Bitcoin’s Bleak Week: A Reflection of Cooling Demand and Monetary Policy Uncertainty

The crypto market has just experienced its second-worst weekly decline of 2024, with a gauge of the largest 100 digital assets falling by approximately 5% in the seven days through Sunday. This steep slide is a reflection of cooling demand for Bitcoin exchange-traded funds and uncertainty over monetary policy.

Bitcoin prices have been on a downward trend

As of Monday, Bitcoin shed around 2% to trade at $62,440, a more than one-month low. The leading token by market value has been buffeted by a six-day streak of outflows from dedicated US ETFs. This is a worrying sign for investors, as it indicates a lack of confidence in the cryptocurrency.

The current crypto market dynamic is characterized by low volatility, soft volumes, and orderbooks getting unbalanced when prices start to move to the edges of their range, according to David Lawant, research head at FalconX. This is a far cry from the excitement and hype that surrounded Bitcoin just a few months ago.

The drops in some corners are particularly notable: the run of weekly declines for Ether and Solana are the longest since last year and 2022 respectively. This is despite fund companies preparing to launch the first US ETFs investing directly in Ether, the second-ranked cryptoasset. Solana, meanwhile, was very recently a favorite for a variety of digital-asset hedge funds.

The crypto market is experiencing a downturn

The crypto market is experiencing a downturn

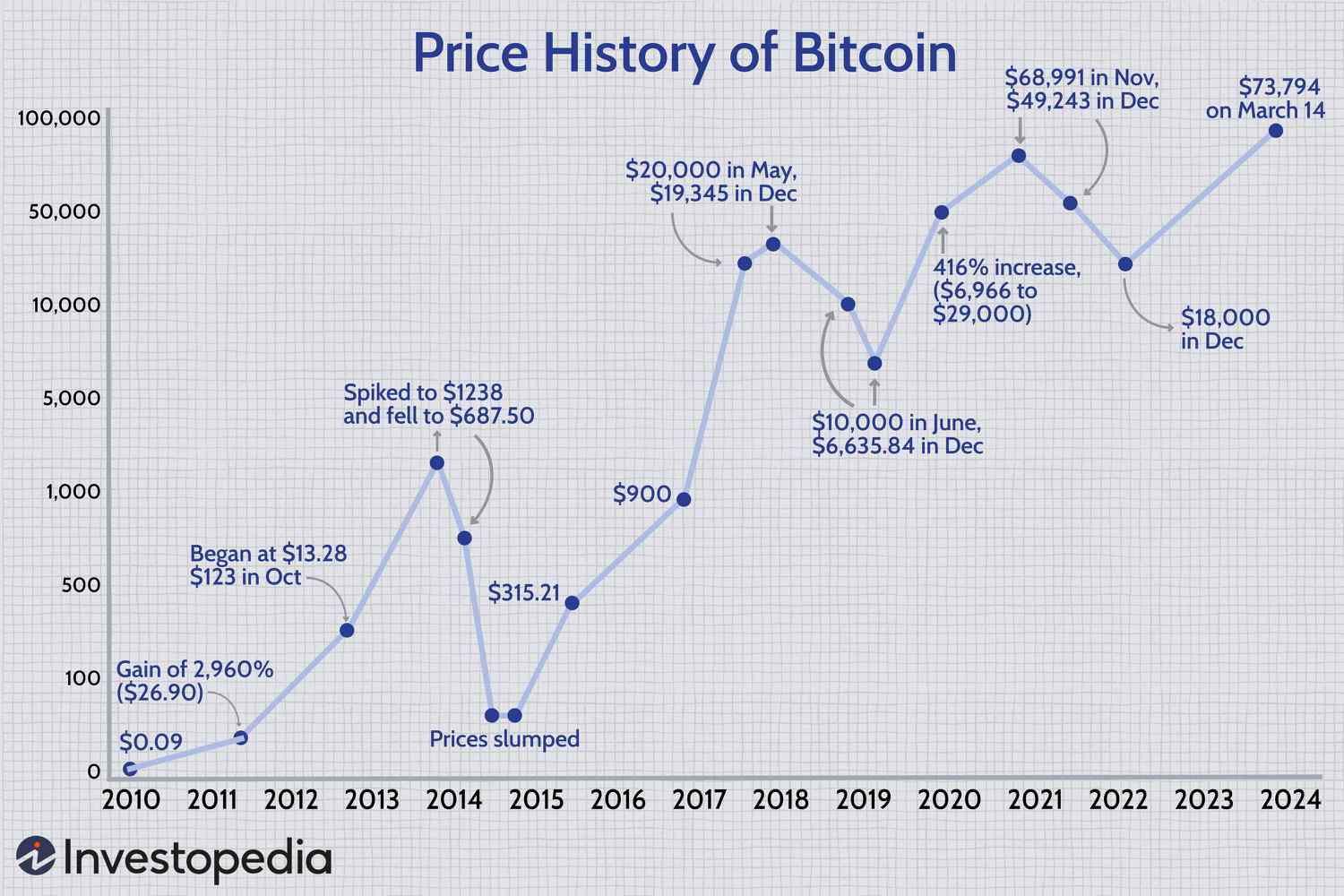

Bitcoin hit a record of $73,798 in March but is trailing traditional investments such as stocks, bonds, and gold this quarter. The 200-day moving average at about $57,500 is in focus now as a possible zone of support for the price, according to IG Australia Pty Market Analyst Tony Sycamore.

A bearish mood seems to be setting in, said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets. The market is finding it hard to digest any large sell orders.

Bitcoin prices are struggling to recover

As an investor, it’s hard not to feel a sense of unease when looking at the current state of the crypto market. The uncertainty surrounding monetary policy and the lack of confidence in Bitcoin ETFs are just a few of the factors contributing to the downturn. However, it’s also important to remember that the crypto market is known for its volatility, and prices can fluctuate rapidly.

The crypto market is known for its volatility

The crypto market is known for its volatility

Only time will tell if the crypto market can recover from this bleak week. One thing is for sure, though - investors will be keeping a close eye on the market in the coming days and weeks.