Bitcoin’s Bullish Future: Bernstein Predicts $1M by 2033

The cryptocurrency market is abuzz with excitement as Bernstein, a leading broker, has initiated coverage of MicroStrategy, the largest corporate owner of Bitcoin. The broker has assigned an outperform rating and a $2,890 price target, citing the software company’s long-term convertible debt strategy as a key factor in its bullish outlook.

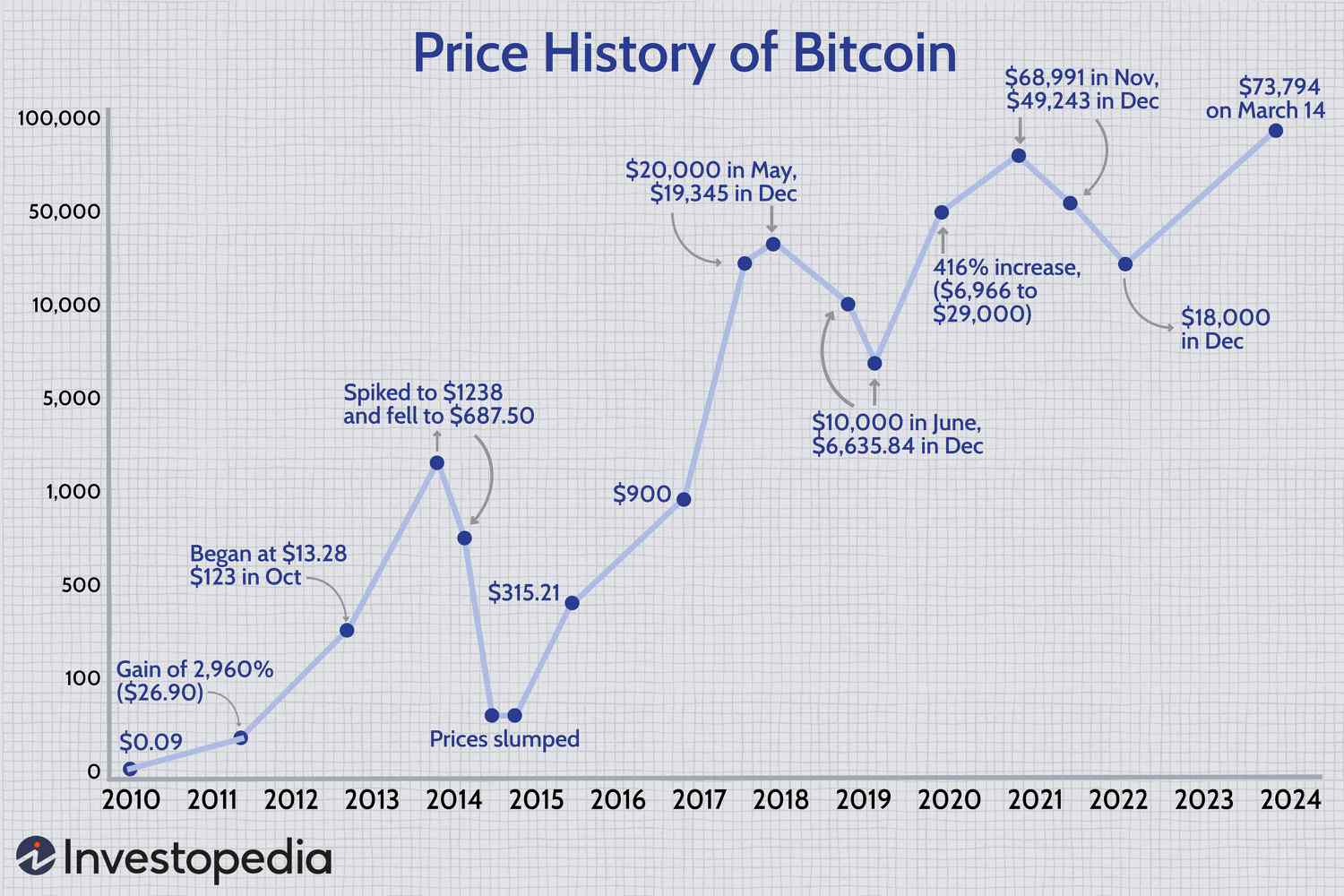

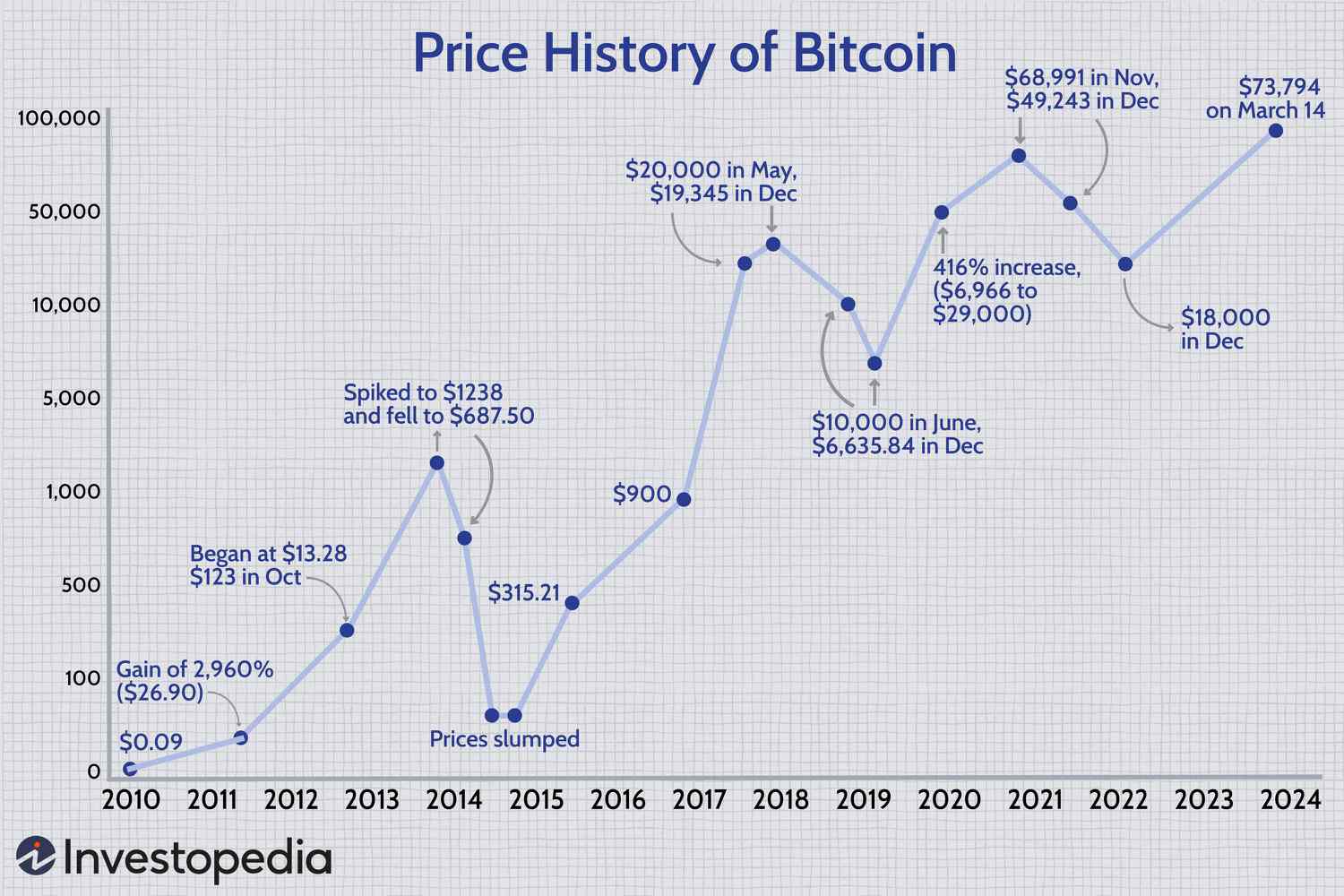

According to Bernstein, the price of Bitcoin could hit $1 million by 2033, with a cycle-high of $200,000 by 2025. This optimistic forecast is driven by the unprecedented demand from spot exchange-traded funds (ETFs) and the constrained supply of the cryptocurrency.

“MicroStrategy has transformed itself from a small software company to a leading bitcoin company, attracting at-scale capital (both debt and equity) for an active bitcoin acquisition strategy.” - Bernstein analysts Gautam Chhugani and Mahika Sapra

MicroStrategy’s founder and chairman, Michael Saylor, has become synonymous with brand bitcoin, positioning the company as a leading player in the cryptocurrency market. The company’s active strategy has produced a higher bitcoin per equity share over the last four years, outperforming passive spot ETFs.

The broker’s report highlights MicroStrategy’s long-term convertible debt strategy, which provides the company with sufficient time to benefit from potential bitcoin upside while limiting liquidation risk to the cryptocurrency on its balance sheet.

As MicroStrategy continues to expand its bitcoin holdings, the company’s proposal to sell $500 million worth of convertible notes is expected to further boost its cryptocurrency stash.

With Bernstein’s bullish forecast and MicroStrategy’s aggressive bitcoin acquisition strategy, the future of cryptocurrency looks brighter than ever.