Bitcoin’s Euphoric Phase: What the Data Says

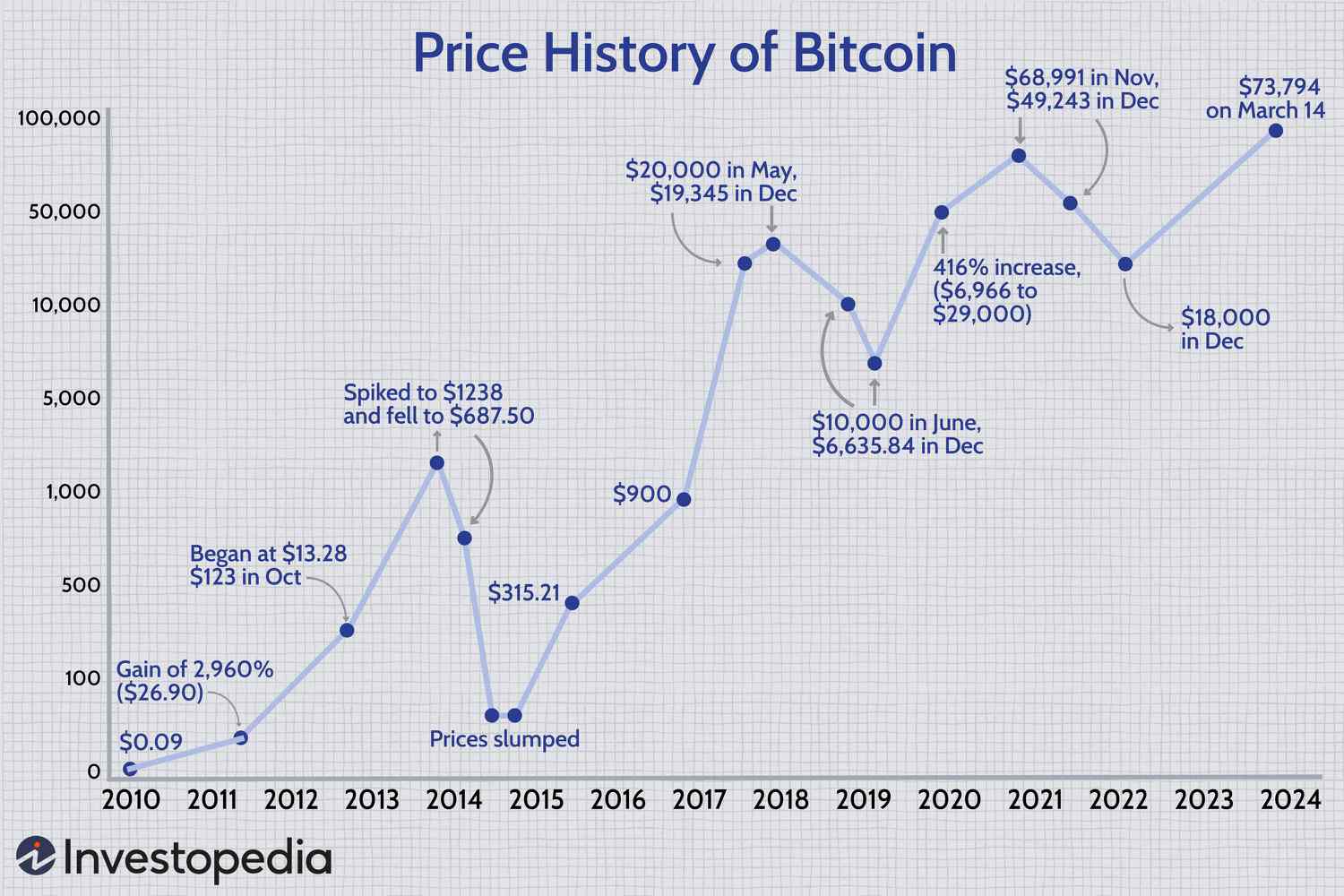

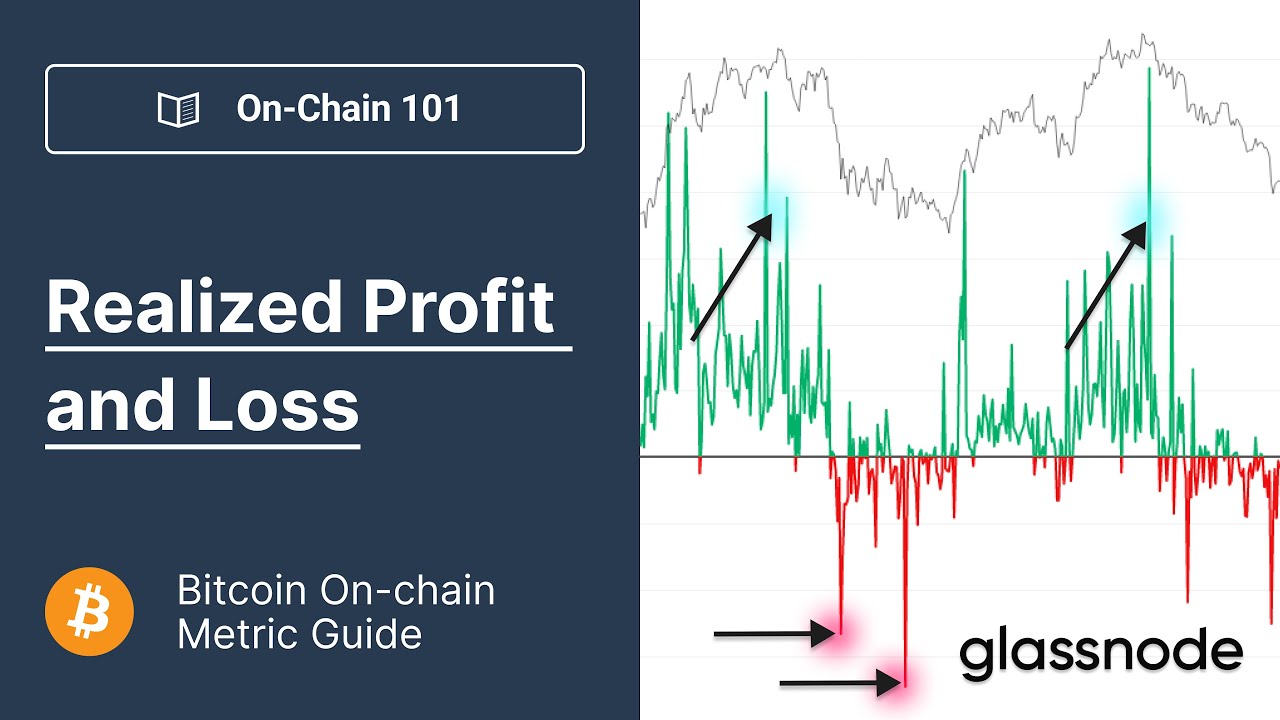

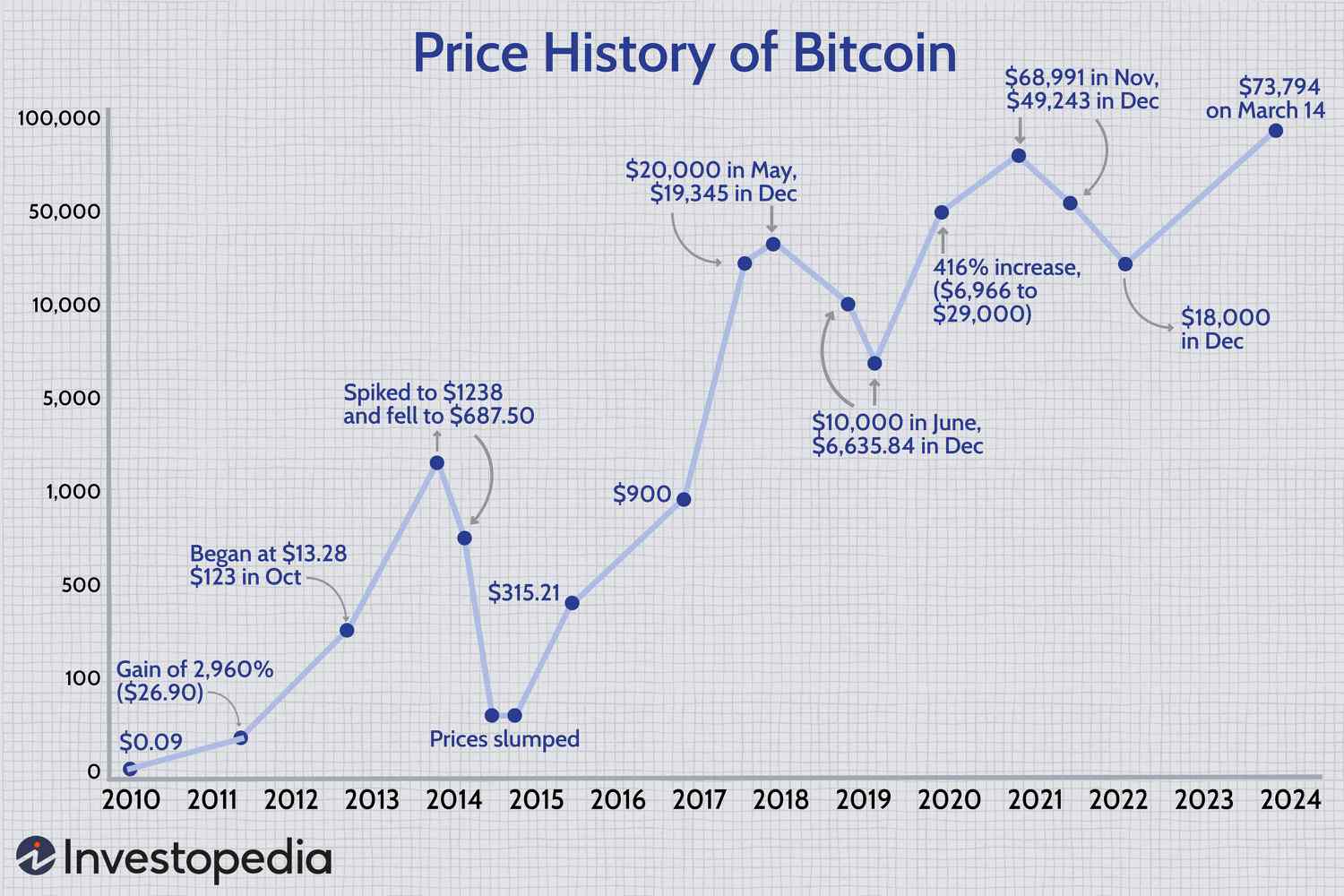

The cryptocurrency market is abuzz with excitement as Bitcoin’s price continues to soar, hitting new all-time highs in March. According to Glassnode, the market has transitioned into a euphoric phase, with profit-taking climbing considerably. But what does the data say about this phenomenon?

Bitcoin’s Spot Volumes Confirm Euphoric Phase

Glassnode’s data suggests that a fresh influx of investor capital marks the crypto market entering a euphoric phase. Bitcoin’s spot trading volume has soared since the spot Bitcoin ETFs began trading in the U.S. on January 11, 2023. The monthly average of total inflows and outflows from exchanges is currently at $8.19 billion per day, substantially higher than the 2021 bull market peak.

Bitcoin’s spot trading volume has soared since the spot Bitcoin ETFs began trading in the U.S.

Bitcoin’s spot trading volume has soared since the spot Bitcoin ETFs began trading in the U.S.

The Impact of the Bitcoin Halving

The upcoming fourth halving is unique due to a substantial increase in institutional engagement since the last halving in 2020, along with the integration of traditional financial products such as exchange-traded funds (ETFs). The Bitcoin halving refers to the event that reduces the rate at which new Bitcoins are released into circulation by 50%. This halving event occurs approximately every 210,000 blocks, or roughly every four years.

The Bitcoin halving event reduces the rate at which new Bitcoins are released into circulation by 50%.

What the Data Says About the Euphoric Phase

Glassnode’s data shows that the market has transitioned into a euphoric phase, with profit-taking climbing considerably. The realized profit also increased to 1.8% in March, reclaiming the 2021 peak. This suggests that ‘1.8% of the market cap was locked in as profit over a 7-day period.’ Glassnode expects new capital to flow into Bitcoin since ‘profit taken by one investor is matched by inflowing demand from the buying party on the other side.’

The realized profit increased to 1.8% in March, reclaiming the 2021 peak.

The realized profit increased to 1.8% in March, reclaiming the 2021 peak.

The Rise of New Investors

The aggregate share of coins younger than 6 months has increased sharply since early 2023, rising to 47% up from 20% on January 1, 2023. This metric reached between 84% and 95% during the last bull markets. Analysts should start to pay more attention to the behavior of these new investors as their share of the capital increases.

The aggregate share of coins younger than 6 months has increased sharply since early 2023.

Conclusion

While the chances of a sustained bullish rally over the next few weeks remain low due to profit-taking as Bitcoin trades above its 2021 all-time high, the data suggests that the market is in an euphoric phase. As the Bitcoin halving approaches, it will be interesting to see how the market reacts to this event. One thing is certain - the cryptocurrency market is full of surprises, and only time will tell what the future holds.

The Bitcoin price continues to soar, hitting new all-time highs in March.

The Bitcoin price continues to soar, hitting new all-time highs in March.