Bitcoin’s $1 Trillion DeFi Opportunity

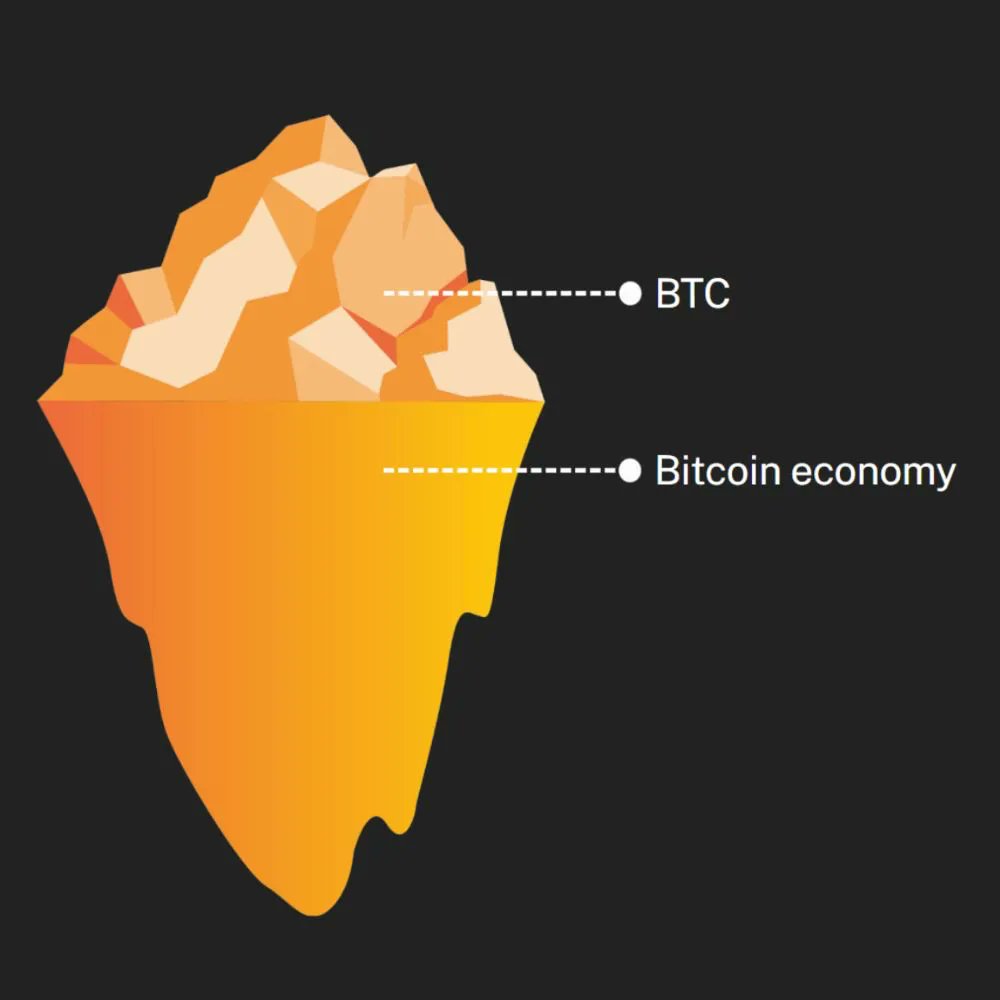

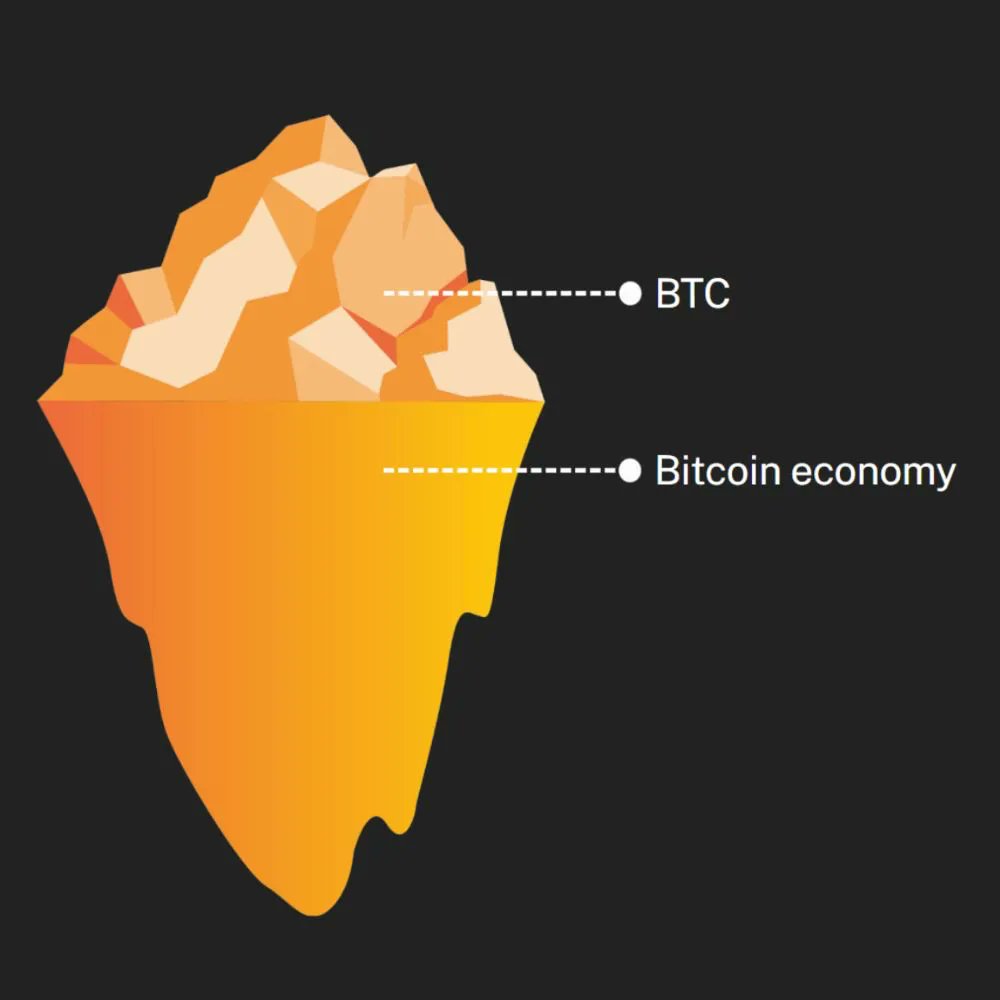

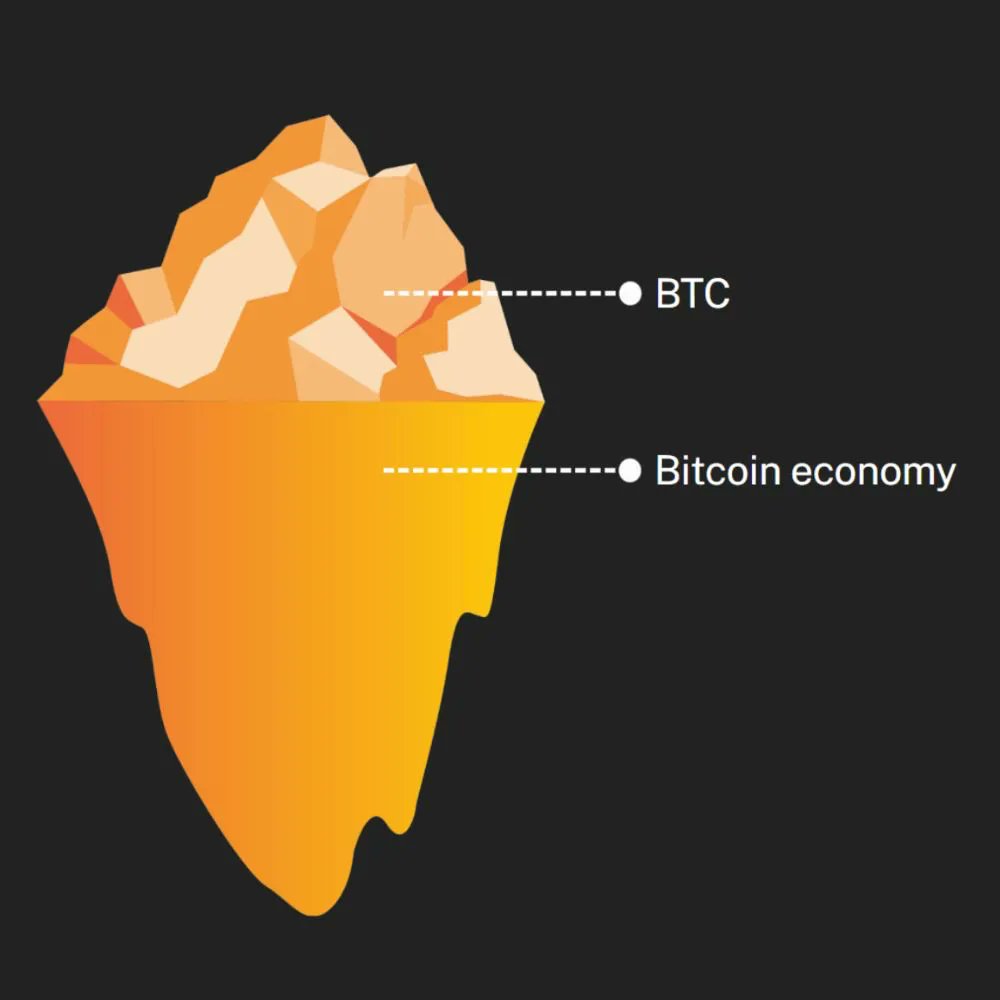

Decentralized finance (DeFi) is coming to Bitcoin, and it’s going to be huge. Since its inception in 2009, Bitcoin has steadily gained adoption and now has a market capitalization of over $1.3 trillion. Designed to be a decentralized currency and real-time gross settlement system, Bitcoin’s decentralized, protocol-based approach enables holders to shift trust from a centralized actor to a decentralized, code-enforced protocol.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

Despite being the original cryptocurrency and corresponding blockchain, Bitcoin’s functionality has been extremely limited up to this point relative to the smart contracts and DeFi functionality offered by Ethereum, Solana, and other blockchains. However, this dynamic is set to change with the emergence of Bitcoin Layers, meta-protocols, sidechains, layer 2s, and other technologies currently being built on the Bitcoin blockchain. These layers will enable faster payments, as well as lending, enhanced functionality of fungible and non-fungible tokens, decentralized exchanges, GameFi, SocialFi, and many other use cases. Holders of Bitcoin will soon be able to increase the productivity of their asset via a protocol-based decentralized financial system.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

The primary differentiator between DeFi on Bitcoin and DeFi on other chains is the underlying asset (native token). Whereas Ethereum, Solana, and next-gen blockchains compete on the merits of their respective technologies, DeFi on Bitcoin is purely focused on increasing the productivity of Bitcoin, placing the Bitcoin DeFi ecosystem in a league of its own.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

The case for value creation via a Bitcoin-based decentralized financial system is driven by three assumptions: preference for the Bitcoin blockchain as the base layer for other tokenized assets, demand for greater productivity of Bitcoin, the asset, and demand for a financial system that reflects the decentralized principles of Bitcoin.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

We already see strong demand signals for the Bitcoin blockchain as a base layer for other tokenized assets. The market for non-fungible tokens on Bitcoin, called Ordinals, grew from less than $100 million to over $1.5 billion in less than six months.

Ordinals

Ordinals

However, the largest opportunity is still ahead. Most of the market value of Bitcoin’s decentralized finance system will show up in the value of fungible tokens on Bitcoin. Fungible tokens will power greater productivity of Bitcoin (the asset) via yield-bearing instruments and decentralized financial systems via protocols and layer 2s. Relative to Ethereum, Solana, and other chains, the value of fungible tokens on Bitcoin is still minuscule, largely because we are in the early innings of programmable functionality on that blockchain.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

Bitcoin’s leading non-fungible token protocol, Ordinals, wasn’t released until January 2023. BRC20s and Runes, Bitcoin’s leading fungible token protocols, were launched in March 2023 and April 2024, respectively. Even with these recent releases, additional functionality is required for a robust decentralized finance ecosystem to exist on Bitcoin.

Bitcoin Improvement Proposals

Bitcoin Improvement Proposals

Additional functionality is being introduced to Bitcoin in two ways: Bitcoin Improvement Proposals (BIPs): Upgrades to Bitcoin’s core software are being pursued through BIPs, such as OP_CAT, which aims to enhance smart contract functionality and increase efficiency on Bitcoin. Technological Developments: Innovations like BitVM, pegs, and bridges are being developed to provide users with enhanced programmability and efficiency without requiring an upgrade to Bitcoin’s core software.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem

As previously mentioned, Bitcoin’s decentralized finance ecosystem is still in the early stages of its life cycle. However, strong indicators of future growth can be seen via growing developer and DeFi activity in the space. In 2023, 40% of Bitcoin open-source developers were focused on Bitcoin L2s and scaling solutions. Then, in the first quarter of 2024, Bitcoin ecosystem total value locked (TVL) grew over six times from $492 million to over $2.9 billion. Given these early indicators, coupled with what we’ve seen transpire across other ecosystems, we believe over $1 trillion in value could be created in the Bitcoin DeFi ecosystem within the next five to 10 years.

Bitcoin’s decentralized finance ecosystem

Bitcoin’s decentralized finance ecosystem