Bitcoin’s Biggest Month Ever?

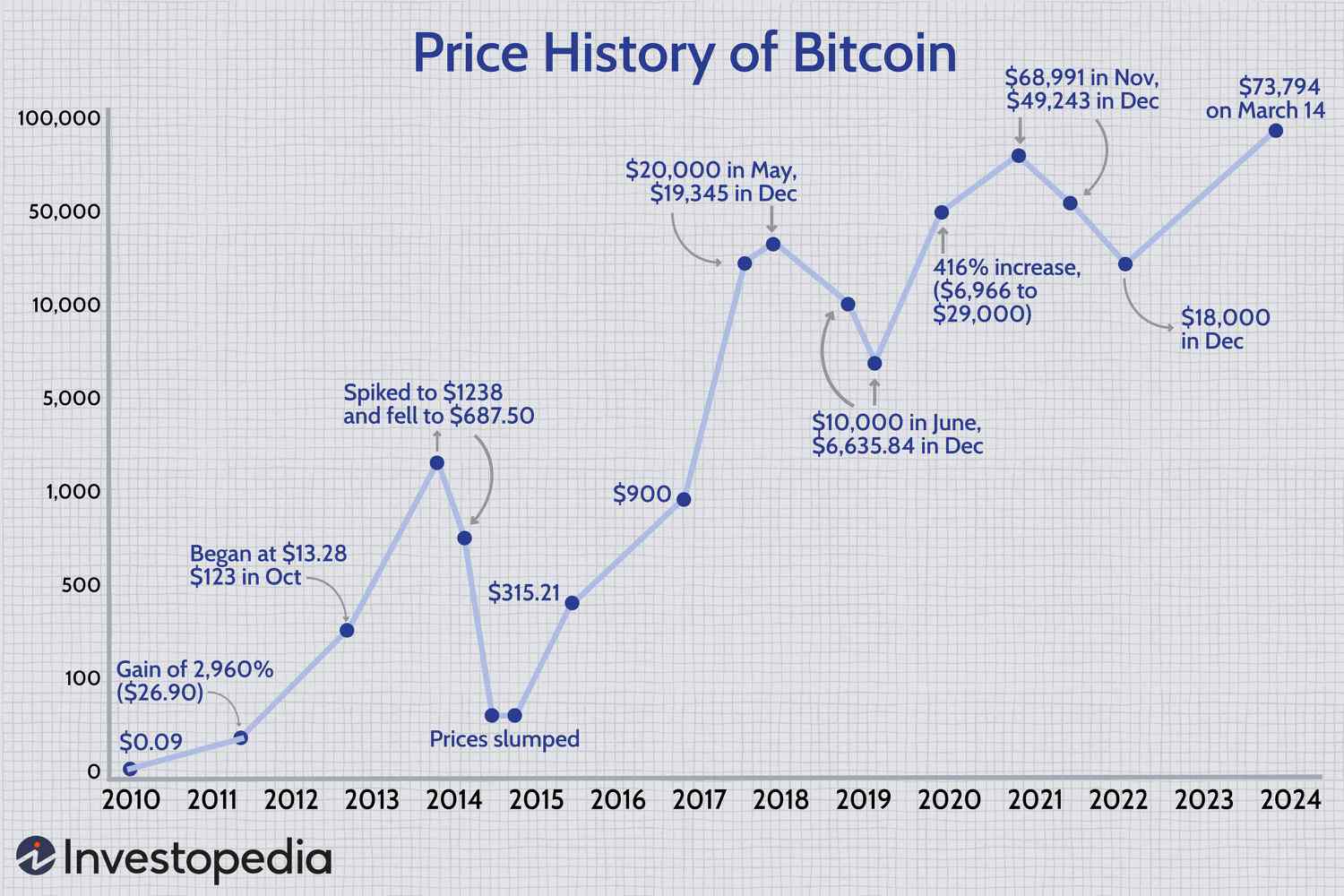

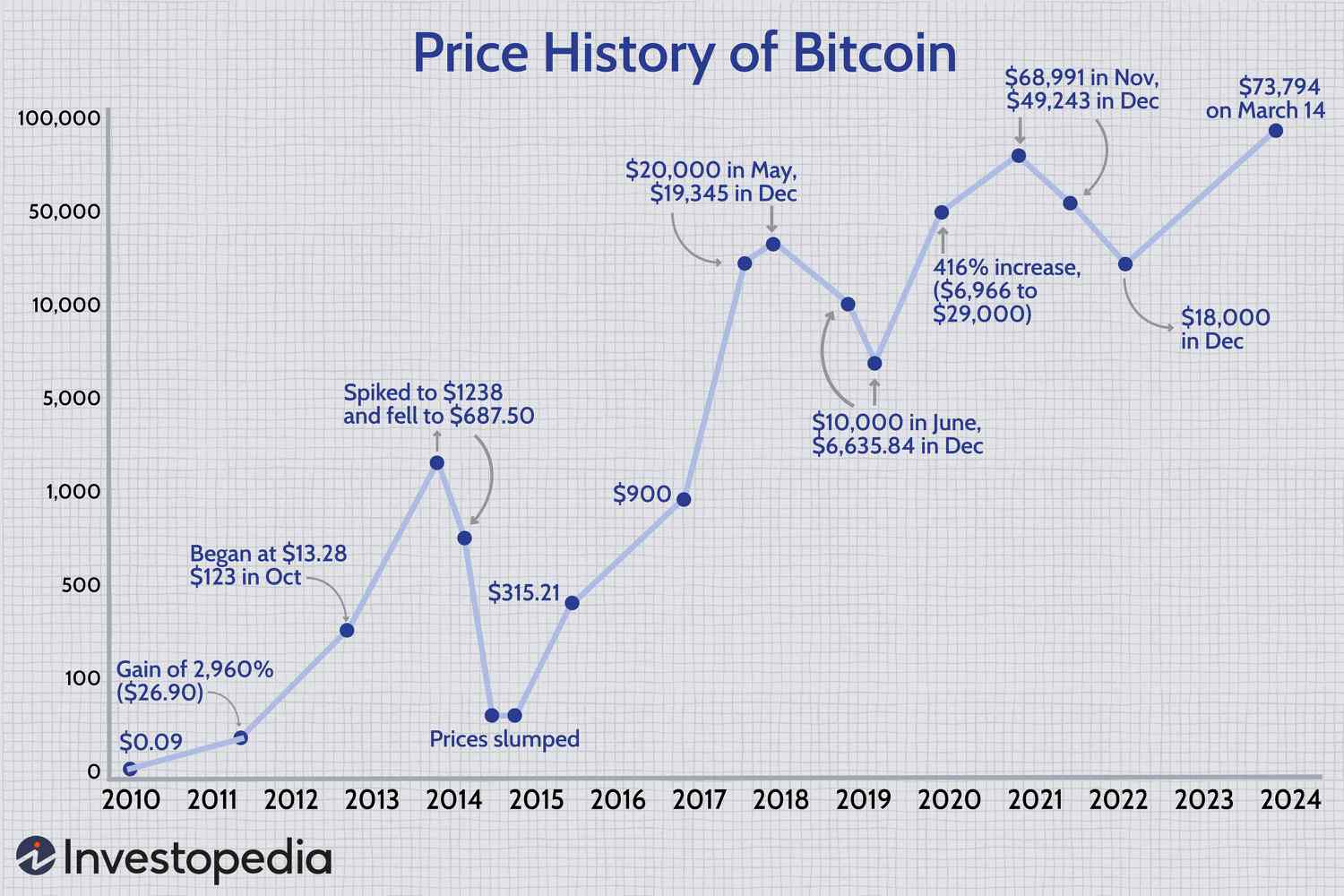

The bitcoin price has surged higher over the last few months, with traders now eyeing what could be a massive China bitcoin price bombshell. The bitcoin price has topped its previous all-time high of $69,000 per bitcoin, climbing to well over $70,000 as Goldman Sachs reveals a Wall Street revolution could be just around the corner.

Bitcoin’s price surge

Bitcoin’s price surge

Now, after Wall Street giants BlackRock and Fidelity sparked a flurry of mega-bullish bitcoin price predictions, the effect on bitcoin’s price of its looming April supply cut, known as a halving, could have been foreshadowed by a smaller rival cryptocurrency.

The Bitcoin Halving Effect

The price of bitcoin cash, a payments-focused fork of bitcoin that split off from the main bitcoin chain in 2016, has rocketed over the last few weeks ahead of its own halving, due for Thursday, April 4. Bitcoin’s halving, its fourth such supply cut that will see the number of new bitcoin issued to so-called miners who maintain the network fall to 3.125 bitcoin from 6.25 currently, is scheduled for April 20.

If bitcoin follows a similar path to bitcoin cash, the bitcoin price could double to almost $150,000 per bitcoin by the time of its own halving, matching some recent bitcoin price predictions.

“This time I think probably two-times [$75,000] because there’s less leverage, so that gets us to $150,000,” Mark Yusko, chief executive of bitcoin and crypto hedge fund Morgan Creek Capital Management, told CNBC.

Bitcoin’s halving event

“Once [the bitcoin halving] occurs, then you start to get an increase in demand but the supply of new coins goes from 900 a day to 450,” Yusko said. “It starts to become more parabolic toward the end of the year, and historically about nine months after the halving…we see the peak in price before the next bear market.”

A Bullish Outlook

The bitcoin price has rocketed over the last year, eclipsing its 2021 peak of $69,000 per bitcoin.

“With so many people talking about the upcoming bitcoin halving and the impact of the U.S. ETFs, it’s clear that the market is sitting long in anticipation of further price appreciation,” John Glover, chief investment officer at Ledn, said in emailed comments.

“Investors should look for an opportunity to add to longs lower, and don’t join those who are planning to stop themselves on a break below $60,000,” Glover said, predicting “$80,000 remains in the cards for later this year.”