Bitcoin’s Bull Run: How to Make the Most of the Current Market

The cryptocurrency market has been on a tear lately, with Bitcoin (BTC) leading the charge. The largest cryptocurrency by market capitalization has been on a bull run, and many experts believe it’s just getting started. In this article, we’ll explore the current state of the market, discuss the factors driving Bitcoin’s growth, and highlight three crypto stocks that could benefit from the current bull run.

Bitcoin’s Bull Run: What’s Driving the Growth?

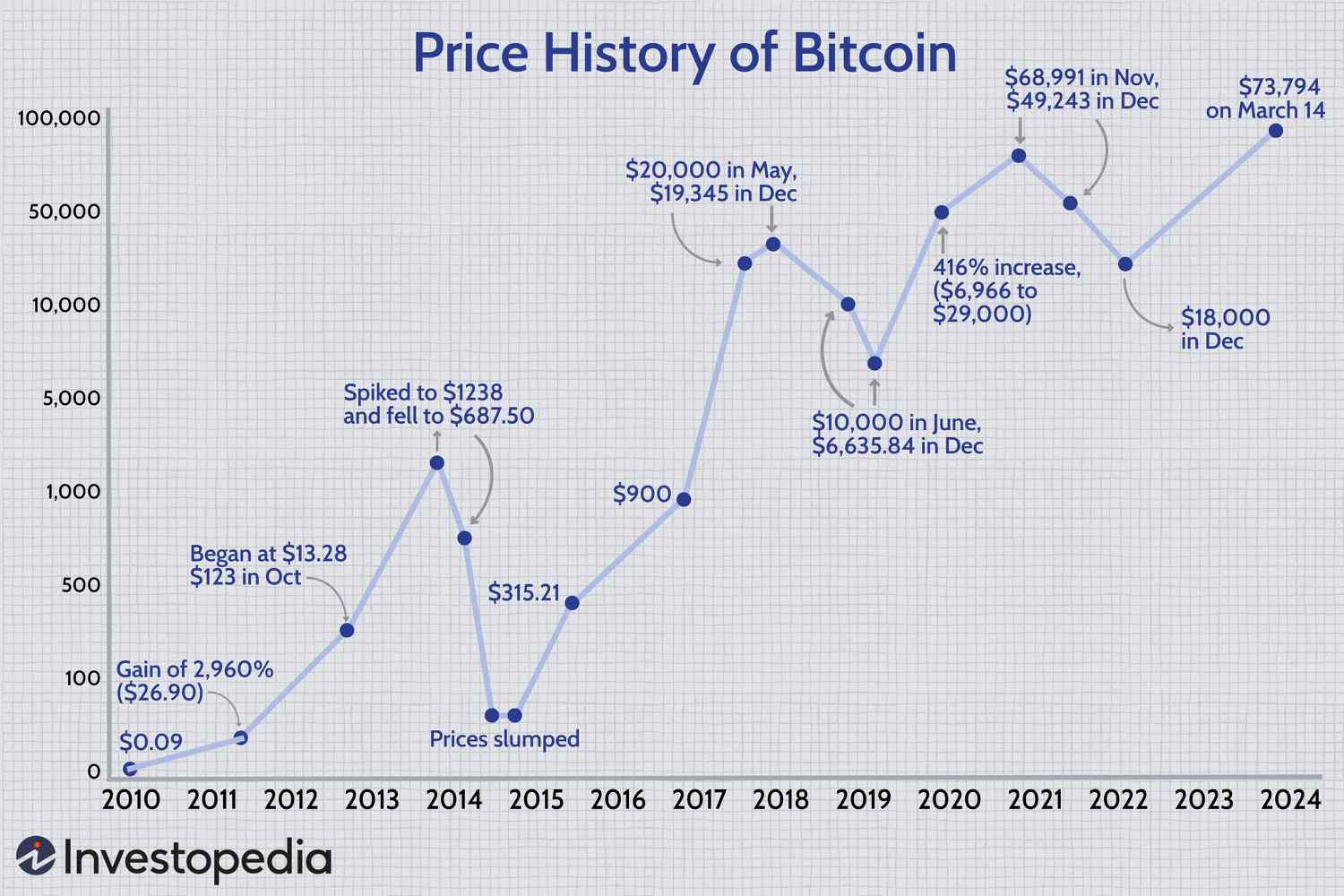

Bitcoin has been on a tear lately, with its price surging above $70,000. The cryptocurrency has been driven by a combination of factors, including the approval of Ethereum (ETH) ETF, the possibility of multiple rate cuts in the next 12 months, and the increasing adoption of cryptocurrencies by mainstream investors.

According to chart expert Peter Brandt, Bitcoin could scale $200,000 before the current bull market ends. This is a staggering prediction, and if achieved, it could lead to multibagger returns for some of the best crypto stocks.

Crypto Stocks to Buy: Coinbase, Riot Platforms, and Bitfarms

Coinbase (COIN)

Coinbase (NASDAQ: COIN) has been a massive winner in the current bull market, with its stock price surging over 300% in the last 12 months. The cryptocurrency exchange has been focused on aggressive international expansion, which is likely to translate into robust revenue growth and profitability expansion.

Riot Platforms (RIOT)

Riot Platforms (NASDAQ: RIOT) seems to be trading at a valuation gap among Bitcoin mining stocks. The company has ambitious growth plans, backed by strong fundamentals, and a zero-debt balance sheet. Riot is targeting a hash rate capacity of 31.5EH/s by the end of the year, which is likely to translate into stellar revenue and EBITDA growth.

Bitfarms (BITF)

Bitfarms (NASDAQ: BITF) is a low-cost Bitcoin miner with a healthy liquidity buffer for aggressive expansion plans. The company has a hash rate capacity of 7EH/s and is targeting capacity expansion to 21EH/s by the end of the year. With a zero-debt balance sheet and high financial flexibility, Bitfarms is positioned to deliver robust EBITDA and cash flows in the coming quarters.

Conclusion

The current bull run in Bitcoin is driven by a combination of factors, including the approval of Ethereum ETF, the possibility of multiple rate cuts, and increasing adoption by mainstream investors. Exposure to quality crypto stocks is one way to benefit from the bull market. Coinbase, Riot Platforms, and Bitfarms are three crypto stocks that could deliver multibagger returns in the next 12 to 18 months.

Bitcoin benchmark: Only eight digital asset tokens hit ATHs in BTC post-FTX collapse

BlackRock IBIT on track to surpass iShares Gold ETF $29 billion AUM by year-end

Semler Scientific Bitcoin strategy sets BTC per share at 0.0000842

Photo by

Photo by