Bitcoin’s Fourth Halving: A Game-Changer in the Crypto World

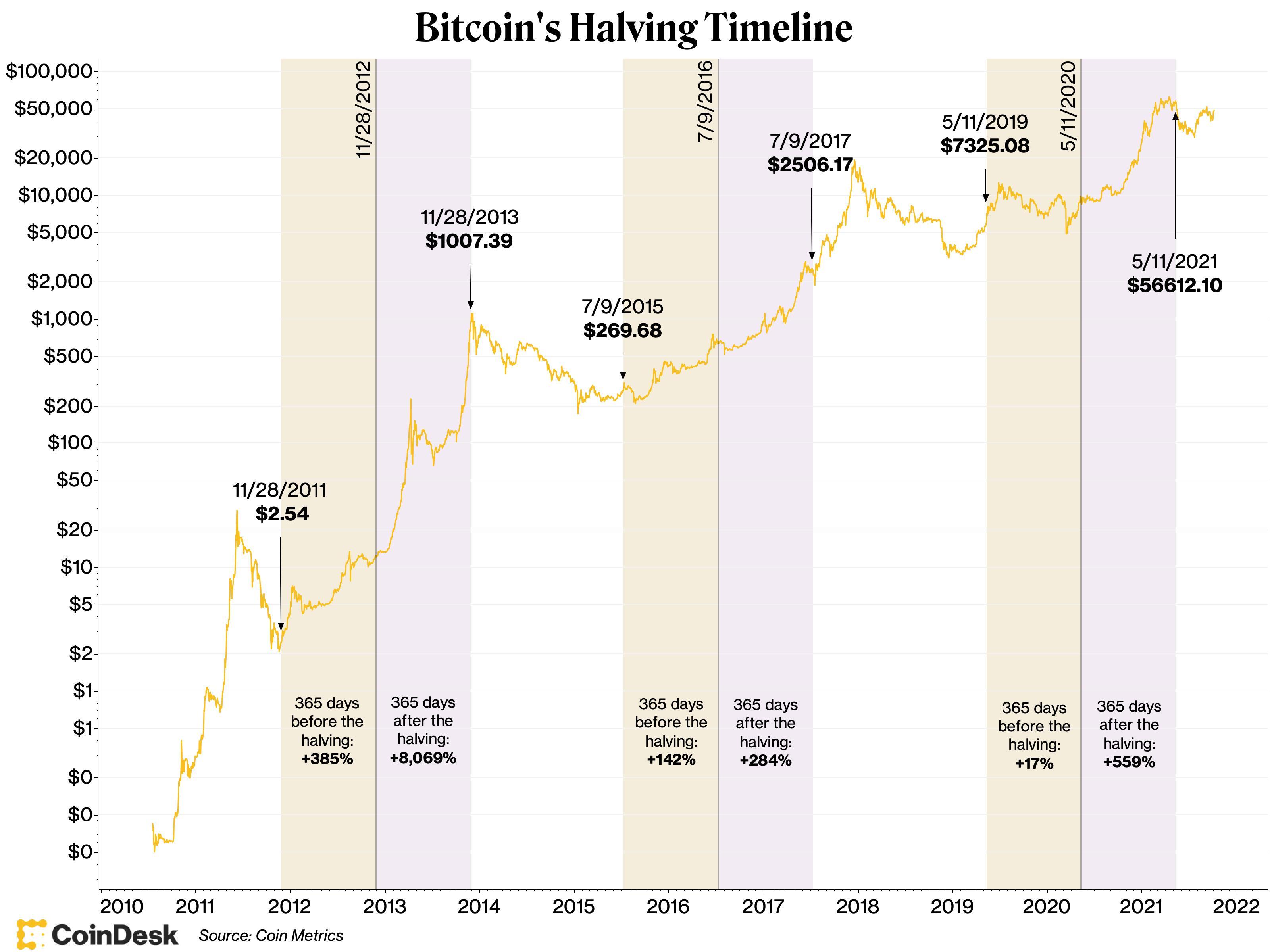

The upcoming Bitcoin halving in April 2024 is causing a stir in the cryptocurrency market. Unlike previous halvings, this event is set to collide with unprecedented demand, driven by the approval of 11 spot Bitcoin ETFs from major asset management firms like BlackRock and Fidelity.

Bitcoin’s halving is expected in April 2024, but the circumstances are different from the prior three events.

Bitcoin’s halving is expected in April 2024, but the circumstances are different from the prior three events.

The Impact of Supply and Demand

Experts predict that the convergence of massive demand from Bitcoin ETFs with the supply shock of the halving will lead to long-term price appreciation. Sandy Kaul, Franklin Templeton’s head of digital asset and industry advisory services, emphasizes that this halving is not to be taken lightly.

The market is witnessing an ’explosive set-up’ as Bitcoin’s value has surged over 60% year-to-date, attracting both seasoned and new investors.

Uncharted Territory

Greg Magadini, director of derivatives at Amberdata, believes that the halving’s impact goes beyond the event itself. The recent influx of funds into Bitcoin ETFs, coupled with historical price surges post-halving, paints a promising picture for Bitcoin’s future.

Halving is likely not a huge deal, outside of this reflexive effect, Magadini states.

Halving is likely not a huge deal, outside of this reflexive effect, Magadini states.

The Role of Demand

While the halving’s effect on Bitcoin’s price remains uncertain, the overwhelming demand for the cryptocurrency and the introduction of new ETFs are expected to play a significant role. Samir Kerbage, chief investment officer at Hashdex, foresees a gradual price increase over the next two years.

Brian Rudick, senior strategist at GSR, echoes this sentiment, anticipating a bullish trend for Bitcoin in the near future.

Conclusion

As the crypto market gears up for Bitcoin’s fourth halving, the interplay between supply, demand, and market dynamics will shape the future of the digital currency. With experts forecasting a positive trajectory for Bitcoin’s price, investors are closely watching how this event unfolds.

Stay tuned for more updates on the evolving landscape of cryptocurrencies and the latest insights from the world of Bitcoin.