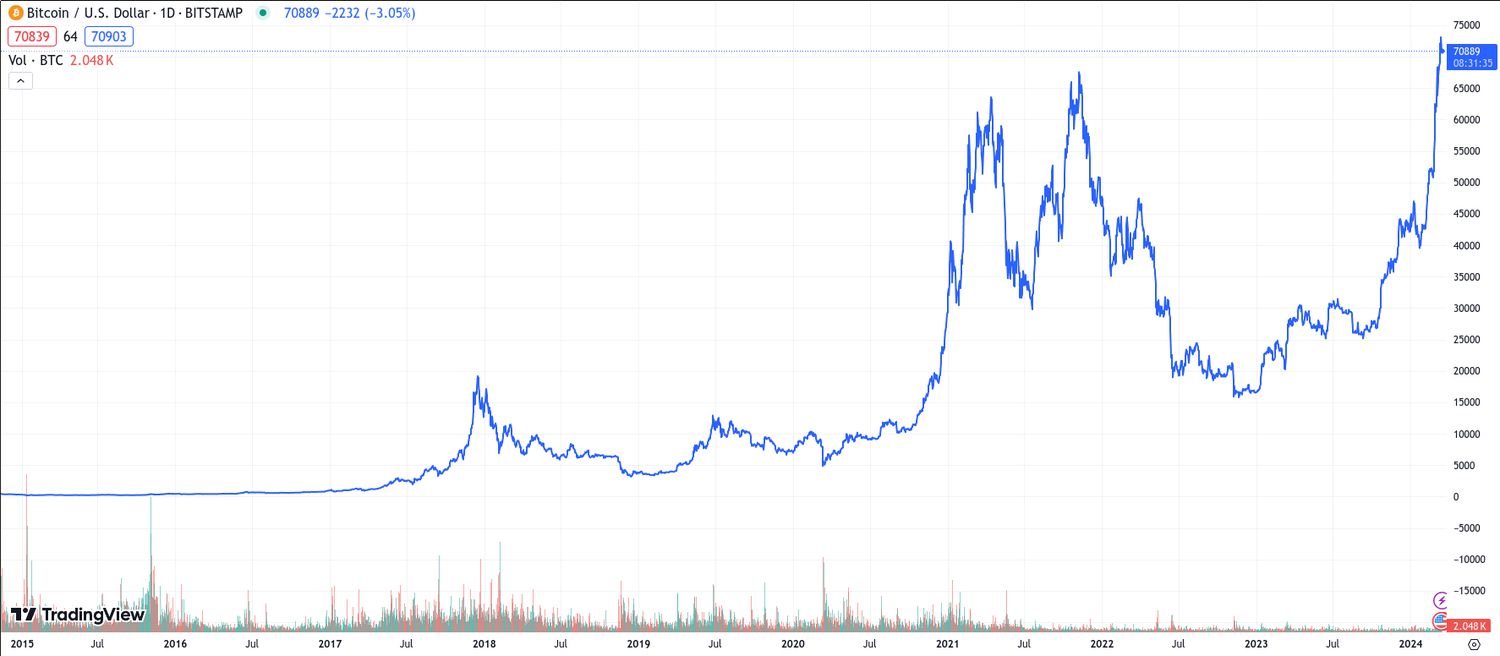

Bitcoin Faces Challenges Amid Economic Data

Bitcoin, the leading cryptocurrency, has encountered a series of challenges as economic data and Federal Reserve monetary policy come into play. The latest Producer Price Index (PPI) for February revealed unexpected inflation rates, with a 0.6% increase last month, surpassing economist predictions. The core PPI, excluding food and energy costs, also rose in February, albeit at a slower pace than January. These developments have led to a rise in the 10-year Treasury yield and the U.S. dollar, signaling potential negative impacts on risk assets like bitcoin.

Market Response

Following a remarkable 70% surge in 2024, reaching a new high close to $74,000, bitcoin faced a correction amid the inflation news. The cryptocurrency dipped to $70,650 post-data release, with current trading prices at $70,900, reflecting a more than 3% decline over the past 24 hours. Despite this, the broader CoinDesk 20 Index experienced a milder drop of 1.7%, with Solana and Dogecoin contributing to its relative strength.

Disclosure and Independence

It is important to note that CoinDesk, a reputable media outlet covering the cryptocurrency industry, maintains strict editorial policies. Acquired by the Bullish group in November 2023, CoinDesk operates independently with an editorial committee safeguarding journalistic integrity. Both CoinDesk and Bullish have vested interests in various blockchain and digital asset ventures, including significant holdings of bitcoin.

For more information and updates on the cryptocurrency market, stay tuned to CoinDesk for comprehensive coverage and analysis.