Bitcoin’s Bull Run Continues: Cryptocurrency Surges 7% to Retake $70,000

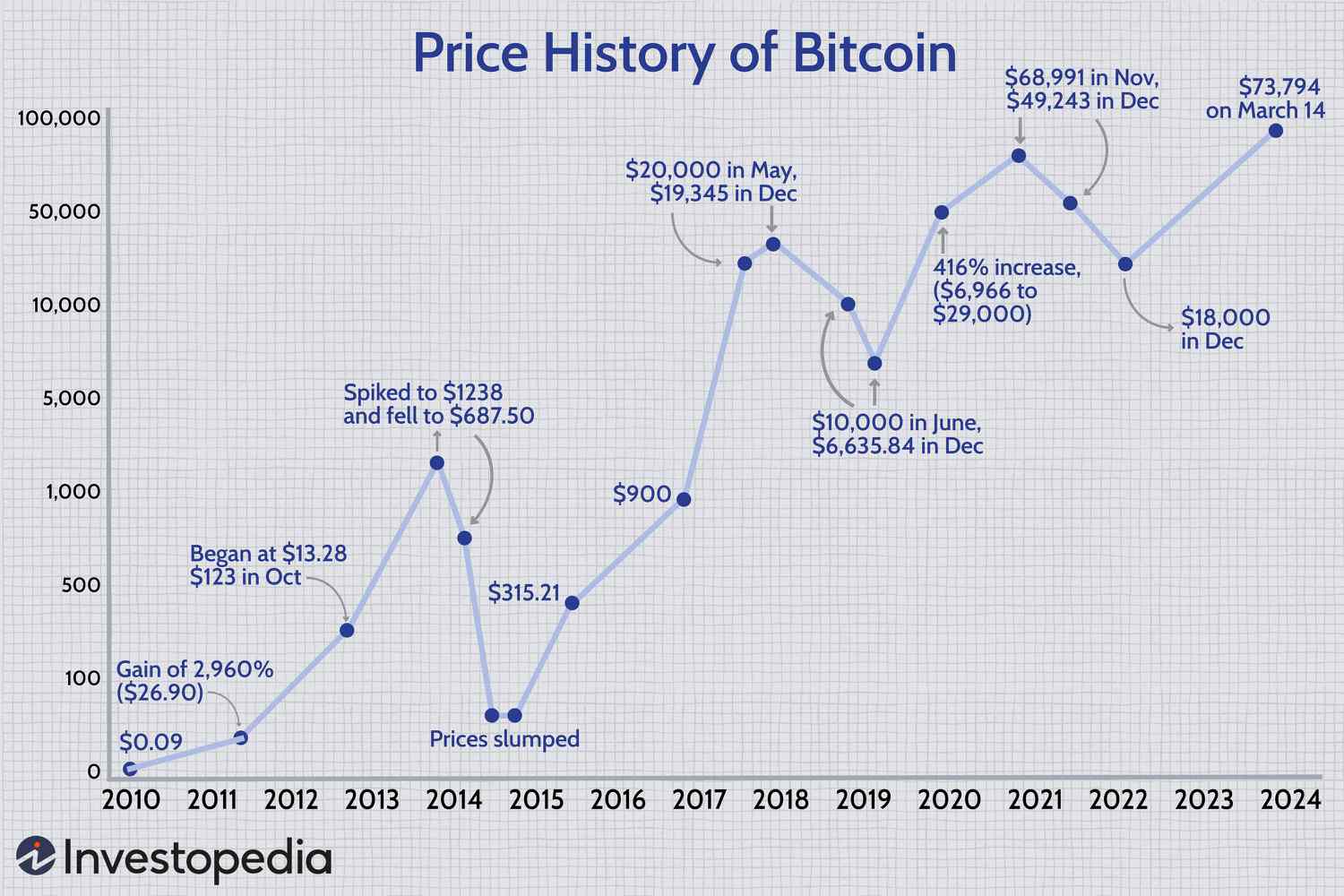

The cryptocurrency market is abuzz with excitement as Bitcoin surged 7% to retake the $70,000 level, marking a significant milestone in its bull run. According to Coin Metrics, the price of the flagship cryptocurrency was last higher by about 7% at $70,617.68. Ether, the second-largest cryptocurrency, also jumped 7% to $3,621.30.

Bitcoin’s price action in March has been characterized by new highs followed by healthy pullbacks.

Bitcoin’s price action in March has been characterized by new highs followed by healthy pullbacks.

The mining sector got a lift from Bitcoin’s surge, with Marathon Digital and Riot Platforms up 4% and 9%, respectively. CleanSpark rose 22% and Cipher Mining gained 15%. MicroStrategy, which trades as a proxy for the price of Bitcoin, surged 20%, while Coinbase advanced 9%.

“Fed officials made it clear last week that they are considering both rate cuts and reducing the pace of its quantitative tightening program this year,” said Sam Callahan, lead analyst at Swan Bitcoin. “Such actions will enhance liquidity conditions, acting as a positive catalyst for asset prices. Bitcoin functions as a barometer of liquidity conditions and responded favorably to the Fed’s messaging that monetary policy will likely ease in the near future.”

Bitcoin’s correction mode last week, which saw its price slide to as low as about $60,800, was well within the norm of historical bull market short-term corrections, according to Alex Thorn, head of firmwide research at Galaxy Digital.

The Federal Reserve’s messaging on monetary policy has been a positive catalyst for asset prices.

The Federal Reserve’s messaging on monetary policy has been a positive catalyst for asset prices.

Despite its pullbacks, Bitcoin is on pace to finish March on a winning note, having gained 12% for the month and 64% so far for the first quarter.

Bitcoin’s price action in March has been characterized by new highs followed by healthy pullbacks.

Bitcoin’s price action in March has been characterized by new highs followed by healthy pullbacks.

The cryptocurrency’s price action in March has been characterized by new highs followed by healthy pullbacks. As the market continues to respond to the Fed’s messaging on monetary policy, it will be interesting to see how Bitcoin’s price action unfolds in the coming weeks.