Bitcoin’s Bullish Sentiment Remains Unshaken Amid Profit-Taking

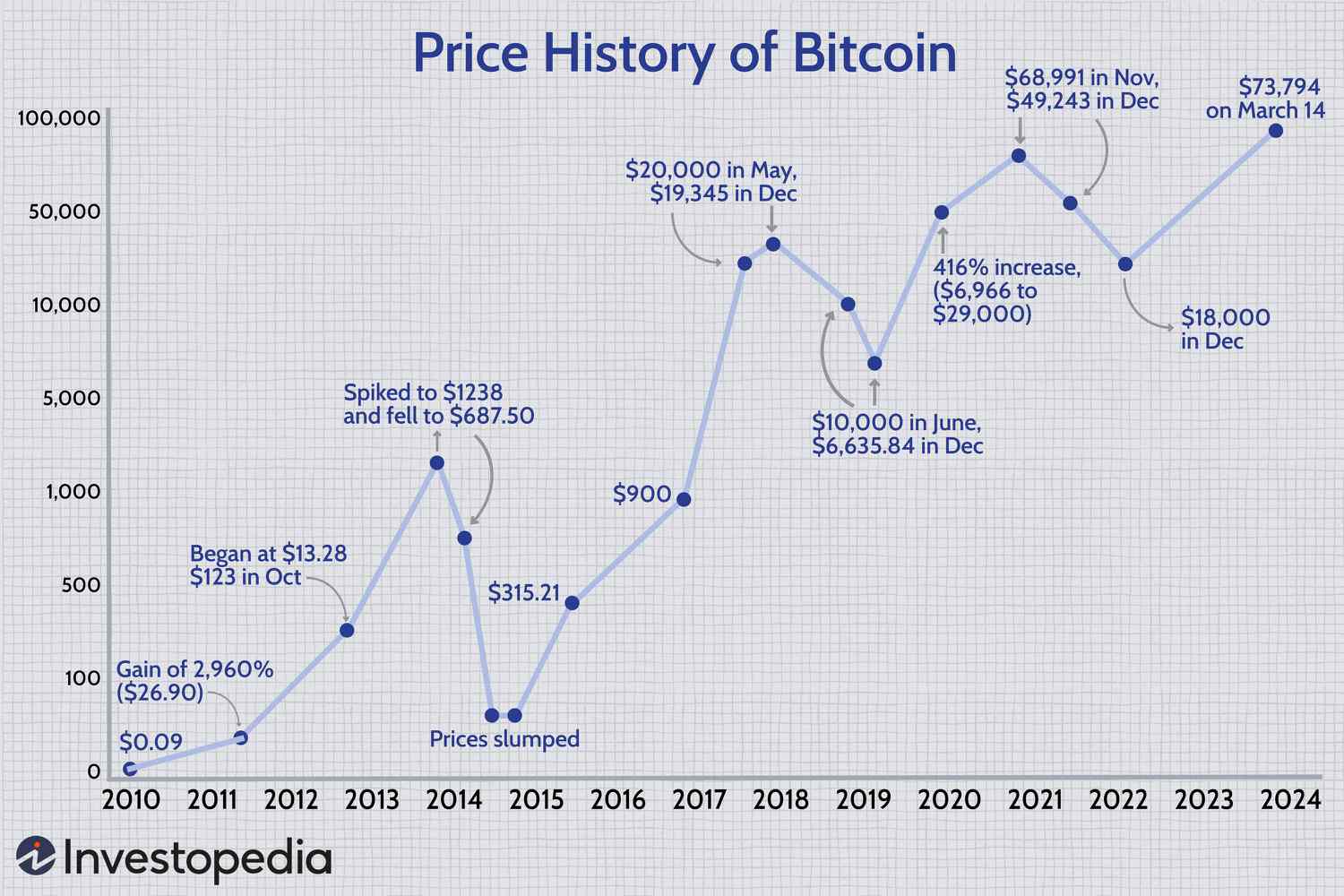

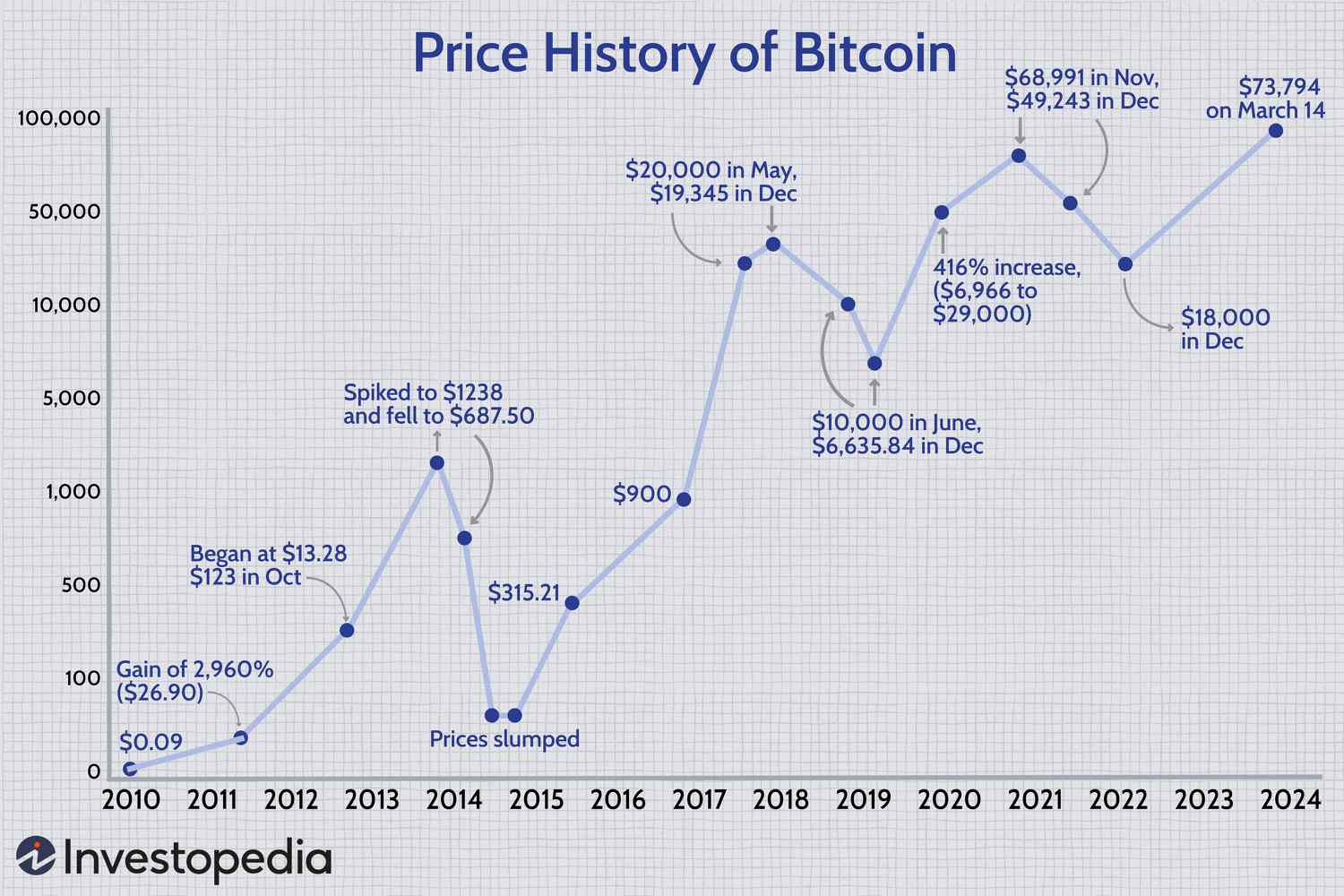

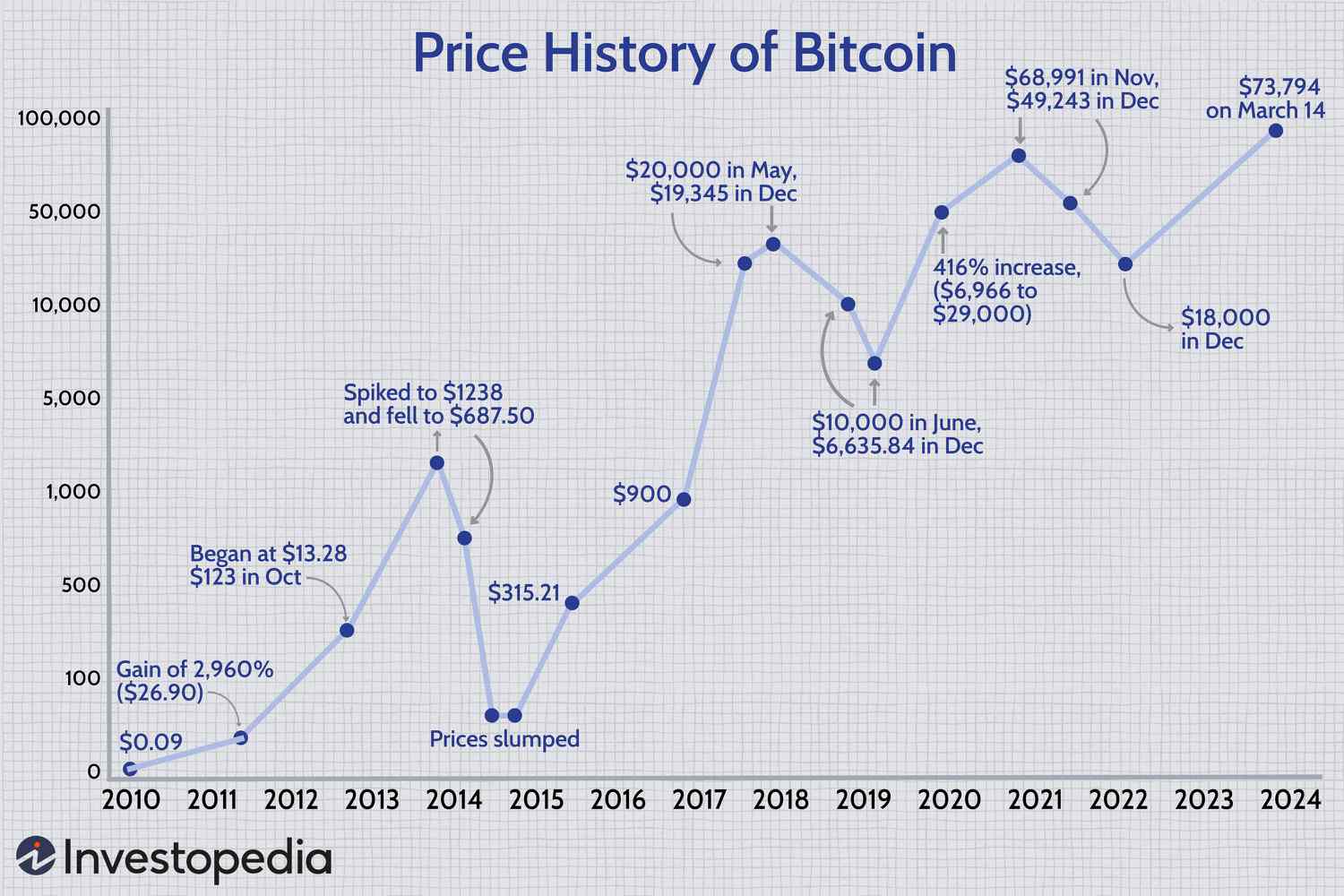

Despite a brief dip to $69,200, Bitcoin’s price has shown remarkable resilience, with on-chain data revealing a strong long-term conviction in the asset. The cryptocurrency’s price action has been closely tied to broader U.S. stock market movements, reflecting risky bets in the market.

Strong Long-Term Conviction

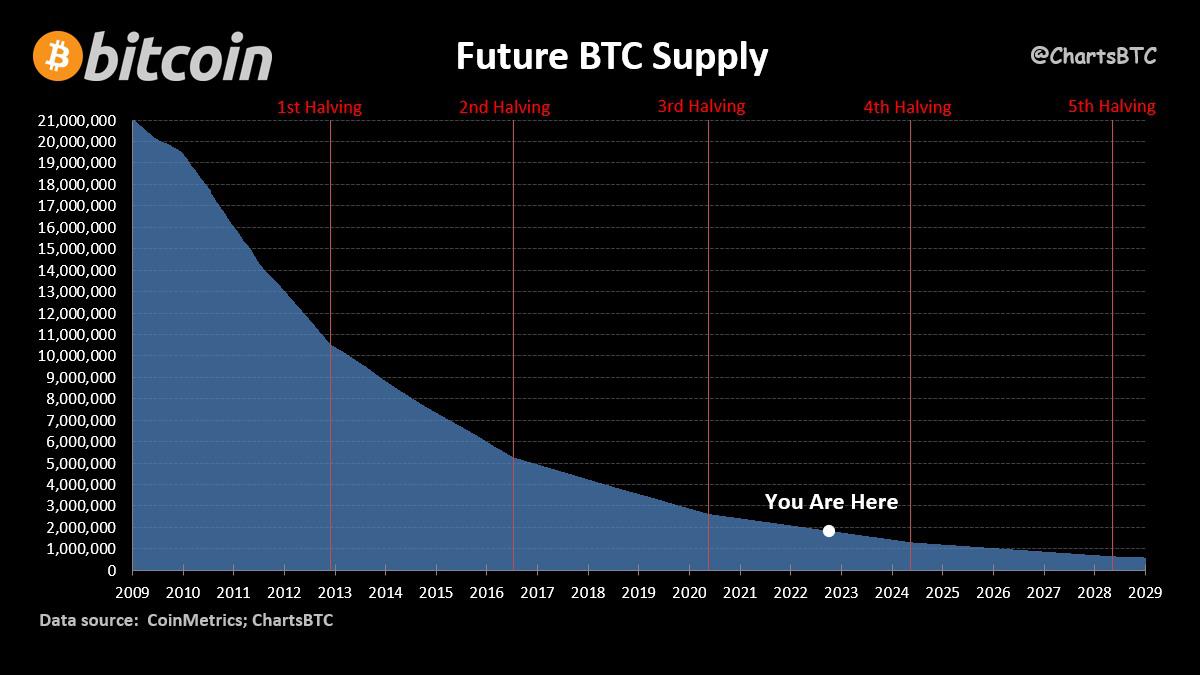

According to CryptoQuant, over 50% of Bitcoin’s supply remains inactive, indicating a strong long-term conviction in the asset. This is a sign that investors are accumulating BTC, which may lead to further price gains.

Inactive Bitcoin supply remains high

Inactive Bitcoin supply remains high

Bullish Sentiment Persists

Despite negative news, sentiment around Bitcoin’s continued growth remains “stubbornly bullish.” Singapore-based QCP Capital notes an increase in trading activity, with the market waiting for the ETH spot ETF to usher in new demand.

Bitcoin price remains bullish

Bitcoin price remains bullish

Other Cryptocurrencies

Elsewhere, ether (ETH) and dogecoin (DOGE) showed slight losses, while Cardano’s ADA and Solana’s SOL rose as much as 3%. The CoinDesk 20 (CD20), a broad-based index of the largest tokens minus stablecoins, is up 0.41% in the past 24 hours.

Cryptocurrency prices fluctuate

Cryptocurrency prices fluctuate

Conclusion

Bitcoin’s bullish sentiment remains unshaken, with investors accumulating BTC and anticipating further price gains. As the market waits for the ETH spot ETF, the cryptocurrency’s price is likely to continue its upward trend.

Bitcoin’s future looks bright

Bitcoin’s future looks bright