Bitcoin’s Bull Run: Why Crypto Stocks Are on a Tear

The world’s first and largest cryptocurrency, Bitcoin, has shown little signs of slowing down, with its performance up nearly 60% year-to-date and 150% over the past twelve months. Despite regulatory hurdles, crypto exchange closures, and a brutal bear market, Bitcoin has climbed the proverbial “Wall of Worry” and is only a few thousand off its all-time high of $73,798.

Looking ahead to the second half of 2024, Bitcoin and Bitcoin proxies should benefit from two major bullish catalysts.

The Bitcoin Halving Fuels Record Gains

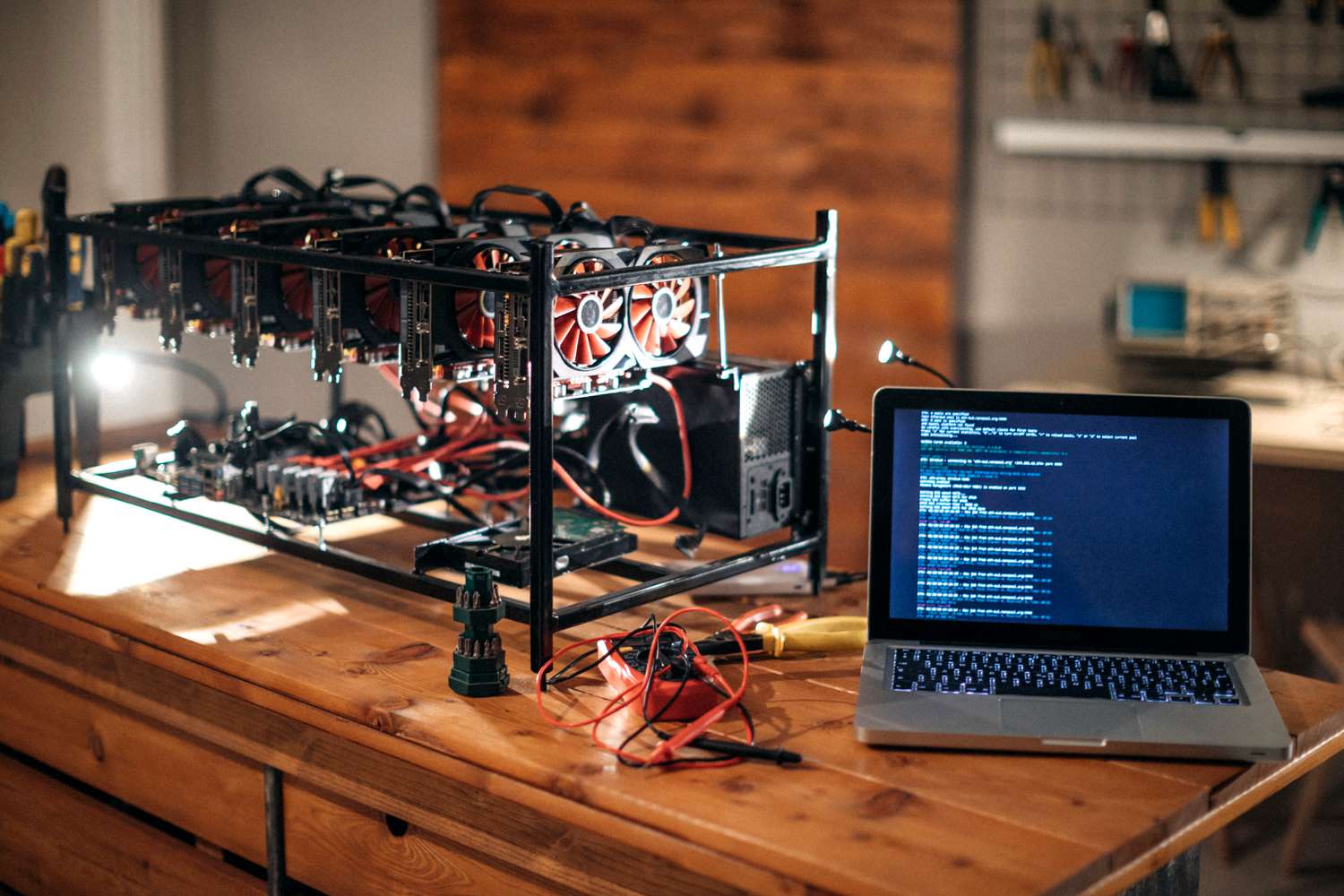

The Bitcoin “Halving” event occurs every four years and cuts the number of newly “minted” Bitcoin in half. Bitcoin’s unique monetary policy separates it from central bank-issued currencies and makes it an attractive investment for many. While central banks have no limit on how much they can inflate their currency, Bitcoin’s supply is limited. Historical price moves illustrate the benefits of the halving.

The first three halvings produced gains of 9,133%, 281%, and 562% one year later!

Bitcoin Halving

Bitcoin Halving

Institutional Adoption Grows with Bitcoin ETFs

A 13F is a disclosure required by the U.S. Securities and Exchange Commission (SEC) that companies with assets under management north of $100 million must present. This quarter, more than 600 institutions disclosed positions in spot Bitcoin ETFs, including a who’s who of top-tier firms like JP Morgan, Wells Fargo, and Millennium (disclosed a $2 billion position), to name a few.

3 Crypto-Related Stocks to Buy Now

Coinbase (COIN) is the most prominent crypto exchange in the U.S., earning a best-possible Zacks Rank #1 (Strong Buy) score.

Coinbase

Coinbase

Seth Klarman is a legendary value investor, billionaire, and one of the highest-earning money managers in the world. In an interview last year, Klarman stated that he avoids crypto but sees value in Coinbase, saying, “Coinbase is sitting on $5 billion in cash, has less than that in debt, and is doing some smart things.” Well, now that number has grown to more than $7 billion.

Robinhood Markets (HOOD) is one of the most popular brokerages in the United States. Robinhood was the first major broker to “democratize” trading by offering a commission-free investing app. The app rose to prominence during the meme stock craze that was spurred on by retail investing groups on the social media platform Reddit and included meteoric moves in stocks like GameStop.

Robinhood

Robinhood

MicroStrategy (MSTR) has been around for years and is a leading provider of business intelligence software.

MicroStrategy

MicroStrategy

Adopting the Bitcoin Standard

Former CEO and billionaire Michael Saylor made waves on Wall Street a few years ago when he got MSTR on the “Bitcoin Standard.” Instead of sitting in inflationary assets like U.S. dollars, Saylor realized MSTR would be better off on a “Bitcoin sail.” Essentially, MSTR is a leveraged Bitcoin bet. The results speak for themselves – over the past five years, MicroStrategy is up more than 1,000%!

Conversely, a good option for investors who do not want a leveraged bet but want to tap into Bitcoin’s potential upside is the iShares Bitcoin Trust (IBIT) ETF. IBIT has some of the lowest fees and the most liquidity out of all the Bitcoin ETFs.

Venture Capital Investment in Crypto Hits $2.4 Billion After Long Decline

Venture capital investment in cryptocurrency companies is reportedly increasing after nearly two years of cooling. Investment in these companies climbed to $2.4 billion during the first three months of this year, citing data from PitchBook.

The crypto industry is still in its early stages, and there is a lot of room for growth and innovation. Barring any major market downturns, we expect the volume and pace of investments to continue increasing throughout the year.

Crypto Investment

Crypto Investment