Bitcoin Soars Above $65,400: Crypto Market Shows Promising Trends

The cryptocurrency market is buzzing with excitement as Bitcoin has crossed the notable threshold of $65,400, signaling bullish momentum across various digital assets. Positive global signals have invigorated investors, bolstered by recent developments in the international arena. Notably, the sharp decline in oil prices, which fell about 3% due to geopolitical reports involving Israel’s military actions, has helped ease inflationary pressures, ultimately benefiting the cryptocurrency landscape.

Bitcoin is on the rise again.

Bitcoin is on the rise again.

Market Overview

In today’s trading activity, Bitcoin (BTC) climbed over 2%, reaching a peak of $65,900, the highest level since July. Earlier in the day, as of 11:57 AM IST, Bitcoin recorded a 2.3% increase, measured at $65,438, while Ethereum (ETH) gained 2.8%, trading at $2,603. The dynamics of these cryptocurrencies are heavily influenced by favorable economic indicators, and today’s market performance proves this narrative.

Influencing Factors

According to industry analysts, the upward trajectory in cryptocurrency prices correlates with growing optimism in the market. Edul Patel, CEO of Mudrex, remarked, > “Bitcoin and other major cryptocurrencies have surged, fueled by a series of crypto-friendly developments worldwide.” Recent excitement stems from a notable surge in sign-ups for a Trump-backed DeFi project, which saw 100,000 registrations almost overnight.

Another significant catalyst is Vice President Harris’ commitment to fostering a crypto-friendly legal framework, particularly aimed at empowering racial minorities. Such initiatives are crucial for investor sentiment and the broader acceptance of cryptocurrency.

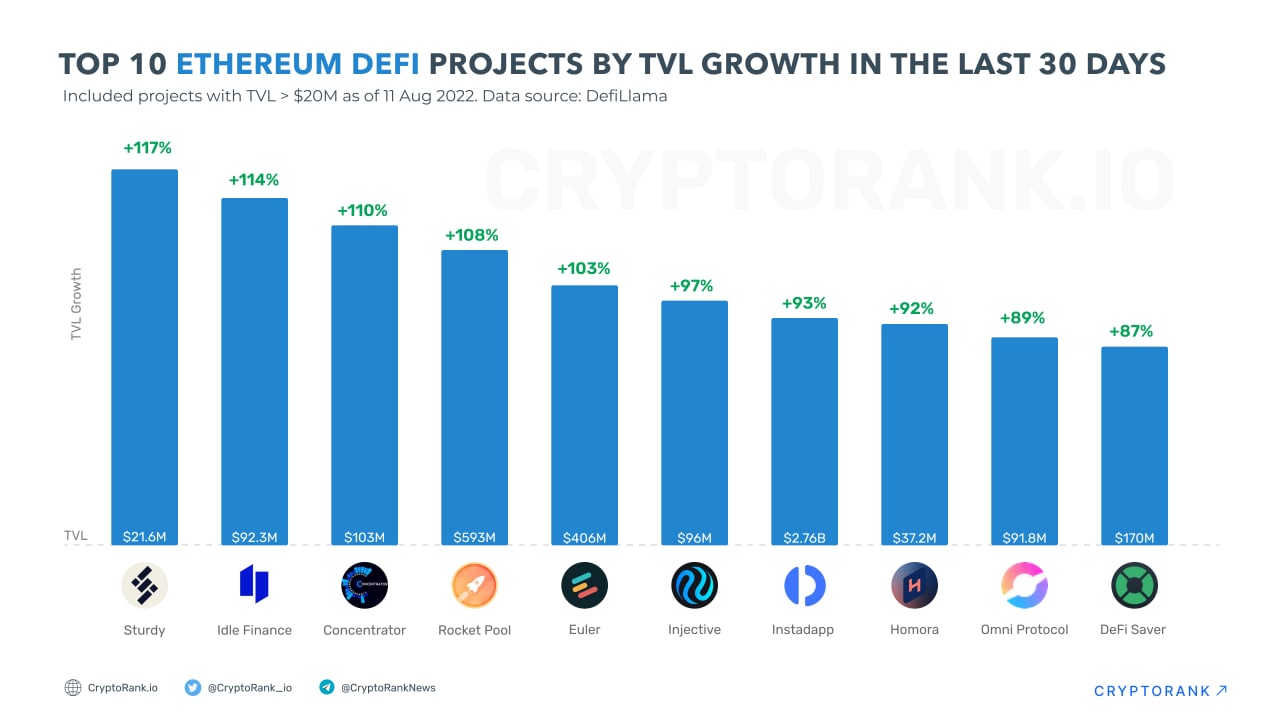

The DeFi landscape continues to expand.

The DeFi landscape continues to expand.

Bitcoin’s Bullish Indicators

Vikram Subburaj, the CEO of Giottus, added, “Bitcoin has broken through its 200-day moving average at $63,340, signaling strong bullish action.” This technical indicator has marked a pivotal point, especially with the inflow of almost $500 million into Bitcoin ETFs just yesterday. Anticipation builds around a decisive move above the critical resistance level of $66,000, which could send Bitcoin racing towards the impressive landmark of $70,000.

In addition to Bitcoin, other cryptocurrencies are also seeing impressive gains. Solana rose 1.8%, XRP by 1.5%, while Dogecoin surged up to 3.5%. Altcoins like Shiba Inu, Chainlink, NEAR Protocol, and Polkadot also displayed healthy increases, showcasing a broad-based recovery in the crypto market.

Market Capitalization Insights

Bitcoin’s market capitalization has now soared to a staggering $1.292 trillion, with its dominance in the market approximated at 56.85%. Transaction volumes surged by 66.7%, reaching $40.64 billion, a significant uptick that indicates robust trading activity and investor interest.

“In order for BTC to confirm a bullish breakout towards a new all-time high, it needs to surpass $68,224,” commented Avinash Shekhar, Co-Founder & CEO of Pi42. He cautioned, however, that a drop below the $63,000 mark could signal bearish sentiment among investors. This highlights the importance of monitoring key resistance and support levels in the dynamic landscape of cryptocurrency trading.

Analyzing market trends in cryptocurrency.

Analyzing market trends in cryptocurrency.

Conclusion

With Bitcoin exhibiting signs of potential growth and other cryptocurrencies following suit, the current moment appears to be one of optimism in the crypto realm. However, investors should remain vigilant and informed about the influencing factors and upcoming market dynamics.

For the latest updates and trends in cryptocurrency, stay tuned as we continue to provide insights into this ever-evolving market.