocating a relatively small portion of a well-diversified portfolio to it – perhaps 1%.

“Be ready for that holding to experience lots of volatility.”

If you’re looking to buy Bitcoin, be sure to maintain a long-term perspective. The top cryptocurrency is set to continue being a winner over the next several years on the path to $150,000.

The future of Bitcoin looks bright

The future of Bitcoin looks bright