Bitcoin’s $300 Billion Price Earthquake: What’s Behind the Surge?

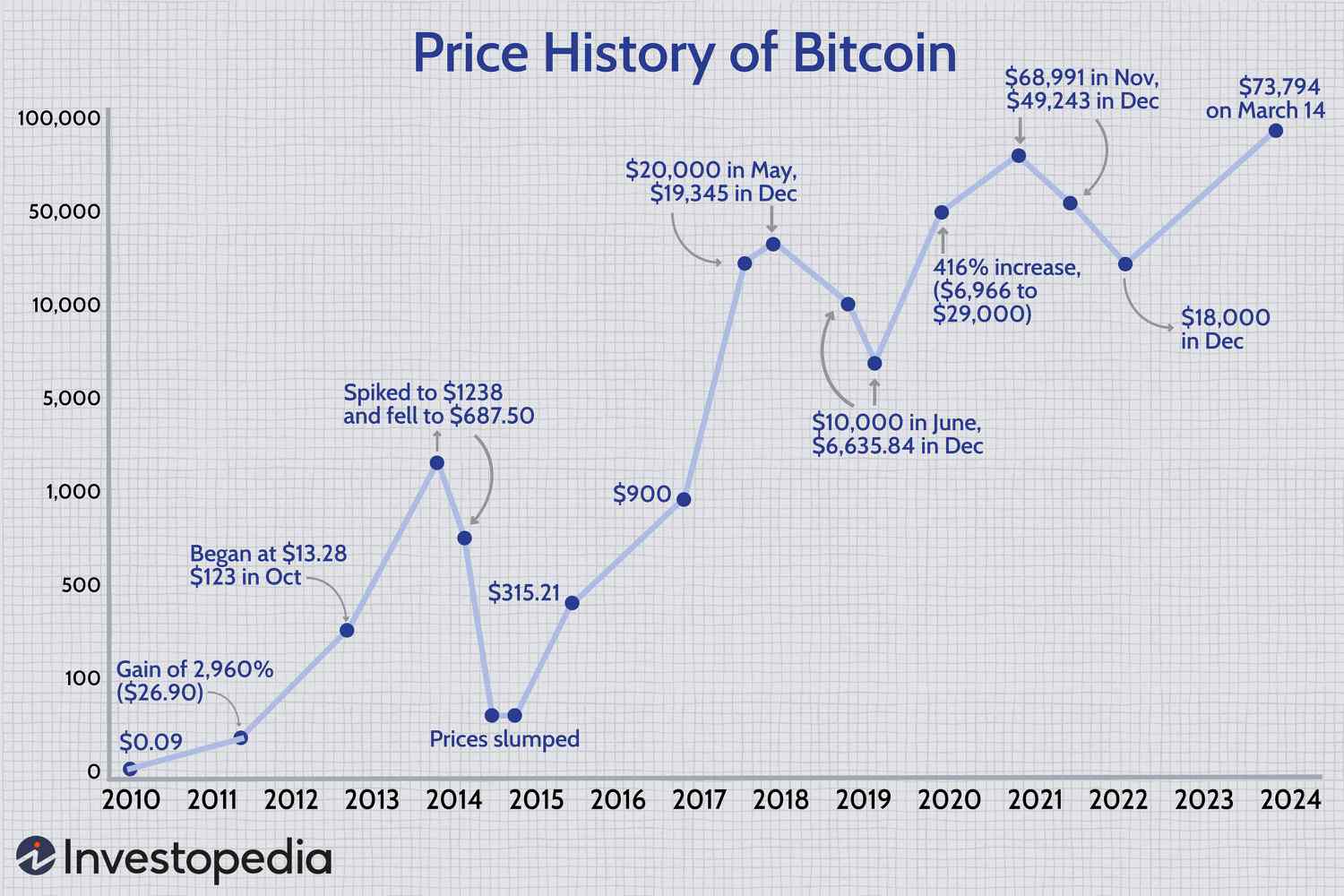

The cryptocurrency market has been abuzz with excitement as Bitcoin’s price has topped $70,000, bringing it closer to its all-time high of almost $74,000. Ethereum, XRP, and other top cryptocurrencies have also seen significant gains, adding $300 billion to the combined crypto market over the last week.

A visual representation of Bitcoin’s price surge

A visual representation of Bitcoin’s price surge

The sudden surge in Bitcoin’s price can be attributed to a famed stock market picker’s huge Bitcoin price prediction. This has led to a sense of FOMO (fear of missing out) among investors, causing a rush to invest in the cryptocurrency.

Goldman Sachs Clients Gear Up to Flood into Crypto Market

According to a top Goldman Sachs executive, the banking giant’s hedge fund clients are gearing up to flood into the crypto market. The majority of interest from the bank’s clients is directed at Bitcoin, although this could change if Ethereum wins a spot ETF of its own.

Goldman Sachs headquarters

Goldman Sachs launched a crypto trading desk in 2021 and currently provides cash-settled Bitcoin option and Ethereum option trading. The bank’s clients are reportedly interested in Bitcoin and crypto again after the latest crypto market gains.

BlackRock’s $5 Trillion by 2030 Plan

BlackRock, the world’s largest asset manager, has launched what’s become the largest of the new U.S. spot Bitcoin ETFs in January. Clients of BlackRock have only “a little bit” interest in Ethereum compared to Bitcoin, according to the company’s head of digital assets.

A visual representation of BlackRock’s $5 trillion plan

A visual representation of BlackRock’s $5 trillion plan

The Bitcoin price surge has topped its previous all-time high of $69,000 per Bitcoin, rocketing past $70,000 per Bitcoin and pushing the price of Ethereum, XRP, and other cryptocurrencies higher.

A chart showing Bitcoin’s price surge

As the crypto market continues to grow, it’s clear that investors are becoming increasingly interested in Bitcoin and other cryptocurrencies. With Goldman Sachs clients gearing up to flood into the crypto market and BlackRock’s $5 trillion by 2030 plan, the future of cryptocurrency looks bright.

A visual representation of the crypto market

A visual representation of the crypto market

In conclusion, the surge in Bitcoin’s price is a clear indication of the growing interest in cryptocurrency. As more investors enter the market, it will be interesting to see how the crypto market continues to evolve.